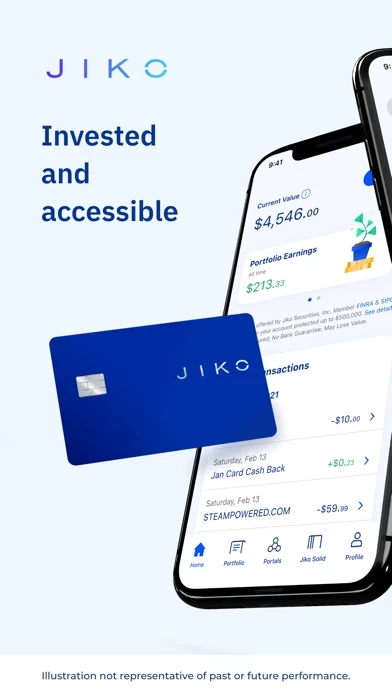

Jiko, owned and operated by Jiko Technologies, Inc., makes available a unique combination of financial services provided by Jiko Technologies, Jiko Securities, Inc., a registered broker-dealer, and Jiko Bank, a division of Mid-Central National Bank, Member FDIC.

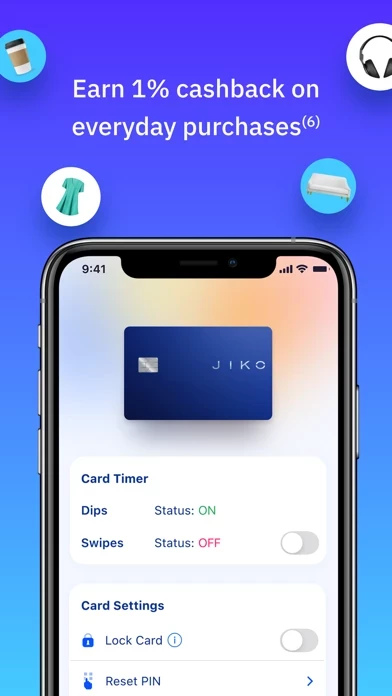

The Jiko Debit Card is issued by Jiko Bank, a division of Mid-Central National Bank, and may be used wherever Discover cards are accepted to perform the transactions and subject to any dollar amount or frequency limitations set forth in the Limitations Disclosures.

Jiko debit cards offer 1% cashback rewards without the monthly payments, high APY, or risk of debt commonly associated with credit cards(6).You can spend without being charged fees related to overdraft, account balance, or late payments(7).

You can access your money immediately using Jiko debit cards; Jiko liquidates your investments in real time when you spend(2).Open an account in about 10 minutes at no cost(3).

Jiko accounts give users 100% of the earnings their investments generate, which in 2020 was equivalent to a yield of 1.71%(4). Earnings may also be tax exempt at the state and local level(5).