TripLog Overview

What is TripLog?

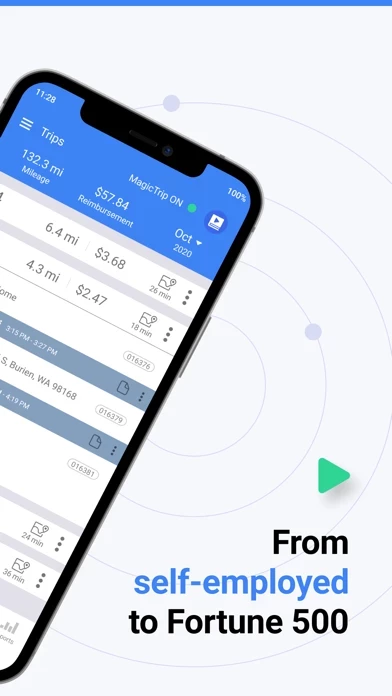

TripLog is an automatic mileage tracker app that helps drivers save time spent logging and processing their mileage logs and easily access IRS-compliant reports. It is trusted by over 500,000 users worldwide and offers diverse options and features for every type of user, from self-employed individuals to big companies.

Features

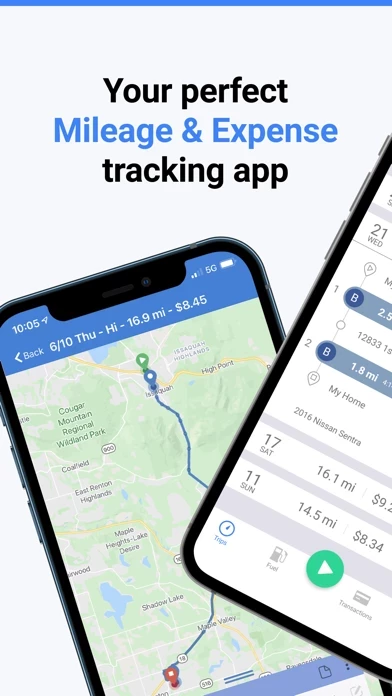

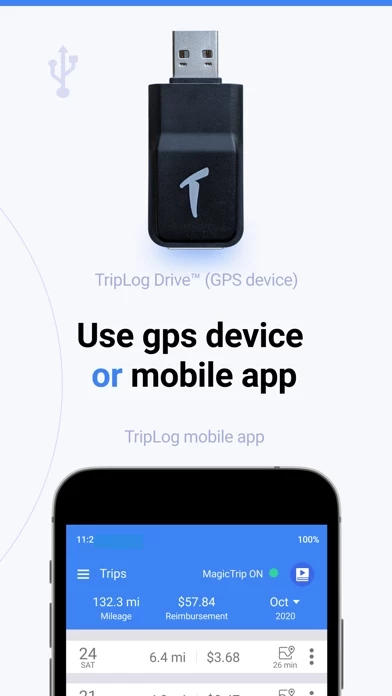

- Automatic Mileage Capture: TripLog uses accurate GPS, ensuring drivers never miss a mile. With six unique tracking options to choose from, users can find the method that works best for them.

- Expense Capture: Upload paper receipts, tolls, and fuel receipts for easy reimbursement. Scan fuel & gas receipts with OCR text recognition.

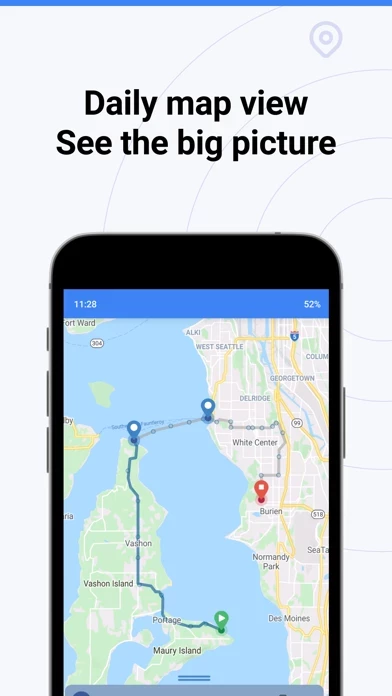

- Better Map Views: Multiple-stop route planning, daily driving overview, frequently traveled heatmap, most visited locations, longest stayed places, and real-time fleet tracking.

- Calendar Integration: Read meetings from Google Calendar, Outlook Calendar, and Salesforce and import them into TripLog.

- Tax Compliant Reports: Hassle-free tax logs.

- Enterprise Approval management, daily commute mileage, department/office, single sign-on, Google maps distance, company address book, time tracking reports, custom tags, and more.

- Track Driving Safety: Detect hard braking, rapid acceleration, phone calls, and speeding.

- Comprehensive Dashboard: Employers can manage their company's accountable plan and employee's requirements with an easy-to-use interface.

- Data Integration: ADP, Concur, Chrome River, QuickBooks, Xero, and bank and credit card integration to track revenue and expenses.

