How to Delete PocketGuard・Money&Bill Tracker

Published by PocketGuard, Inc. on 2024-07-10We have made it super easy to delete PocketGuard・Money&Bill Tracker account and/or app.

Table of Contents:

Guide to Delete PocketGuard・Money&Bill Tracker

Things to note before removing PocketGuard・Money&Bill Tracker:

- The developer of PocketGuard・Money&Bill Tracker is PocketGuard, Inc. and all inquiries must go to them.

- Check the Terms of Services and/or Privacy policy of PocketGuard, Inc. to know if they support self-serve account deletion:

- Under the GDPR, Residents of the European Union and United Kingdom have a "right to erasure" and can request any developer like PocketGuard, Inc. holding their data to delete it. The law mandates that PocketGuard, Inc. must comply within a month.

- American residents (California only - you can claim to reside here) are empowered by the CCPA to request that PocketGuard, Inc. delete any data it has on you or risk incurring a fine (upto 7.5k usd).

- If you have an active subscription, it is recommended you unsubscribe before deleting your account or the app.

How to delete PocketGuard・Money&Bill Tracker account:

Generally, here are your options if you need your account deleted:

Option 1: Reach out to PocketGuard・Money&Bill Tracker via Justuseapp. Get all Contact details →

Option 2: Visit the PocketGuard・Money&Bill Tracker website directly Here →

Option 3: Contact PocketGuard・Money&Bill Tracker Support/ Customer Service:

- 51.16% Contact Match

- Developer: PocketGuard, Inc.

- E-Mail: [email protected]

- Website: Visit PocketGuard・Money&Bill Tracker Website

- 53.33% Contact Match

- Developer: Minilol

- E-Mail: [email protected]

- Website: Visit Minilol Website

Option 4: Check PocketGuard・Money&Bill Tracker's Privacy/TOS/Support channels below for their Data-deletion/request policy then contact them:

*Pro-tip: Once you visit any of the links above, Use your browser "Find on page" to find "@". It immediately shows the neccessary emails.

How to Delete PocketGuard・Money&Bill Tracker from your iPhone or Android.

Delete PocketGuard・Money&Bill Tracker from iPhone.

To delete PocketGuard・Money&Bill Tracker from your iPhone, Follow these steps:

- On your homescreen, Tap and hold PocketGuard・Money&Bill Tracker until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the PocketGuard・Money&Bill Tracker app from your phone.

Method 2:

Go to Settings and click on General then click on "iPhone Storage". You will then scroll down to see the list of all the apps installed on your iPhone. Tap on the app you want to uninstall and delete the app.

For iOS 11 and above:

Go into your Settings and click on "General" and then click on iPhone Storage. You will see the option "Offload Unused Apps". Right next to it is the "Enable" option. Click on the "Enable" option and this will offload the apps that you don't use.

Delete PocketGuard・Money&Bill Tracker from Android

- First open the Google Play app, then press the hamburger menu icon on the top left corner.

- After doing these, go to "My Apps and Games" option, then go to the "Installed" option.

- You'll see a list of all your installed apps on your phone.

- Now choose PocketGuard・Money&Bill Tracker, then click on "uninstall".

- Also you can specifically search for the app you want to uninstall by searching for that app in the search bar then select and uninstall.

Have a Problem with PocketGuard・Money&Bill Tracker? Report Issue

Leave a comment:

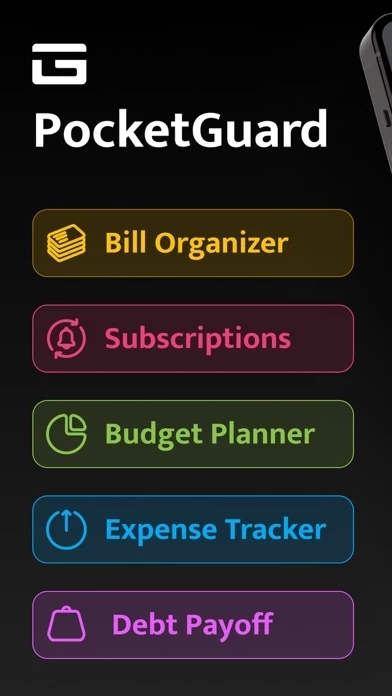

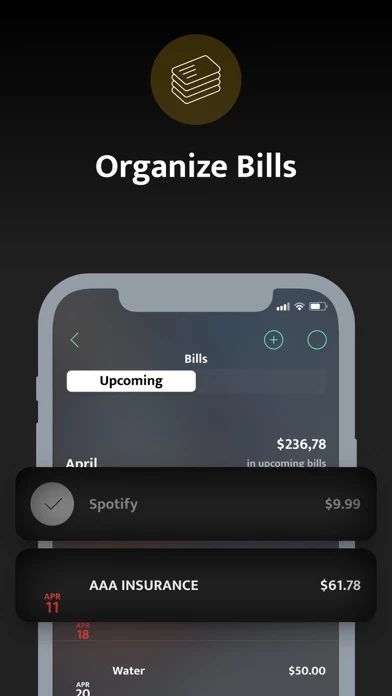

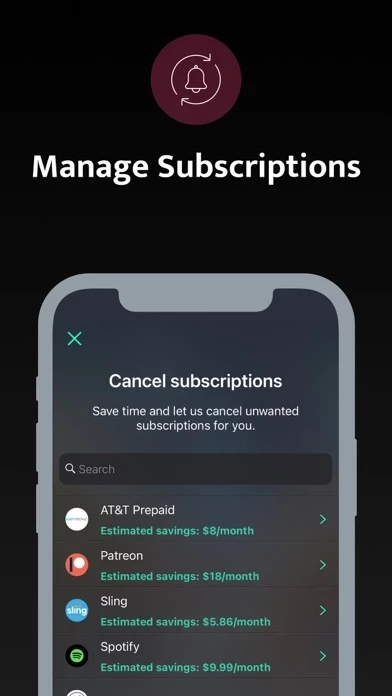

What is PocketGuard・Money&Bill Tracker?

PG - PocketGuard is a free budgeting app for people who want to be on top of their money. Personal finance made simple by smart algorithms, which means budgeting with PocketGuard is so easy that you don't have to spend your entire life crunching numbers. We take care of all the routines like expense tracking and bill monitoring so you can clearly focus on money management operations. Always know what's in your pocket! Basically, a budget is a difference between income and expenses. If it's positive - you're doing well. In any other case, the budget is unbalanced and needs attention. This is where the "IN MY POCKET" feature takes action. How much disposable income do you have after paying your bills, saving for your goals, and setting aside enough money for needs and wants? PocketGuard budgeting app does those calculations for you! Always know the actual safe-to-spend amount so you can fit your monthly budget. Comprehensive analytics! Budget and expense tracking are just a part of t...