BabySteps Reviews

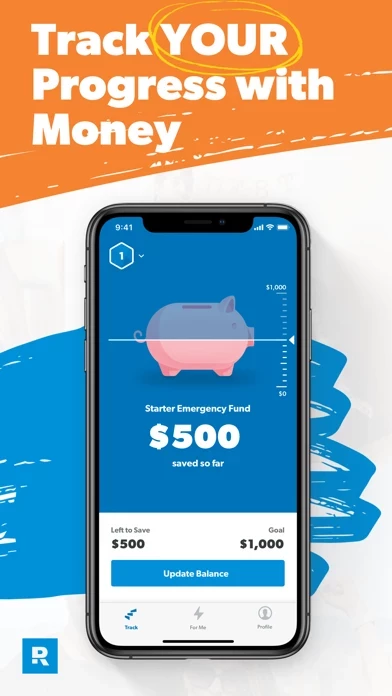

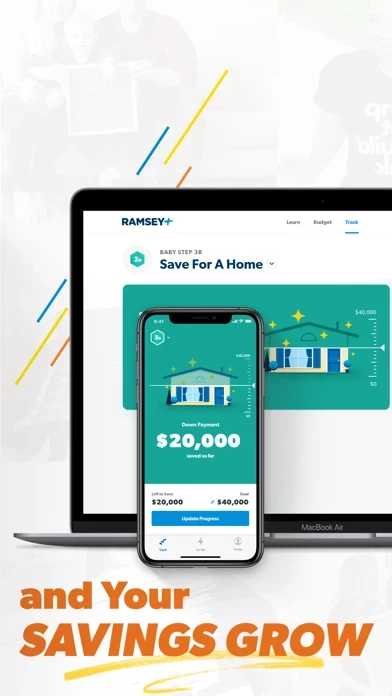

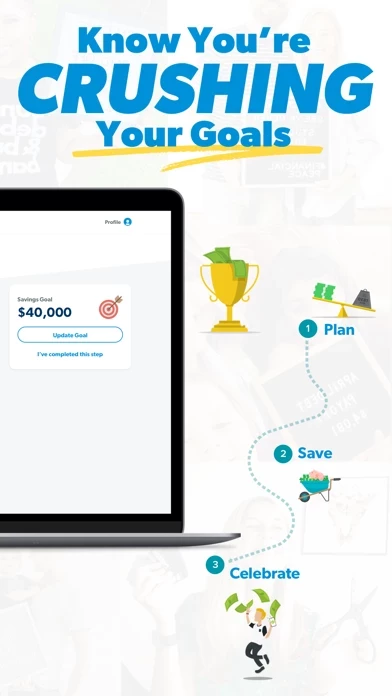

Published by The Lampo Group Incorporated on 2021-04-23🏷️ About: The BabySteps app is a financial management app that helps users pay off their debts, build an emergency fund, save for a down payment on a home, and invest for their future. The app follows Dave Ramsey's 7 Baby Steps, which is a step-by-step playbook that has helped millions of people achieve their financial goals. The app tracks all payments in one place and uses the powerful debt snowball method to take them out one by one. The app is available to Ramsey+ members, which also includes access to EveryDollar and FinancialPeace.