LendingTree Spring Software

Company Name: LendingTree

About: LendingTree is an online lending exchange that connects consumers with multiple lenders who compete

for their business.

Headquarters: Charlotte, North Carolina, United States.

LendingTree Spring Overview

What is LendingTree Spring? The LendingTree app allows users to track their credit score, manage their budget, shop for loans, and get personalized savings recommendations. Users can also monitor all their loans, credit cards, and accounts in one place, compare refinance and debt consolidation options, and find their best debt payoff strategy. The app also provides access to a trusted lender network for great rates and service, and users can request a loan, compare offers, and apply in minutes.

Features

- Credit score tracking with no impact on credit

- Credit factor pages to understand what's impacting the score

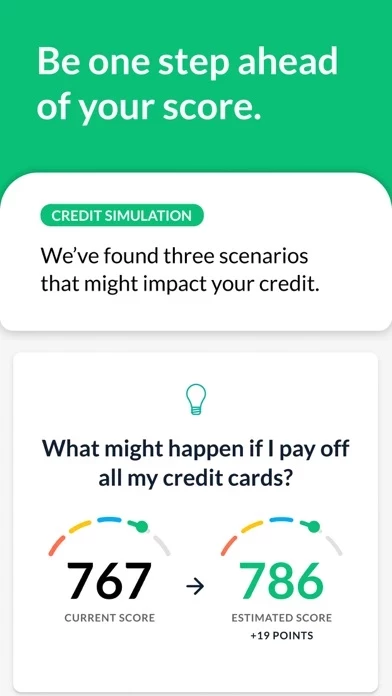

- Credit simulator to see how potential actions could change the score

- Recommendations on how to improve credit

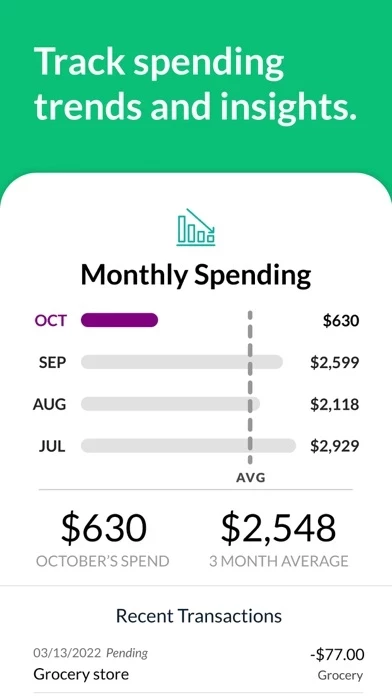

- Account tracking for loans, credit cards, and expenses

- Budget building and monitoring

- Debt payoff strategies, including avalanche and snowball methods

- Access to a trusted lender network for loans, refinancing, and insurance

- Personalized savings recommendations

- Preapproved loan offers that fit the user's budget and goals

- Comparison of loans and interest rates to get the best deal

- Quick videos with tips and tricks from financial experts

- Simplified and confident money management.

Official Screenshots

LendingTree Spring Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $89.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Track your credit score and accounts in one app. Get insights and ways to save! It’s LendingTree at your fingertips! Track your credit score, manage your budget, shop for loans, and SO much more. It’s all easy to use, super secure, and available right in the app. IMPROVE YOUR CREDIT SCORE • Track your credit score as often as you want – it won’t hurt your credit! • Understand what's impacting your score in the Credit Factor pages • See how potential actions could change your scorewith the credit simulator • Get recommendations on how to improve your credit TRACK ALL YOUR ACCOUNTS • View all your loans, credit cards and accounts in one place • Monitor your expenses and build a budget • Know how much money you’ll have next month GET RID OF DEBT • Work towards financial freedom • Compare refinance and debt consolidation options • Find your best debt payoff strategy, including avalanche and snowball methods SHOP FOR BETTER RATES • Tap into our trusted lender network for great rates and service • Personal loans, auto loans, home loans, credit cards, insurance, and refinancing • Read lender reviews to find your favorite • Request a loan, compare offers and apply in minutes FIND WAYS TO SAVE • Take advantage of personalized savings recommendations • Get preapproved loan offers that fit your budget and goals • Compare loans and interest rates to get your best deal LEARN MORE ABOUT FINANCES • Watch quick videos with tips and tricks from the experts to improve your finances • Simplify and manage your money with confidence https://www.lendingtree.com/legal/advertising-disclosures/?disclosures=1,101 A Personal Loan can offer funds relatively quickly once you qualify you could have your funds within a few days to a week. A loan can be fixed for a term and rate or variable with fluctuating amount due and rate assessed, be sure to speak with your loan officer about the actual term and rate you may qualify for based on your credit history and ability to repay the loan. As of 15-Apr-22, LendingTree Personal Loan consumers were seeing match rates as low as 2.99% (on a $10000 loan amount for a term of three (3) years. Rates and APRs were based on a self-identified credit score of 700 or higher, zero down payment, origination fees of $0 to $100 (depending on loan amount and term selected). Here’s how it can work: Example 1: A $10,000 loan with a 5-year term at 13% Annual Percentage Rate (APR) would have a maximum repayment period of 60 months at $228/mo. This loan would have a minimum repayment period of 12 months at $872/mo. The actual payment amount and year-end balance will vary based on the APR, loan amount, and term selected. Example 2: A $25,000.00 secured personal loan financed for 60 months at an interest rate of 8.500% would yield an APR* (Annual Percentage Rate) of 8.496% and 59 monthly payments of $512.87 and 1 final payment of $513.24. These examples are for illustrative purposes only.

Top Reviews

By tinabells50

I love how they teach you

I love how they teach me how to make my credit better . Now I don’t make the same mistakes again help they help figure it out and show you how to do it so you can build your credit and have a wonderful Credit score after they help me this is a great company to come to

By Lilli Conner

Great app!

Love this app. Super easy for beginners monitoring their credit, easy to dispute unknown credit marks, even has a loan feature and credit card offers you can be approved for. Definitely recommend this even if you’re a newbie at all things credit and auditing like me 😂

By t.Washington

The best

Love LendingTree because it keep you up dated with your credit score an show u many ways to improve your credit an save you money in different area..... Lending tree is a perfect solution to help your needs on improving your credit score..... thanks LendingTree