FamZoo Family Finance Overview

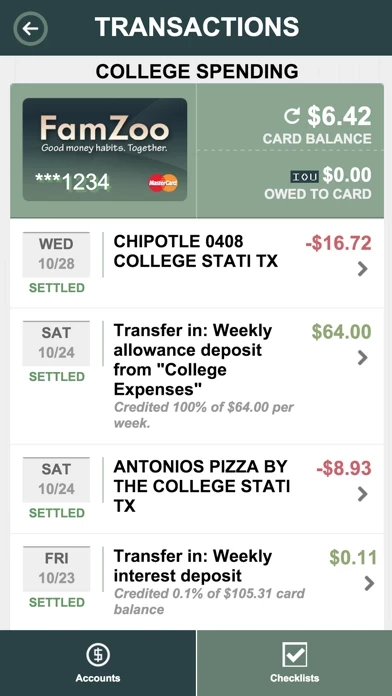

(If your kids aren’t quite ready for our cards, you can use FamZoo’s IOU accounts to track money held elsewhere.) Use FamZoo to manage your family’s spending, saving, charitable giving, allowances, chores, budgets, goals, loans, and much more.

Official Screenshots

Product Details and Description of

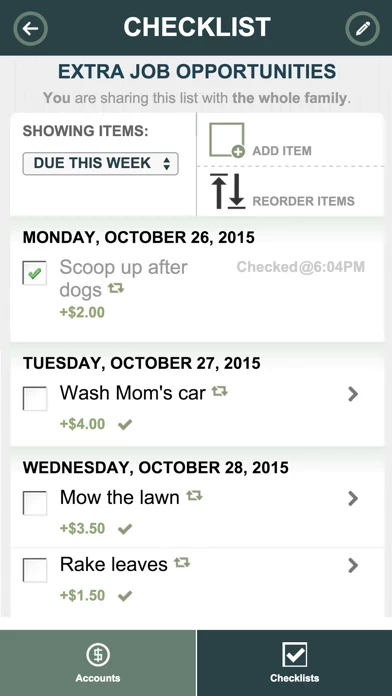

“Thank you for the FamZoo service! It has really helped my kids understand money, budgeting and saving. It’s also way more convenient than cash for me and for them!” ~Matt H., Derby, Kansas FamZoo helps kids, teens, and parents develop good personal finance habits without the hassle. FamZoo is a collection of prepaid cards for your family. The cards are linked together by our award-winning app filled with family finance features that reinforce good money habits. (If your kids aren’t quite ready for our cards, you can use FamZoo’s IOU accounts to track money held elsewhere.) Use FamZoo to manage your family’s spending, saving, charitable giving, allowances, chores, budgets, goals, loans, and much more. IT’S EASY TO GET STARTED Sign up for a free trial by visiting FamZoo.com in your browser using any device. Register your family and order your prepaid cards or set up your IOU accounts in just minutes. No credit check required. Easy online verification. After initial setup, your registered family members can use this app or any browser (mobile or desktop) to access FamZoo anytime, anywhere. FAMZOO IS PERFECT FOR: • All ages — preschool through college. • Avoiding credit card debt, overdraft fees, and other hidden fees. • Moving money instantly between family members (like in emergencies!). • Purchasing items safely online and in stores. • Managing your child’s allowance. • Tracking chores and odd jobs. • Keeping kids (and parents) on budget. • Maintaining parental control, while empowering kids. • Handling money requests, reimbursements, and IOUs between family members. • Teaching your children the power of compound interest, the dangers of debt, the rewards of hard work, the importance of staying on budget, and the wonders of charitable giving. • Customizing your virtual bank to emphasize your family’s own unique values. SEE OUR FULL LIST OF FEATURES: famzoo.com/faqs NOTE: FamZoo cards are only issued in the United States. IOU accounts are available everywhere. WHY PEOPLE LOVE AND TRUST FAMZOO • Winner of the Finovate 2011 and 2013 Best of Show Awards • Winner of the FinCon 2015 Judge’s and People’s Choice Awards • Featured in The Wall Street Journal, The New York Times, TIME, NPR, PBS, Headline News, Money Magazine, and Family Circle. • Featured in the New York Times bestselling book “The Opposite of Spoiled” by Ron Lieber, personal finance columnist for the New York Times. • Featured on top personal finance podcasts including “Stacking Benjamins” and Farnoosh Torabi’s “So Money.” • “No one has attacked the issue more thoroughly than FamZoo.com...Everything I wanted.” ~Dan Kadlec, TIME • “A wonderful app that enables you to teach your kids financial management in a way that fits with your busy life.” ~Caren Merrick, women2.0 • “Among FamZoo’s many clever teaching tools is the ability to pay (and automate) interest on savings balances at whatever rate the parent sets. This allows a parent to demonstrate compounding and growth in a fraction of the time it would take a bank savings account.” ~Kimberly Rotter, Credit Card Insider • “‘Let’s check FamZoo’ has become a common phrase in our house.” ~Danielle Beerli, The Well Organized Mom • Your most sensitive data like SSNs and card account numbers are never stored on FamZoo servers; it is managed by our MasterCard® Network certified, PCI DSS compliant, SSAE 16 compliant, and Regulation E compliant card processing partner, TransCard. • FamZoo prepaid card accounts are FDIC insured. • FamZoo cards can be used anywhere MasterCard® is accepted, in stores and online. • FamZoo has been serving families since 2006. • “I truly appreciate your customer service. It’s above and beyond expected from today’s business. Keep up the brilliant work.” ~Maricio D. GOT QUESTIONS? famzoo.com/faqs NEED TO TALK? famzoo.com/contactus

