Brigit: Fast Cash Advance Software

Company Name: Brigit Inc

About: A financial health app which helps everyday Americans relieve stress, start saving for tomorrow and

transform their financial futures.

Headquarters: New York, New York, United States.

Brigit Overview

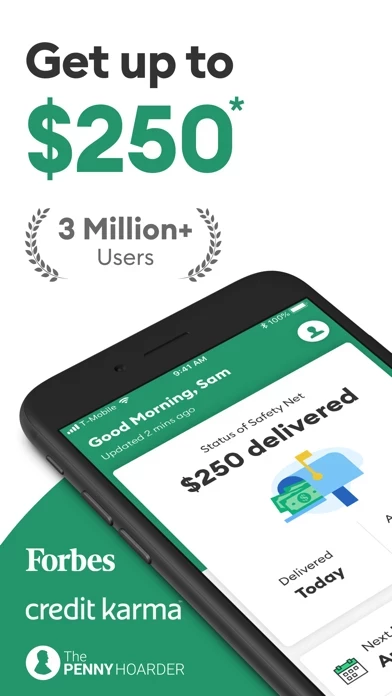

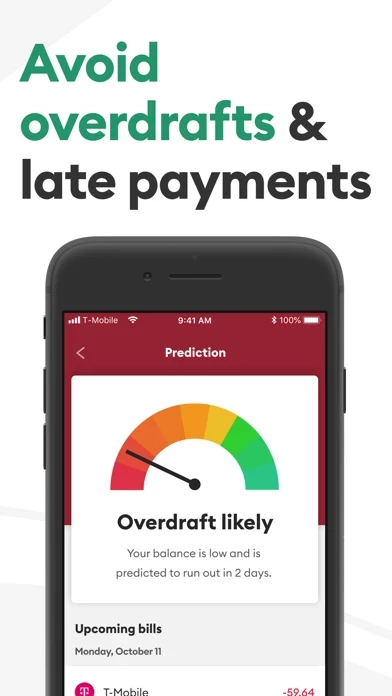

What is Brigit? Brigit is a personal finance app that offers cash advances, credit building loans, credit score insights, budgeting tools, and job opportunities. The app is designed to help users save money, avoid overdraft fees, and reduce financial stress. Brigit works with thousands of banks and offers two simple plans with no hidden fees or fine print.

Features

- Instant cash advances up to $250 with no credit check, interest, processing fees, or tips

- Easy repayment options with no origination fees or processing fees related to the advance

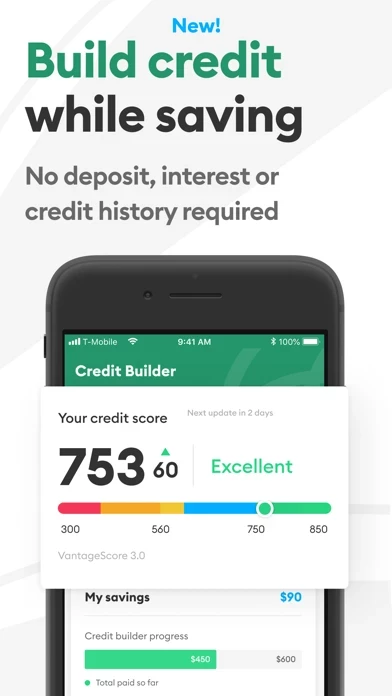

- Credit builder loans with no credit check, upfront security deposit, or interest

- Credit bureau reporting to Experian, Equifax, and Transunion

- Credit score tracker and full credit reports

- Job opportunities and discounts on everyday expenses

- Two simple plans with no hidden fees or fine print

- Basic plan with account alerts and financial insights is free to use

- Plus plan with interest-free cash advances and extra financial tools for a flat $9.99 monthly fee

- Support available 7 days a week via email.

