Mint: Budget & Expense Manager Software

Company Name: Mint.com

About: Minted is a design platform whose mission it is to bring the best in independent design to consumers

everywhere.

Headquarters: San Francisco, California, United States.

Mint Overview

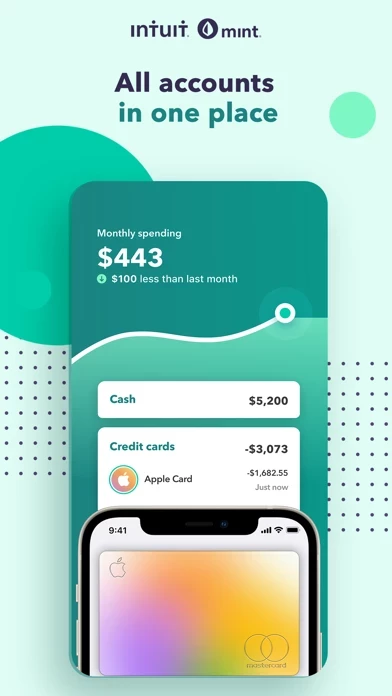

What is Mint? Mint is a free money management app that helps users manage their finances by bringing together all their financial accounts in one place. It offers personalized insights, custom budgets, spend tracking, and subscription monitoring. Users can easily see their monthly bills, set goals, and build stronger financial habits. Mint also offers features like Billshark bill negotiation, subscription cancellation, and Mintsights to help users save money and spend smarter.

Features

- All your money in one app: Mint brings together all your financial accounts, including cash, credit cards, loans, investments, and more, to give you a complete picture of your financial health.

- Monitor your cash flow: Mint helps track your transactions, budgets, expenses, and subscriptions, and alerts you when you're close to going over budget or overdrafting from an account.

- Billshark bill negotiation: A new feature that helps users save on their monthly bills.

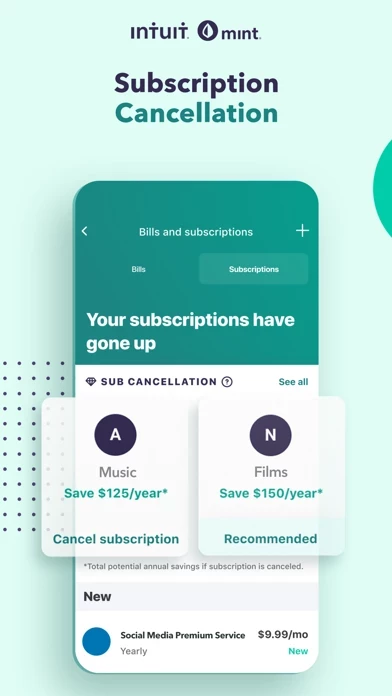

- Subscription cancellation: Mint can now cancel subscriptions directly from the app and notify users when subscription prices go up or uncover old ones they don't use.

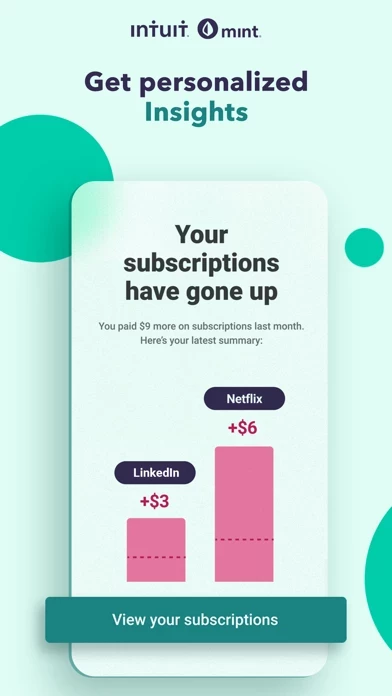

- Mintsights: A feature that takes a deep dive into your accounts and uncovers new ways to make every dollar count.

- Better budgeting and expense monitoring: Mint offers a smart budget based on your spending on day 1 and a budget tracker to keep tabs on your balances.

- Bill tracker: Mint's bill tracker makes it easy to manage your expenses and track bills right alongside your account balances, helping you keep tabs on your debt and avoid late fees.

- IRS tax refund: Users can file and track their taxes directly in Mint with TurboTax and get notified when their refund arrives in their account.

- Financial goals: Set custom financial goals in Mint's budgeting app and get actionable tips tailored to you.

- Free credit score and credit report: See your free credit score and credit report whenever you sign in, and get fraud and identity alerts and updates to your score in one money management app.

- Security: Mint takes data protection seriously and is constantly improving its security measures to keep users' accounts safe.

