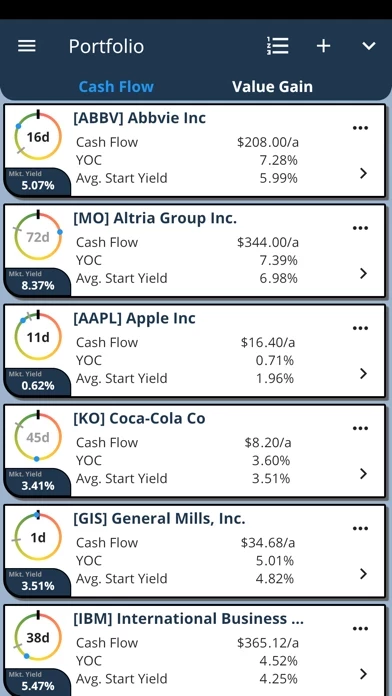

I just started using 22Dividends in spite of its meaningless (to me) name. After first looking at a dozen dividend tracker apps in detail and finding NOTHING that tracks Total Yield ( That is Price Appreciation & Income Yield [on both cost & current price]), I opened 22Dividends to find Nirvana.

22Dividends DOES WHAT NO OTHER APP DOES and it does it well. I’m thrilled because manually calculating total yields on dividend stocks is tedious and time consuming. But total yield is a fundamental feature of Dividend Stocks. And for stock investors, if your app can’t calculate the various components of total yield easily and accurately, then 22Dividends is wasting your time. 22 Dividend does all yield calculations easily and displays them elegantly and intuitively. It makes total yield an actionable item. How can you compare dividend stocks to non-div stocks, bonds, CEF’s, CD’s, Real Estate, etc., if you can’t accurately calculate Total Yield? You can’t.

Download 22Dividends and try it out. If you don’t understand what it’s doing and the information it’s providing, then please consider learning more about dividend stocks and how to calculate their appreciation and income yield components and then come back and try 22Dividends again. You’ll love it. And, more importantly, you’ll learn about the edge that dividend stocks provide over other (stock) investments.

Notes to developers, please consider:

- changing 22Dividends name to DIVIDEND YIELD ANALYZER;

- beefing up your app description with an emphasis on its yield calculation features. You’re offering something both VALUABLE & UNIQUE;

- using a native English speaking technical writer to revamp all of your text online and in 22Dividends ;

- adding an explanation as to how to treat DRIP purchases in 22Dividends and their impact on yield calculations in 22Dividends ;

- maybe show the math formulas in your help/explanations in 22Dividends .

- adding technical and fundamental analysis features (then I’d likely hardly ever leave 22Dividends .)