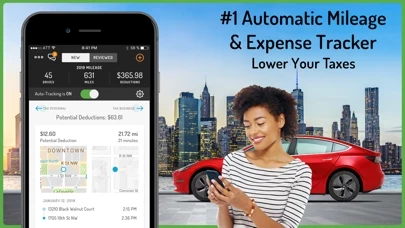

Hurdlr Mileage Expenses Tax Reviews

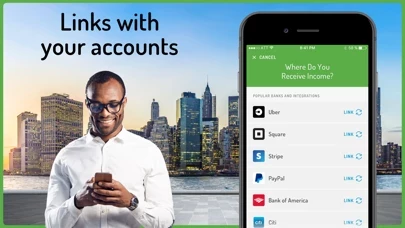

Published by Hurdlr, Inc. on 2025-04-10🏷️ About: Hurdlr is a business expenses and mileage tracker app that helps self-employed individuals, independent contractors, freelancers, and small business owners save thousands of dollars in IRS tax deductions. The app connects with thousands of leading banks and other platforms to import income and expenses automatically for easy income tax calculations. Hurdlr offers a free version with more features than mileage-only alternative apps and a premium version with more robust automation features at half the price of alternative apps like QuickBooks Self-Employed. The app also has a detailed business tax tracker for 2020 quarterly tax accounting.