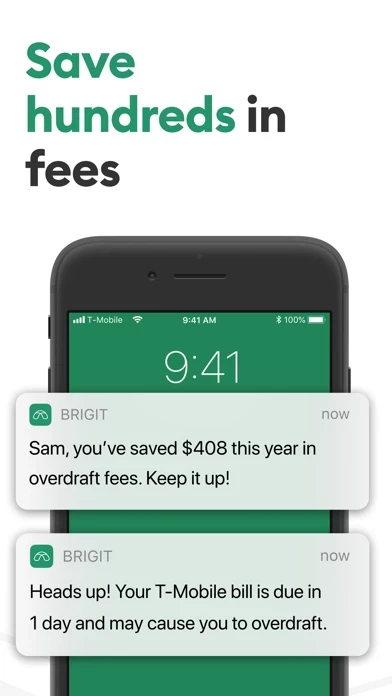

Official Screenshots

Brigit Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $11.00 |

| Weekly Subscription | $13.33 |

| Monthly Subscription | $9.99 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Get up to $250 when you need it*. Build credit, save money, get credit score insights, start budgeting smarter & avoid overdraft fees with this app. It’s personal finance, simplified. Our members have saved over $300 million - over $514 annually per member. Plus, 91% of our members report a reduction in their financial stress thanks to this app**. HERE’S WHY MILLIONS OF PEOPLE USE this app UP TO $250* WITH INSTANT CASH - Get cash fast and avoid expensive overdraft fees and charges with up to $250* when you need it - No credit check, interest, processing fees, late payment fees or tips - Easy Repayment: Want to repay early? No problem. Need a bit of extra time? Repay us when you get paid or when you can afford it by setting the term in the app or reaching out to [email protected] - Example $250 cash advance: Sent via debit card instantly and paid back on the date you set with no interest, $0 origination fees, $0 processing fees related to the advance BUILD YOUR CREDIT WHILE YOU SAVE - Build your credit score*** and save money with this app’s Credit Builder - No credit check. No upfront security deposit. Never any interest. - We arrange a 12-24 month loan for you & store the funds in a new deposit account - Choose your monthly contribution, even as little as $1 – the rest will be paid from the new account -When the loan is paid off, the money you put in all comes back to you! - Credit bureau reporting to Experian, Equifax & Transunion - this app’s Credit Builder is a more affordable alternative to secured credit cards and is designed to work whether you are new to credit or are rebuilding your credit. CREDIT BUILDER LOANS - All Credit Builder Loans are 0% APR - Loan term is between 1 to 2 years – you can always repay early - Credit Builder loans issued by Coastal Community Bank, Member FDIC - Example terms for this app's Credit Builder account: a $600 loan, paid back over 12 months with $50 dollar monthly payments and no interest (0% APR). $0 for processing, origination, late payment, transfer, or early payment fees CREDIT SCORE INSIGHTS - Credit score tracker lets you check your credit score - Get full credit reports and tools to help you grow credit confidence EARN EXTRA CASH & SAVE MONEY • Earn extra cash in your spare time • Find remote work, part-time gigs, & full-time jobs • Save on everyday expenses with discounts and special partner offers EASY SIGN UP. FAST ACCESS. - Connect your bank account and that’s it! - this app works with thousands of banks like Bank of America, Wells Fargo, TD Bank, Chase, and 15,000+ more. - Two simple plans. No hidden fees, tips or fine print - this app’s basic plan with account alerts and financial insights is free to use - Our Plus plan is a flat $9.99 monthly, with interest free cash advances and extra financial tools to help you build credit, budget better, protect your identity & save SUPPORT 7 DAYS A WEEK - If you ever need us, please email [email protected] DISCLOSURES this app is not affiliated with Credit Karma, Kikoff Credit Builder Loan, Credit One, Credit Strong, Albert, Earnin, Dave - Banking, Chime, Cleo, Klover, MoneyLion, FloatMe, Empower, Cash Now App, Venmo, Self, or Possible Finance this app Credit Builder (included with this app Plus membership) is provided by this app and its bank partner, Coastal Community Bank, Member FDIC. this app Credit Builder is separate from this app Instant Cash. this app Credit Builder installment loans and lines of credit are issued by Coastal Community Bank, Member FDIC, subject to approved underwriting practices. (*) Subject to this app’s approval and policies (**) Analysis conducted by this app, assumes an average overdraft fee of $34 (***) Impact to credit score may vary, and some users’ credit scores may not improve. Results depend on many factors including whether your loan payments are on time, the status of your other, non-this app accounts, and financial history

Top Reviews

By ONE HONEST REVIEW

SUCH A LIFESAVER !!!!

I have had a wonderful experience with this app. I have the enable auto transfer disabled but I keep an eye on my account myself and when I see I’m low I request for this app to send funds. I also have alerts enabled so when this app sees I’m low they’ll send me a text and I gauge from there if I need the funds or not. I also have the express delivery to receive funds set up, so funds usually arrive in minutes. When your living check to check this app definitely comes through and helps you have money to last until payday. Their fee to borrow is much less than payday loans so I don’t mind paying the $9.99 each month to use their service. It’s just one fee of $9.99 monthly and then you can borrow every pay period I get paid bi-weekly so I usually have the opportunity to borrow 2x a month. When payday comes and funds from my job are deposited they auto draft the same day. So, just be mindful when getting your check that a withdrawal will need to take place. I’ve recommended this app to two friends who now use the service and have enjoyed their experience as well .

By SFOY14

BEWARE

1st and foremost when I signed up for the app it was the last week of December. It informed me that if I signed up during this period (I’m assuming it was a Christmas promotion) that I wouldn’t be charged $10 for December. I got my advanced with no problem BUT they charged me on December 28th $10!!! and have another $10 pending for January. First off why am I being charged for only 2 days left in the month ? BEWARE that there is an option to cancel your subscription but when you go to cancel it prompts you to contact them by email!!! How big of an inconvenience and they take forever to respond. Why do I have to contact y’all via email at that to cancel my subscription if the option is on the app?? I contacted them explaining the issue and told them to cancel my subscription, once I finally got a response the email representative stated that there was never a promo stating that and it’s been a week and a half and my subscription has not been canceled!! Save your self a headache and go to DAVE who only charges $1 for advances.

By Reese54519

The Goat 😌

This app is truly a blessing in disguise!!! I’ve used other apps like Dave which is a rip off and never worked but consistently charged me $1 each month for linking my account. I’ve tried to use Earning but it requires too much work on the back end by the subscribers to show prove of income and check in every-time I’m at work (basically clocking in) to determine how much one is able to borrow before funds are expressed. It is obvious that this app did their research and took out a lot of the potholes and red tape to make it easier for consumers. I can appreciate apps like this as I’ve been someone who has used and still uses pay day loan companies as I’m still getting in front of my finances. As millennials we need breathing room and I’m thankful for this app who will keep a close eye on things and keep me afloat. $10/month may seem like a lot but if you’re someone who Overdrafts a lot this is saving you millions over time. My hope is that I no longer have to lose money with payday loans moving into the new year.