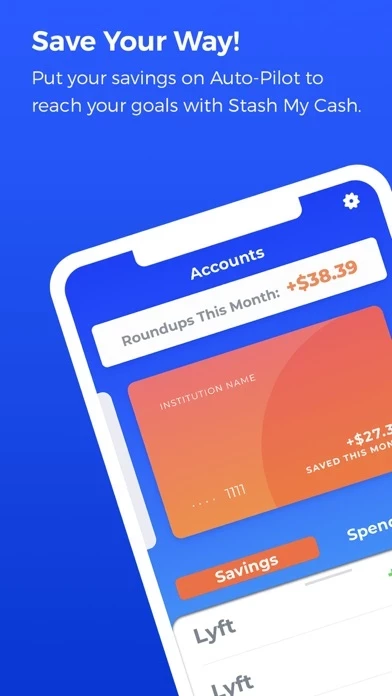

I originally signed up for Changed a year ago. Connected my bank account, my loans, and was off to the races on saving money and making a payment. Eventually I got to the point where a loan payment was made, great! However, a little over a month later I moved states and subsequently bank accounts (from a ‘traditional’ bank to a federal credit union). When I went to link my new credit union up, they had implemented the Plaid interface, which my credit union is not a part of. It’s been 8 months now that my account has been on hold and I just keep going round and round with support with no answers. I loved this concept, still want to, but not worth the hassle at this point.