Official Screenshots

Product Details and Description of

Experience a fresh way to manage money. Reach your goals with personalized insights, custom budgets, spend tracking, and subscription monitoring—all for free. Easily see your monthly bills, set goals, and build stronger financial habits. Get the #1 personal finance and budgeting app now*. this app is the money management app that brings together all of your finances. From balances and budgets to credit health and financial goals, your money essentials are now in one place. Join the 24 million users that trust this app to help them reach their goals. ALL YOUR MONEY IN ONE APP Your spending and financial accounts all in one place. this app gives you a more complete picture of your financial health by bringing everything together: account balances, monthly expenses, spending, your free credit score, net worth, and more. Connect your cash, credit cards, loans, investments, and more. MONITOR YOUR CASH FLOW this app helps track your transactions, budgets, expenses, and subscriptions. We bring together all your numbers to show your net worth and spending trends. Get alerted when you’re close to going over budget and before you overdraft from an account. We’ll notify you when subscription prices go up and uncover old ones you don’t use. START SAVING WITH BILLSHARK BILL NEGOTIATION A new and exciting feature that could help you save on your monthly bills**. NEW PREMIUM FEATURE ENABLING SUBSCRIPTION CANCELLATION this app can now cancel subscriptions directly from our App. Get notified when subscriptions have gone up and let us do the work for you! A new and exciting feature that could help you save on your monthly bills**. SPEND SMARTER AND SAVE MORE WITH PERSONALIZED MINTSIGHTS™ Mintsights will take a deep dive into your accounts and uncover new ways to make every dollar count. Use our money tracker to get a quick view of your financial health. BETTER BUDGETING AND EXPENSE MONITORING Make every dollar count with our budgeting feature. Get a smart budget based on your spending on day 1 and keep tabs on your balances with our budget tracker. SEE YOUR BILLS LIKE NEVER BEFORE Track bills right alongside your account balances. Our bill tracker makes it easy to manage your expenses, helping you keep tabs on your debt. Plus, get bill reminders so you can put an end to late fees. Expense tracking can help you reach your goals sooner. FILE and TRACK YOUR IRS TAX REFUND File and track your taxes directly in this app with TurboTax. Check your refund status and date estimate in this app when you file with TurboTax. We’ll notify you when it arrives in your account. STAY FOCUSED ON YOUR FINANCIAL GOALS Set custom financial goals in our budgeting app and get actionable tips tailored to you. With our money management advice, you can see and celebrate your progress. We’ll help you make the most of your money. GET YOUR FREE CREDIT SCORE & CREDIT REPORT See your free credit score & credit report whenever you sign in. Get fraud and identity alerts and updates to your score in one money management app. STAY SECURE Protecting your data is our top priority. We’re serious about keeping your account safe and are constantly improving our security measures. See more here: https://www.this app.com/how-this app-works/security#toc *based on all-time app downloads **additional terms and conditions apply FROM INTUIT INC. this app is part of a suite of financial tools that include TurboTax®, QuickBooks®, QuickBooks Self-Employed™, and ProConnect™. To learn how Intuit works to protect your privacy, please visit https://security.intuit.com/index.php/privacy By installing or using this app, you agree to our Terms: https://www.this app.com/terms. this app currently connects to US and Canadian financial institutions only.

Top Reviews

By Hablo espanol.

This is the best app ever!

This is the only app I use for finances and it’s all I need! This has helped me to be on top of budgets, account balances, bills and my credit score. This app would be great for anyone, even if you are starting out with you first savings account. It’s easy and can only be opened with your thumbprint or passcode if you wish. It sends you alerts if you have high spending or if your account balance gets to low. On the budgets you can use their categories and subcategories or create your own. I have only found a way to create them on the website, not on the app but they may have updated since, not sure. Basically everything about this app is customizable as for as organization goes. You can rename your accounts and when transactions come through under a category that may not make sense, you can change the category to fit in with where it goes in your budget. You can even hide transactions from your budgets and trends (there are trends a graphs for everything)!! I use this If say... I bought something for a friend who was going to pay me back with cash, but I didn’t want to take the cash back to the bank to balance the account. I could use this feature to just hide the transaction.

By Csnvette92

Mint user since 2012

this app is the perfect tool to keep track of 100% of your finances. Want to track your net worth and credit for free this app is perfect. Saving goals, monthly budgets, pay bills, get reminded about bills. It's customizable and intuitive. It has gotten better over time. It used to be that you struggled to keep all your accounts synced, this app has improved the reliability. Of 20+ accounts, maybe one or two need to be fixed a year. Even your Lowe's card now syncs with this app. I only give it 4 stars because I wish I could pay to remove recommendations but that really isn't that annoying, it's less like a ad and more like an adviser showing you tools on how to save money. One thing I wish the app could do that you can do on the web version is reset the monthly rollover budget for a category. Like if you went over on groceries last month and you need headroom this month, I have to go to the web version to reset the budget to zero without the overage carrying over from last month. Good job this app team! Can't wait to see how you integrate this app and turbo tax in the future. One more request, add net worth to the trends within the App, web version has it app does not. Important to ensure it always is going up!

By MarcosaurusRex

Best Finance app, but still needs more

Update: All my bills in which I use mostly this app for are all gone. Just disappeared. Not cool. this app has worked wonders in managing my finances. No longer do I need registries, or keep up with my reciepts. If your a numbers geek, want to keep up your finances, or want to watch you banks grow. This is the app to do it. I find myself looking at trends and budgets. Tweaking and adjusting to my financial goals and needs. With out this app I would be truly clueless where all my money is going. Now I know where every penny goes. As a current college student recovering from credit card debt, watching my debts decrease and my net value increase has been addicting. Highly recommend. However I wish this app allowed to add estimated payday payouts to the calendar on bills, giving you a balance of what you'd receive and what would be left after bills of the following 2 weeks and month. That way customers will know how much money they can budget everymonth. Or simply just adding the ability to add expected income before and adjusting automatically to when the deposit comes in. this app is great for tracking expenses, investments and property. Just not the best at income!