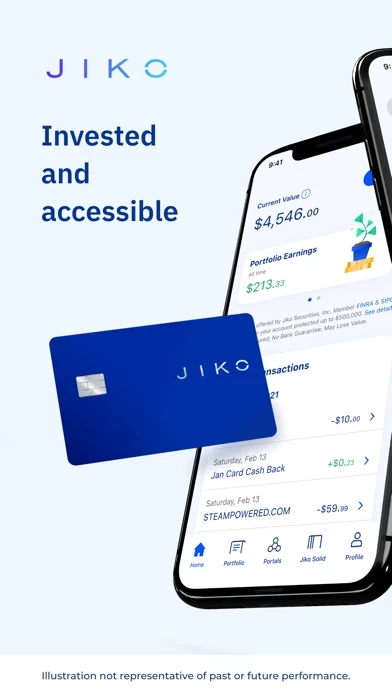

Jiko Overview

Jiko, owned and operated by Jiko Technologies, Inc., makes available a unique combination of financial services provided by Jiko Technologies, Jiko Securities, Inc., a registered broker-dealer, and Jiko Bank, a division of Mid-Central National Bank, Member FDIC.

The Jiko Debit Card is issued by Jiko Bank, a division of Mid-Central National Bank, and may be used wherever Discover cards are accepted to perform the transactions and subject to any dollar amount or frequency limitations set forth in the Limitations Disclosures.

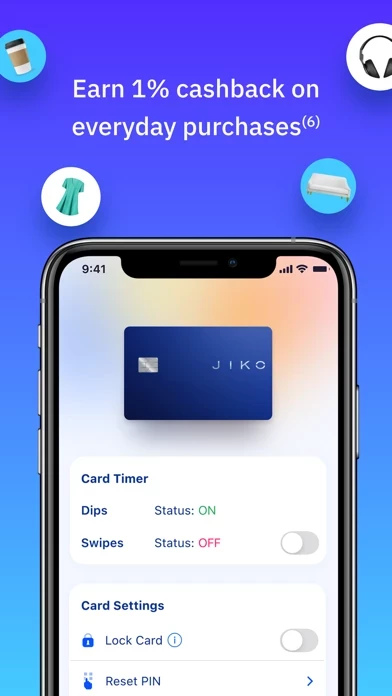

Jiko debit cards offer 1% cashback rewards without the monthly payments, high APY, or risk of debt commonly associated with credit cards(6).You can spend without being charged fees related to overdraft, account balance, or late payments(7).

You can access your money immediately using Jiko debit cards; Jiko liquidates your investments in real time when you spend(2).Open an account in about 10 minutes at no cost(3).

Official Screenshots

Product Details and Description of

this app accounts automatically invest your money in government-backed US Treasury Bills, instead of keeping it dormant in a checking account(1). You can access your money immediately using this app debit cards; this app liquidates your investments in real time when you spend(2).Open an account in about 10 minutes at no cost(3). EARN WHEN YOU SAVE this app accounts give users 100% of the earnings their investments generate, which in 2020 was equivalent to a yield of 1.71%(4). Earnings may also be tax exempt at the state and local level(5). REWARDS WHEN YOU SPEND this app debit cards offer 1% cashback rewards without the monthly payments, high APY, or risk of debt commonly associated with credit cards(6).You can spend without being charged fees related to overdraft, account balance, or late payments(7). TRANSPARENT AND SECURE Keep your money in an account with historically stable performance. You can spend with confidence as the this app Solid™ Debit Card doesn’t display your card number, CVV, or expiration date. Use this app Virtual Cards for online & phone transactions, subject to limitations(2). -- DISCLOSURES SECURITIES INVESTMENTS: Not FDIC Insured • No Bank Guarantee • May Lose Value Illustrations not representative of future or past performance. 1 - US Treasury securities (“Treasuries”) are issued by the federal government and are backed by the “full faith and credit” of the US government. Learn more at https://www.finra.org/investors/learn-to-invest/types-investments/bonds/types-of-bonds/us-treasury-securities. Past performance is not indicative of future performance. Funds are invested in T-Bills in $100 increments. Aggregate funds in your this app Brokerage Account of less than $100 will remain in that account in cash. 2 - Subject to current limitations. Learn more at https://this app.io/docs/limitations.pdf 3 - Available to every American citizen or permanent resident upon application approval. In some cases, accounts may be subject to additional review to be in accordance with financial laws and regulations, including the USA Patriot Act. Additional review could take up (but is not limited) to 5 business days. You may be asked to present documentation to verify your personal information. 4 - this app accounts performed to an equivalent yield of 1.71% from Jan. 1, 2020 to Dec. 31, 2020. Past performance is not indicative of future returns. 5 - Profits from T-Bills may or may not be tax exempt at the state and local level. We do not provide tax or legal advice. Please refer to your financial advisor or tax professional for advice. 6 - Cashback rewards apply to qualifying purchases only. See our Reward Program Terms for more information: https://this app.io/docs/RewardProgram.pdf. 7 - Learn more about our fees in https://this app.io/truthinsavings this app, owned and operated by this app Technologies, Inc., makes available a unique combination of financial services provided by this app Technologies, this app Securities, Inc., a registered broker-dealer, and this app Bank, a division of Mid-Central National Bank, Member FDIC. Banking services provided by this app Bank, a division of Mid-Central National Bank, Member FDIC. The this app Debit Card is issued by this app Bank, a division of Mid-Central National Bank, and may be used wherever Discover cards are accepted to perform the transactions and subject to any dollar amount or frequency limitations set forth in the Limitations Disclosures. Securities are offered by this app Securities, Inc. (“JSI”), acting as the principal carrying firm. JSI is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). All your securities and funds are held in an omnibus account at Apex Clearing Corporation, pursuant to the U.S. Securities and Exchange Commission Rule 15c3-3 customer protection rules. SIPC protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org.

Top Reviews

By Chattry

Great for my savings

This App makes it easy and fun to save money. It’s very addictive to see it grow everyday. Looking forward to receiving the card!