Classic Netspend Software

Company Name: NETSPEND CORPORATION

About: NetSpend provides reloadable prepaid debit cards and related financial services to underbanked

consumers in the U.S.

Headquarters: Austin, Texas, United States.

Classic Netspend Overview

What is Classic Netspend?

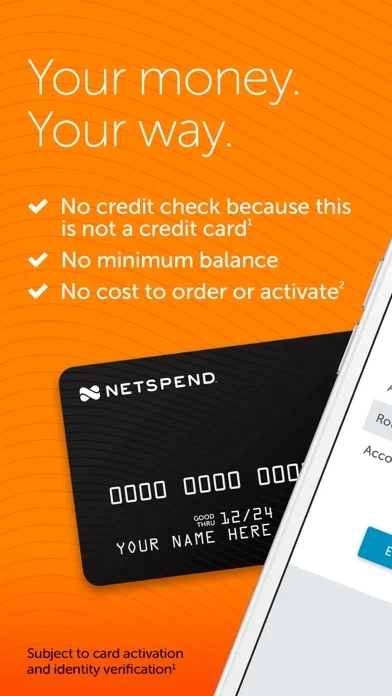

The Netspend Prepaid Card is a convenient way to manage your money. With features like direct deposit, mobile check load, and the Netspend Mobile App, you can easily add money to your account, check your balance and transaction history, send money to friends and family, and find no-cost reload locations. The card can be used anywhere Visa debit cards or Debit Mastercard is accepted.

Features

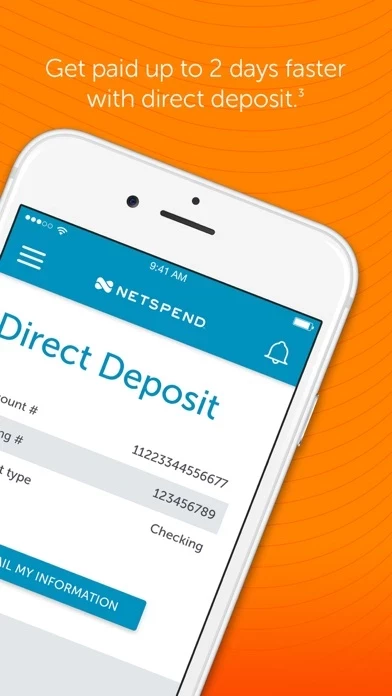

- Direct deposit for faster access to funds

- Mobile check load by taking a few pictures

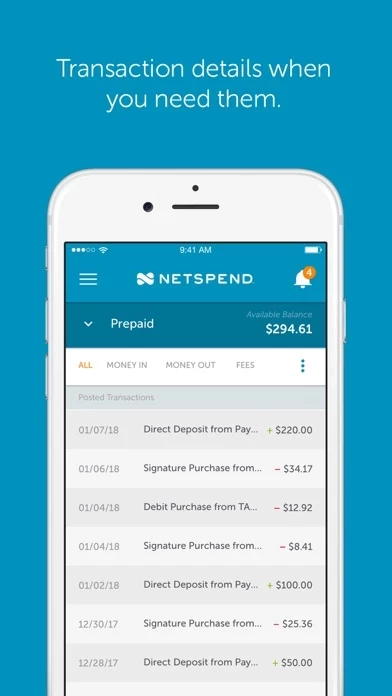

- Check account balance and transaction history

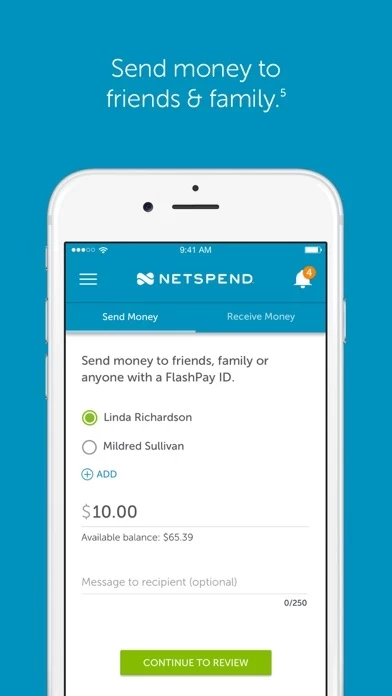

- Send money to friends and family

- Find no-cost reload locations

- Use anywhere Visa debit cards or Debit Mastercard is accepted

- Netspend Mobile App for easy account management

- Activation, ID verification, and funds availability required

- Transaction fees, terms, and conditions apply

- Issued by Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company

- Members FDIC

- Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

Official Screenshots

Classic Netspend Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Monthly Subscription | $11.23 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

