How to Cancel Intuit Credit Karma

Published by Credit Karma, Inc. on 2023-12-12We have made it super easy to cancel Intuit Credit Karma subscription

at the root to avoid any and all mediums "Credit Karma, Inc." (the developer) uses to bill you.

Complete Guide to Canceling Intuit Credit Karma

A few things to note and do before cancelling:

- The developer of Intuit Credit Karma is Credit Karma, Inc. and all inquiries must go to them.

- Check the Terms of Services and/or Privacy policy of Credit Karma, Inc. to know if they support self-serve subscription cancellation:

- Cancelling a subscription during a free trial may result in losing a free trial account.

- You must always cancel a subscription at least 24 hours before the trial period ends.

How easy is it to cancel or delete Intuit Credit Karma?

It is Very Easy to Cancel a Intuit Credit Karma subscription. (**Crowdsourced from Intuit Credit Karma and Justuseapp users)

If you haven't rated Intuit Credit Karma cancellation policy yet, Rate it here →.

Potential Savings

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

| Duration | Amount (USD) |

|---|---|

| If Billed Once | $8.65 |

| Monthly Subscription | $29.95 |

How to Cancel Intuit Credit Karma Subscription on iPhone or iPad:

- Open Settings » ~Your name~ » and click "Subscriptions".

- Click the Intuit Credit Karma (subscription) you want to review.

- Click Cancel.

How to Cancel Intuit Credit Karma Subscription on Android Device:

- Open your Google Play Store app.

- Click on Menu » "Subscriptions".

- Tap on Intuit Credit Karma (subscription you wish to cancel)

- Click "Cancel Subscription".

How do I remove my Card from Intuit Credit Karma?

Removing card details from Intuit Credit Karma if you subscribed directly is very tricky. Very few websites allow you to remove your card details. So you will have to make do with some few tricks before and after subscribing on websites in the future.

Before Signing up or Subscribing:

- Create an account on Justuseapp. signup here →

- Create upto 4 Virtual Debit Cards - this will act as a VPN for you bank account and prevent apps like Intuit Credit Karma from billing you to eternity.

- Fund your Justuseapp Cards using your real card.

- Signup on Intuit Credit Karma or any other website using your Justuseapp card.

- Cancel the Intuit Credit Karma subscription directly from your Justuseapp dashboard.

- To learn more how this all works, Visit here →.

How to Cancel Intuit Credit Karma Subscription on a Mac computer:

- Goto your Mac AppStore, Click ~Your name~ (bottom sidebar).

- Click "View Information" and sign in if asked to.

- Scroll down on the next page shown to you until you see the "Subscriptions" tab then click on "Manage".

- Click "Edit" beside the Intuit Credit Karma app and then click on "Cancel Subscription".

What to do if you Subscribed directly on Intuit Credit Karma's Website:

- Reach out to Credit Karma, Inc. here »»

- Visit Intuit Credit Karma website: Click to visit .

- Login to your account.

- In the menu section, look for any of the following: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

How to Cancel Intuit Credit Karma Subscription on Paypal:

To cancel your Intuit Credit Karma subscription on PayPal, do the following:

- Login to www.paypal.com .

- Click "Settings" » "Payments".

- Next, click on "Manage Automatic Payments" in the Automatic Payments dashboard.

- You'll see a list of merchants you've subscribed to. Click on "Intuit Credit Karma" or "Credit Karma, Inc." to cancel.

How to delete Intuit Credit Karma account:

- Reach out directly to Intuit Credit Karma via Justuseapp. Get all Contact details →

- Send an email to [email protected] Click to email requesting that they delete your account.

Delete Intuit Credit Karma from iPhone:

- On your homescreen, Tap and hold Intuit Credit Karma until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Intuit Credit Karma app.

Delete Intuit Credit Karma from Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Intuit Credit Karma, » then click "Uninstall".

