How to Delete Changed

Published by ChangEd LLC on 2024-06-12We have made it super easy to delete Changed - Automate Debt Payoff account and/or app.

Guide to Delete Changed - Automate Debt Payoff

Things to note before removing Changed:

- The developer of Changed is ChangEd LLC and all inquiries must go to them.

- Under the GDPR, Residents of the European Union and United Kingdom have a "right to erasure" and can request any developer like ChangEd LLC holding their data to delete it. The law mandates that ChangEd LLC must comply within a month.

- American residents (California only - you can claim to reside here) are empowered by the CCPA to request that ChangEd LLC delete any data it has on you or risk incurring a fine (upto 7.5k usd).

- If you have an active subscription, it is recommended you unsubscribe before deleting your account or the app.

How to delete Changed account:

Generally, here are your options if you need your account deleted:

Option 1: Reach out to Changed via Justuseapp. Get all Contact details →

Option 2: Visit the Changed website directly Here →

Option 3: Contact Changed Support/ Customer Service:

- Verified email

- Contact e-Mail: [email protected]

- 63.64% Contact Match

- Developer: ChangEd Inc.

- E-Mail: [email protected]

- Website: Visit Changed Website

How to Delete Changed - Automate Debt Payoff from your iPhone or Android.

Delete Changed - Automate Debt Payoff from iPhone.

To delete Changed from your iPhone, Follow these steps:

- On your homescreen, Tap and hold Changed - Automate Debt Payoff until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Changed - Automate Debt Payoff app from your phone.

Method 2:

Go to Settings and click on General then click on "iPhone Storage". You will then scroll down to see the list of all the apps installed on your iPhone. Tap on the app you want to uninstall and delete the app.

For iOS 11 and above:

Go into your Settings and click on "General" and then click on iPhone Storage. You will see the option "Offload Unused Apps". Right next to it is the "Enable" option. Click on the "Enable" option and this will offload the apps that you don't use.

Delete Changed - Automate Debt Payoff from Android

- First open the Google Play app, then press the hamburger menu icon on the top left corner.

- After doing these, go to "My Apps and Games" option, then go to the "Installed" option.

- You'll see a list of all your installed apps on your phone.

- Now choose Changed - Automate Debt Payoff, then click on "uninstall".

- Also you can specifically search for the app you want to uninstall by searching for that app in the search bar then select and uninstall.

Have a Problem with Changed - Automate Debt Payoff? Report Issue

Leave a comment:

Reviews & Common Issues: 1 Comments

By elena acakios

11 months agoThere is no way to close my changed app account. I am not interested in using it.

What is Changed - Automate Debt Payoff?

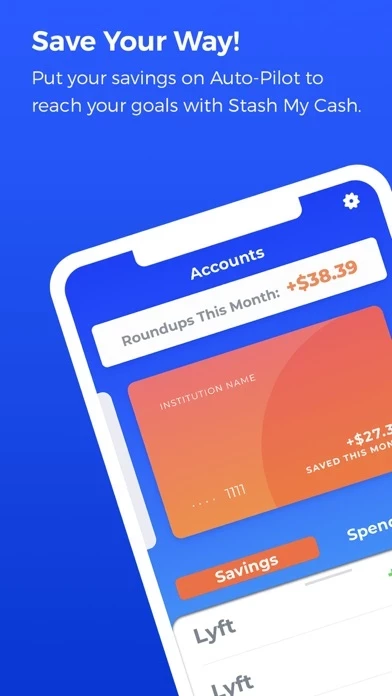

"If you have Debt, you need this app" - Mark Cuban, this app Investor “…I already feel like it is helping me make a dent on my loan debt. It is super simple to use, and I enjoy checking to see how much I’m saving. I also love the updates they give you on how much you are saving when they send your round-up receipts. Overall, I think it’s a great resource!” - Sam, a this app member “I’ve been able to send an extra $1,000 over the last year to my loans without effort! What a great idea. Using your spare change to pay your student loans.” -A review from Leslie Roundup change, pay down your Mortgage and Student Loans. Get out of debt sooner, and save money with Stash My Cash! Download the app that has helped send over $25 Million in extra student loan and Mortgage payments for our members. AKA the Squirrel Squad. You have debt...we all do (including all of the founders of this app), and it's the biggest burden in our lives. Committing to 10,15, 25, or 30 years of repayment is no joke....