With the Netspend Prepaid Card, you’re in charge. Features like direct deposit offer a convenient way to add money to your Card Account and get paid up to 2 days faster.³ Use your card anywhere Visa® debit cards or Debit Mastercard® is accepted. And with the Netspend Mobile App⁶ you can manage your account wherever you go. You’ll be able to do things like: • Load checks directly to your Card Account—just by taking a few pictures.⁴ • Check your Card Account balance and transaction history. • Send money to friends and family. • Find no cost reload locations.² With the Mobile App⁶ it’s all at your fingertips. 1 ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver’s license or other identifying information. Card use restrictions may apply. See netspend.com or card order page for details. Residents of Vermont are ineligible to open a card account. 2 While this feature is available at no cost, certain other transaction fees and costs, terms and conditions are associated with the use of this Card. See the Cardholder Agreement. 3 Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instruction. 4 Mobile Check Load is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card. Unapproved checks will not be funded to your card. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for message and data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card. See your Cardholder Agreement for details. 5 Fees for bank transfers are determined by the transferor’s bank and may be charged to the transferor’s bank account by the service provider or originating bank. No cost for online or mobile Account-to-Account transfers between Netspend Cardholders; a $4.95 Account-to-Account Transfer Fee-CS Agent applies. 6 Netspend does not charge for this service, but your wireless carrier may charge for messages or data. The Netspend Visa Prepaid Card is issued by Axos Bank®, The Bancorp Bank, MetaBank®, and Republic Bank & Trust Company, pursuant to a license from Visa U.S.A. Inc. The Netspend Prepaid Mastercard is issued by Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company pursuant to license by Mastercard International Incorporated. Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company; Members FDIC. Please see back of your Card for its issuing bank. Netspend, a TSYS® Company, is a registered agent of Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company. The Netspend Visa Prepaid Card may be used everywhere Visa debit cards are accepted. The Netspend Prepaid Mastercard may be used everywhere Debit Mastercard is accepted. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms and conditions apply to the use and reloading of the Card Account. See Cardholder Agreement for details. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Top Reviews

By I need a nickname 123

Love it

I absolutely love Netspend, I work for the University of Arkansas and I started when I was 16, I used a pay card by them for a while, until it expired. They graciously sent me another official Netspend card once I turned 18. I activated it once my pay card expired and downloaded the app. The user interface is very mobile friendly and easy to use. I don’t use the mobile check load cause ya know, direct deposit is the way to go these days. But I’ve used everything else in the app. Payback rewards is a cool little way to save a little money, it’s easy to load and send money, easy to view transactions, and most of all, you can start a savings account! Which is something I’ve always wanted to do ever since I started getting paid. Also, customer service is very helpful and friendly. Netspend is a great Mastercard bank, and I’ll be continuing to use their card for a long time, the only thing I’d ask for is for prepaid cards to be accepted everywhere just like an average debit card from an bank such as Bank of America, or CHASE. I recommend this online bank for any young people just getting started.

By 2smalls0639

No Brainer!!

I absolutely LOVE Netspend!!! I’ve been with them for over 3 years, had my account upgraded & I have NEVER had ONE issue with them! I get paid 2 days earlier than everyone else. Their customer service is on point. They have awesome no overdraft... which sometimes I do & they will let it go through but it’s usually only like 10 bucks. There isn’t any over draft fees. They do charge a 5 dollar service fee every month but that’s no issue. If you can’t afford that then something is wrong with you. Lol. They do charge an ATM FEE WHICH I WISH THEY WOULDNT! That’s THE ONLY ISSUE I HAVE WITH THEM!! Stop the ATM FEES NETSPEND!!! Dontgo to Chime, it’s a scam. If you don’t want to deal with an actual bank, this is the one to have. I’ve had banks that lied to me & took my money orclosed my account for no reason & I got tired of it, so I went searching, found Netspend & im soooo glad I did. I refer all my friends to Netspend. I’m telling you, they’re the way to go. & they give you rewards every month. Love yoooou Netspend!!!

By Ncms85713

Great Service!!!

I’ve been with NetSpend since my son was 7. He’s now 22, and I still love the service. I use NS in addition to my banks. My only issues are: 1) PayPal doesn’t accept the bank to be linked to receive funds and withdraw them to the card, and 2) the FEDERAL regulations that only allow so many transfers between family members and the number of times I can remove from savings. But that’s Federal, not NS. My kids live in AZ while my husband and I are living in Ohio now. This is the most convenient way to send my kids money when they need it. AND ITS FREE TO TRANSFER!!! I see other reviews that aren’t so good. Not to discredit the problems they may have had, but overall, NS is a great company. Otherwise, I wouldn’t have been here so long!!!