Have a Problem with Intuit Credit Karma? Report Issue

Leave a comment:

Reviews & Common Issues: 4 Comments

By Ingrid Browley

5 months agoI applied for a credit card on Credit Karma at their suggestion. The credit card is named Avant. I filled out the application, half way through it disappeared, I tried to pulled it back up but with no luck. I started on another application, I finished it. Then they asked me for a promo code. I didn't have a promo code They wouldn't let me continue without the code. I tried to mail Credit Karma but when then the email was finished it took me over to a site that asked me for money for my help. Now I am worried that my personal information is in the hands of somebody who is going to take advantage of me.

By renaud ouellet

2 years agoI don't want to receive any more emails from Credit Karma regarding my credit score.

By Margaret A. Patton

2 years agoPLEASE CANCEL !!

By robert l James

2 years agopay pal makes it diffucult to go to apps

What is Intuit Credit Karma?

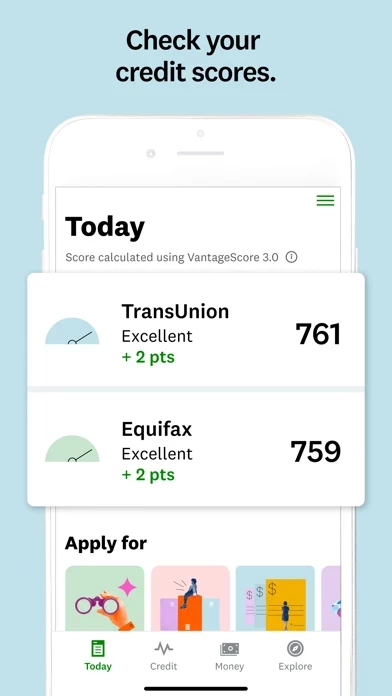

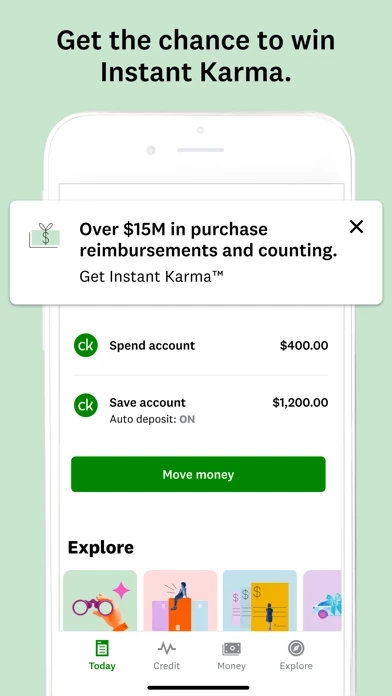

Get the money app where your hard work pays off with a new credit score, a new credit card or even a new house. • Check your free credit scores – Learn what affects your credit scores and how you can take control. • Credit Karma Money™ Spend – A checking experience* with Early Payday and a daily chance to win Instant Karma™ cash reimbursements for debit card purchases.** • Credit Karma Money™ Save – Now saving is easy with no fees, an interest-bearing savings rate and a monthly chance to win $20,000.*** • Karma Confidence – See personalized offers and know your chances of approval for a personal loan or credit card before you apply. • Credit card choices – Browse great credit card offers based on your unique credit profile. And thanks to Karma Confidence technology, our members get approved 66% more often.**** • Auto savings and more – Tune up your auto loan, see about saving on insurance, see open recalls and find vehicle records. • Karma Drive – Track your safe driving score to see if you can unlock lower car insurance rates.***** • Home sweet home – Calculate how much home you can afford, see personalized home loan offers and get a mortgage pre-qualification letter. • Personal loan shopping – Whether you want to refinance credit card debt or borrow for an emergency, you can compare personal loan offers on Credit Karma (members who compare offers on Credit Karma save an average of 32% on interest rates!).****** • Explore the Relief Roadmap - Connect to government stimulus...