- Touch ID and Face ID authentication for secure access

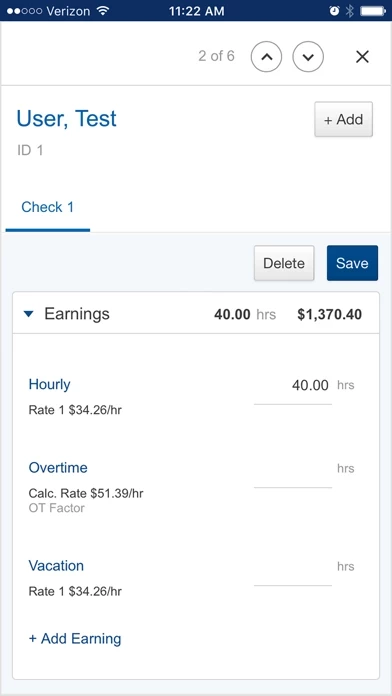

- Employers can submit payroll, enter, review, and submit on the go, and resume payrolls started on a tablet or desktop

- Employers can access all reports, including payroll reports and cash requirements, employee check stubs and tax documents, employee profiles, compensation, taxes, deductions, and time-off balances, retirement plan balances, participation rates, and employee eligibility, health and benefits carrier information and member guides, and health and benefits employee enrollment and election information

- Employees can access check stubs and W2s, retirement balances, contributions, returns, and loans, update retirement contributions and investments, profile, compensation, taxes, deductions, and time-off balances, health, dental, and life insurance benefit details, deductions, and contact information, and FSA contributions, balances, claim, and reimbursement activity.