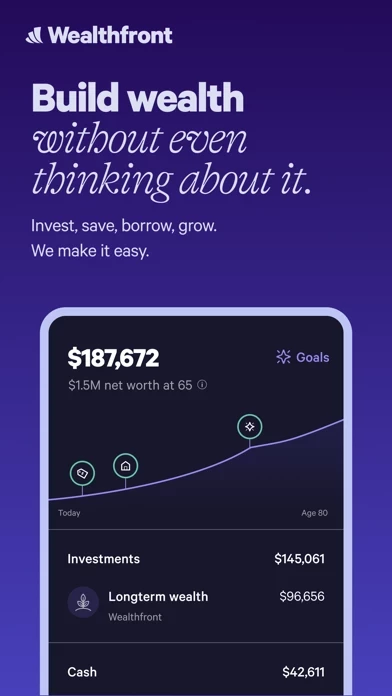

I let — and I love to let — the robots at this app completely manage my financial portfolio. this app has been my main bank since the addition of checking accounts, and its Autopilot feature is also highly useful (which automatically invests/moves money between internal categories/external accounts upon reaching predefined thresholds).

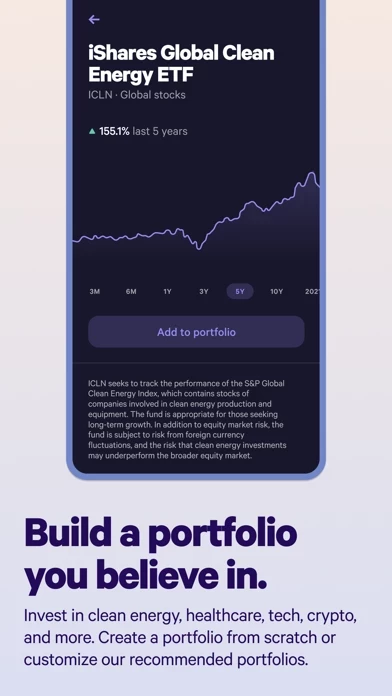

There are certain, newer features that some people may gripe about (i.e., the ability to customize your investments yourself) but this, in my opinion, comes down to whether someone has the self-restraint to use, or not use, such features. For me, I see such features as a boon despite not using them because the more the merrier.

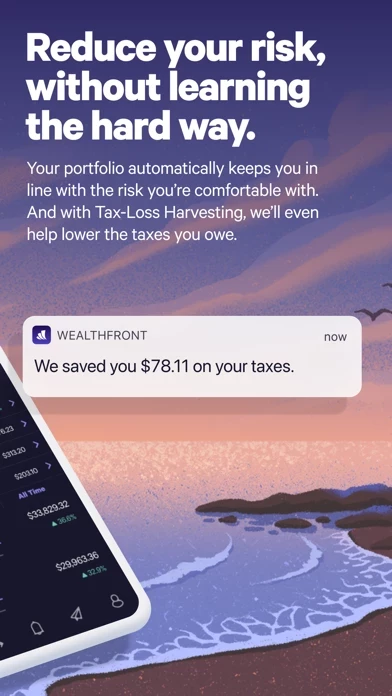

My favorite bit about this app, although this is a shared trait amongst the robo-advisors, is the peace of mind that such a platform can bring. More involved financial platforms require constant monitoring (i.e., stealing your attention) and can be quite destructive to those with addictive personalities. this app manages this by making it absolutely simple to “set and forget.” There’s no need to check Wealthfront everyday, there’s no need to whip out your phone at every alert. You know where your money is going and what your money is doing. This is truly tranquil stuff.

I have only high praise for this app.