LendingTree Spring Reviews

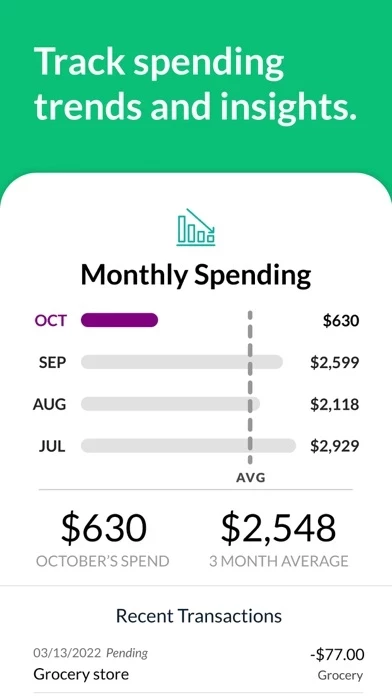

Published by LendingTree on 2025-05-15🏷️ About: The LendingTree app allows users to track their credit score, manage their budget, shop for loans, and get personalized savings recommendations. Users can also monitor all their loans, credit cards, and accounts in one place, compare refinance and debt consolidation options, and find their best debt payoff strategy. The app also provides access to a trusted lender network for great rates and service, and users can request a loan, compare offers, and apply in minutes.