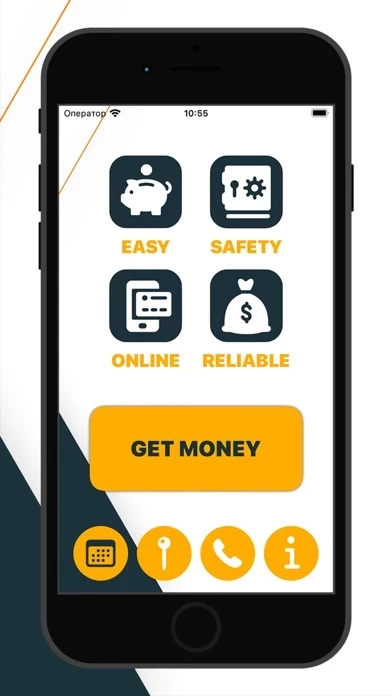

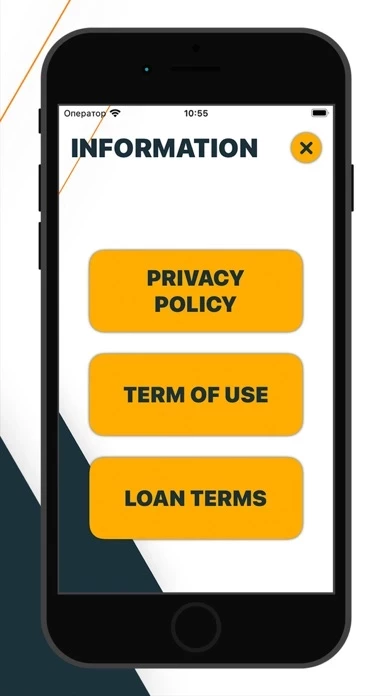

Official Screenshots

Product Details and Description of

Connect with lenders through Payday Cash Advance: Loans! Discover a reliable way to connect with an extensive network of lenders using Payday Cash Advance: Loans! We understand the urgency and unpredictability of financial needs, and our main mission is to bridge the gap between you and potential lenders. Note: Payday Cash Advance: Loans is not a direct lender. We serve as a portal that connects you with a broad spectrum of lenders available in our app. Why choose Payday Cash Advance: Loans? - Extensive network of lenders: Our platform unites hundreds of lenders, increasing your chances of finding a suitable offer. - User-friendly interface: Navigate with ease and locate potential lenders with just a few taps. - Secure and confidential: Your data security is our top priority. Our robust encryption ensures your information's confidentiality. Key Points: Always make sure you've read and understood the terms offered by the lender. Keep in mind that different lenders may have varying interest rates, terms, and policies. Use our platform responsibly. It's crucial to borrow only what you can repay. Disclaimer: We are a platform designed to connect potential borrowers with lenders. The final lending decision, terms, and conditions are entirely dependent on individual lenders. Payday Cash Advance: Loans does not endorse or guarantee any specific loan product and does not charge users for its services. Ensure you make an informed decision, understanding all terms before entering a loan agreement. Dive into the world of financial opportunities with Payday Cash Advance: Loans. Equip yourself with the right tools and connections to cater to your urgent monetary needs. Download now and take a step towards financial flexibility! Material Disclosure: APR (Annual Percentage Rate) varies from 5.99% to 35.99%, with the highest rate available to qualified consumers. Repayment terms range from 3 to 36 months. The specific rate will be determined by your lender, and you will be notified of the exact figure before finalizing the loan agreement. Note that we are not a lending institution and thus cannot provide an exact APR. Below is an example of how APR might be calculated if you decide to borrow money instantly (all applicable fees included): A loan of $2,000 taken out over 2 years with a 15% APR will cost you: Total charge: $2,000 * 0.15 (15% APR) * 2 (2 years) = $600 Total amount you would have to repay: $2,000 + $600 = $2,600 Monthly loan repayment: $2,600 / 24 = $108.33. Loans Terms - Max. Annual Percentage Rate (APR): 35,99% - Min. Repayment Period: 65 Days - Max. Repayment Period: 3 Year - Payment due date: 90 days