- HIPAA Compliance: TripLog encrypts protected health information (PHI) and personally identifiable information (PII) in a secure environment for your privacy.

- Real-time Location Monitoring: Helps companies and drivers stay on track throughout the day, including a map view with daily/weekly travel routes.

- Country Support & Mileage Rates: TripLog automatically calculates reimbursements based on the current mileage rates from your local tax authority and custom rates for you to maximize your benefits.

Official Screenshots

Product Details and Description of

Ditch manual mileage logbooks for the #1 automatic mileage tracker! Trusted by over 500,000 users worldwide, this app helps drivers save time spent logging and processing their mileage logs and easily access IRS-compliant reports. ► Top Benefits of this app • this app helps users save an average of $7,200 annually. • Save significant time by automating your mileage & expense capture. ► The Most Feature-rich Mileage & Expense Tracking App • Automatic Mileage Capture: this app uses accurate GPS, ensuring drivers never miss a mile. With six unique tracking options to choose from, users can find the method that works best for them. • Expense Capture: Upload your paper receipts, tolls, and fuel receipts for easy reimbursement. Scan fuel & gas receipts with OCR text recognition. • Better Map Views: Multiple-stop route planning, daily driving overview, frequently traveled heatmap, most visited locations, longest stayed places, and real-time fleet tracking. • Calendar Integration: Read meetings from Google Calendar, Outlook Calendar, and Salesforce and import them into this app. • Tax Compliant Reports: Hassle-free tax logs. this app provides accurate mileage tracking for tax deductions and reimbursements for every type of user and business, big or small. From drivers using their cars for their rideshare business to companies offering mileage reimbursement to their employees, this app offers diverse options and features for every type of user. ► Miles = Money this app is perfect for the self-employed, employers, and employees, for any and all business needs: • Employers: Businesses rely on this app to track mileage expenses, reimbursements, and minimize their tax exposure. • Employees: Employees can easily track and submit mileage expense logs for fast, accurate reimbursement, so you never miss a deserved dollar. • Business owners: Business owners can cover a single car or a small fleet of vehicles to ensure accurate and tax compliant mileage tracking. this app is the best mileage tracker for contractors, sales representatives, real estate agents, and home care providers. • Freelancers: easily segment between business use and personal use when tracking mileage related to work. • Independent contractors: can easily keep their business and personal mileage separate and properly track mileage related to client work. • Built for the gig economy: this app makes it easy for rideshare drivers to track mileage related to service passengers and reporting expenses to the IRS. Great for Uber / Lyft / GrubHub / etc. • Personal use: Whether using a vehicle for charity work or personal reasons, keep track of virtually every mileage situation. ► Enterprise Features While also the #1 mileage tracker for single users, this app also offers a best-in-class enterprise feature suite. • Built With Companies In Mind: Approval management, daily commute mileage, department/office, single sign-on, Google maps distance, company address book, time tracking reports, custom tags, and more. • Track Driving Safety: Detect hard braking, rapid acceleration, phone calls, and speeding. • Comprehensive Dashboard: Employers can manage their company's accountable plan and employee's requirements with an easy-to-use interface. • Data Integration: ADP, Concur, Chrome River, QuickBooks, Xero, and bank and credit card integration to track revenue and expenses. • HIPAA Compliance: this app encrypts protected health information (PHI) and personally identifiable information (PII) in a secure environment for your privacy. • Real-time Location Monitoring: Helps companies and drivers stay on track throughout the day, including a map view with daily/weekly travel routes. COUNTRY SUPPORT & MILEAGE RATES - this app automatically calculates reimbursements based on the current mileage rates from your local tax authority and custom rates for you to maximize your benefits. SUPPORT - If you have questions or feedback please contact us [email protected]

Top Reviews

By Abel Finta

Awesome! Been using this app for close to 3 years!

I work multiple jobs which require me to track my work mileage and this app is great at allowing me to keep track of all my miles. I recently had a problem with my data not syncing to a new phone and support was very helpful in helping me figure out how to get everything working again. It’s great that I can access all my data both via my phone app and by using a computer browser. This is a subscription type app but it is affordable and worth every penny, I highly recommend it!

By NicolePalmer_46

Works great! I love it.

Great for autonomous tracking Has saved me money in the ease of tracking small business related trips like going down the road a few miles to the safety supply store and tracking it for me, while I was forgetting to start the log. I have it set up to start automatically when both there is GPS movement and it's connected to my Jeeps Bluetooth system. If you forget to log a trip entirely by forgetting to enable your GPS, no worries you can add a trip to the log and the mileage will adjust. It has a report log that can be emailed.

By Happy376545

Convienient & Easy to use

Before I downloaded this app, I researched and found that this app had the best views. I have been very pleased. It’s easy to use and extremely helpful was to organize my receipts. My only recommendations for updates would be to have a way to remove the red ‘dot’ for notifications, to widen the number of credit cards that can sync, and to allow an ‘auto track’ to turn on Monday - Friday from xxx - xxx. I don’t want my job to track my personal time, and if I forget to shut off the auto start, they can.