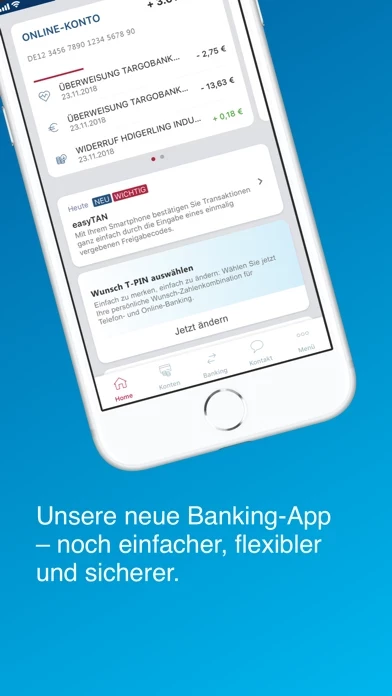

- Account overview and transaction display for all accounts, credit cards, and deposits

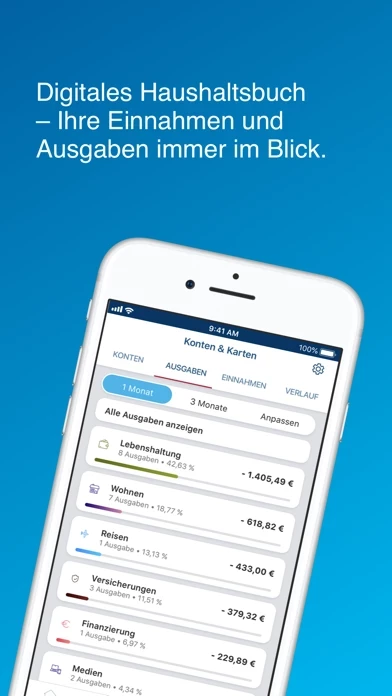

- Digital budgeting for categorizing income and expenses (optional)

- News feed with current information

- Transfers, standing orders, and transfers between accounts

- Direct debit returns

- Branch and ATM locator

- Schedule a consultation appointment with a TARGOBANK branch directly through the app

- Personal mailbox for messages and notifications to TARGOBANK

- Access to bank documents such as financial status and credit card statements

- Change personal information such as address, email, and more

- Optional free account SMS service to keep track of account movements

- Free cash withdrawal service without a debit card

- Money to Go service for quick and secure access to financial information on the go

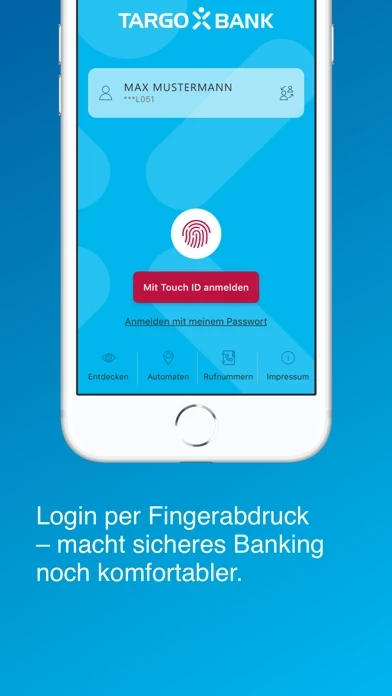

- Access only with online banking credentials

- Login via mobile device security, e.g. Touch ID/Face ID (if available)

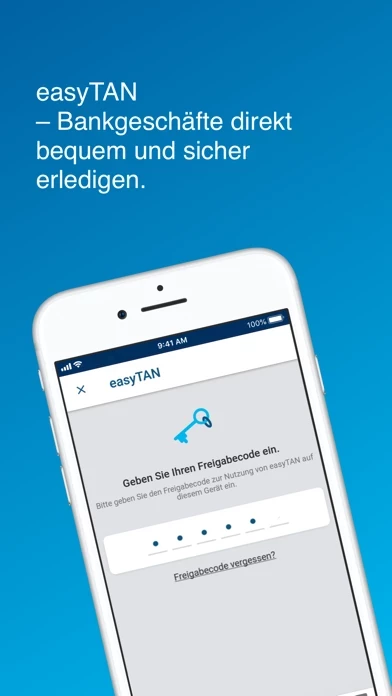

- Approval of transactions in online and mobile banking directly through the smartphone with the easyTAN process

- Protection against the consequences of abusive online banking transactions with the online security guarantee (registration required)

- Modern security technologies and continuous adaptation of the security standard

- In-house development of the banking app

- Requirements: Access and registration for TARGOBANK online banking (registration also possible through the banking app), setup of the easyTAN process, supported TARGOBANK accounts include checking accounts, savings accounts, fixed-term accounts, money market accounts, deposits, and credit card accounts.