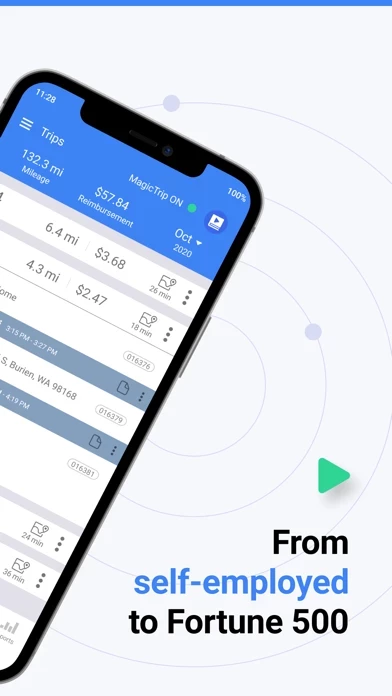

From drivers using their cars for their rideshare business to companies offering mileage reimbursement to their employees, TripLog offers diverse options and features for every type of user.

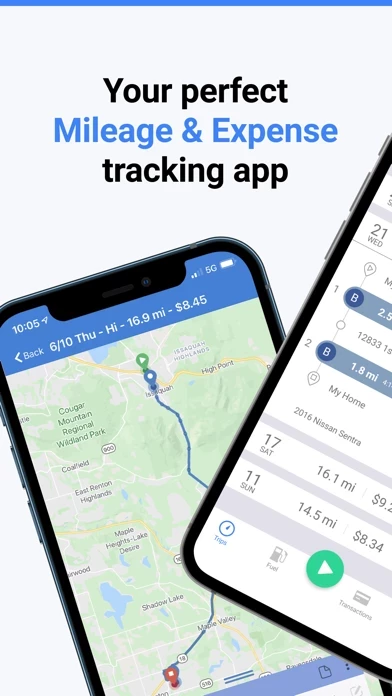

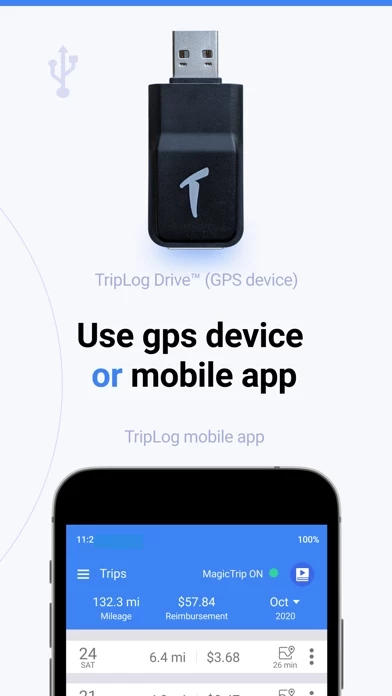

Ditch manual mileage logbooks for the #1 automatic mileage tracker! Trusted by over 500,000 users worldwide, TripLog helps drivers save time spent logging and processing their mileage logs and easily access IRS-compliant reports.

• Built for the gig economy: TripLog makes it easy for rideshare drivers to track mileage related to service passengers and reporting expenses to the IRS.

TripLog provides accurate mileage tracking for tax deductions and reimbursements for every type of user and business, big or small.

• Built With Companies In Mind: Approval management, daily commute mileage, department/office, single sign-on, Google maps distance, company address book, time tracking reports, custom tags, and more.