Top Reviews

By E*W

No more allowance guilt

I struggled every week to have cash to pay allowance, so mostly it wasn't paid. Being young, my kids didn't really care too much, but they also weren't learning how to handle money either since I'd often give in and buy that trinket out of guilt knowing that I owed them allowance. FamZoo has totally solved that problem since the money is effectively virtual. I literally can't forget to pay it since it is automated and never need to make change. My kids are now engaged with learning about finance with the tools to track saving, and we get to talk again about the useless stuff they spend money on when we review their spending every couple of weeks: "so here's that $2 you spent on the funny pencil. Do you still think that was worth the money? (And by the way do you even know where it is?) Tip: check out the blog from the earlier days of the app as well as the associated family finance favs blog for some great ideas about how to get more from the app (love the "could have earned" account where we note how much was spent on stuff that just wasn't worth it as well as jobs they passed on so they can start to connect long term financial effects to short term decisions) and how to approach finance education with your kids.

By John C

Outstanding tool for teaching finances to kids

What could be more empowering for a kid than having their own real debit card? What could be more effective for a parent than being able to teach kids about money by supervising them actually manage it? Famzoo is a powerful platform that allows parents to configure a wide range of options. We choose to pay the kids 2% interest per month. If they save their money, they watch it grow. They actually hold back spending because they want their interest. That's exactly the lesson we are trying to teach. When they do their chores, they check them off and get paid - and we are notified via email so we can ensure it was really done. Some tasks are daily and others are weekly or monthly? Check. You can do that. Unlike some platforms that are focused only on very young kids, Famzoo matures with your kids. My high school teens still love using Famzoo and appreciate being able to get a card without the whimsical logo they enjoyed when they were younger. Everything I mentioned here is just the tip of the iceberg. If you are working to raise responsible financially literate kids, this app is a great tool.

By A'bel

Great for adults w/ ADHD & kids too

This app and the program it represents are a fabulous system that provides very clear boundaries about money, but also a lot of flexibility. My kids are 5, 10, and 15, so I’m getting a full experience of FamZoo across the various development stages. My teenager loves her independence, my 10yo loves how she can’t lose her money (esp. compared to keeping her money in a box), while my 5yo likes being like “the big kids” and I am the keeper of the cards. We aren’t anywhere near using this system to its full potential, but when I have a new task to do, the blogs, Facebook group, and the quick customer service will be what I do This app is also fabulous for me and my ADHD. Folks with ADHD can have serious problems with money, keeping to a budget, etc. FamZoo is flexible enough that I was able to set up different cards for each of out budget areas, like grocery , kids’ clothes, pet care, etc. I can always look up how much money we have in a given account. My ADHD issues with money are now much better managed, thanks to FamZoo. Update, a year later: we are still really, really happy with FamZoo.