ASK A CPA Tax Answers Overview

What is ASK A CPA Tax Answers? The ASK A CPA app is a tax reference tool that provides free instant answers to thousands of tax and accounting questions. It is a great resource for individual taxpayers, business owners, accounting students, and tax accountants. The app includes the latest tax changes and how they affect you. You can search for up-to-date answers to help you prepare your tax return and plan for the future.

Features

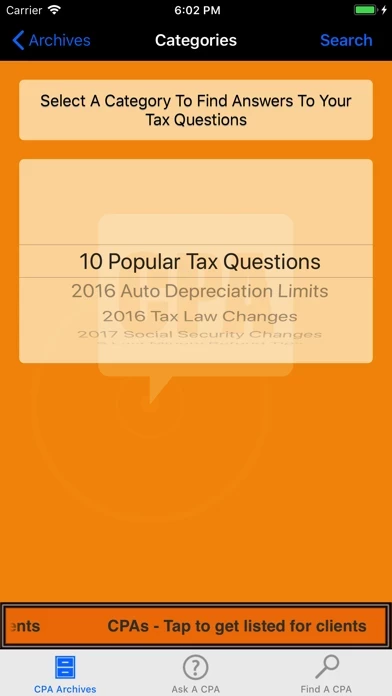

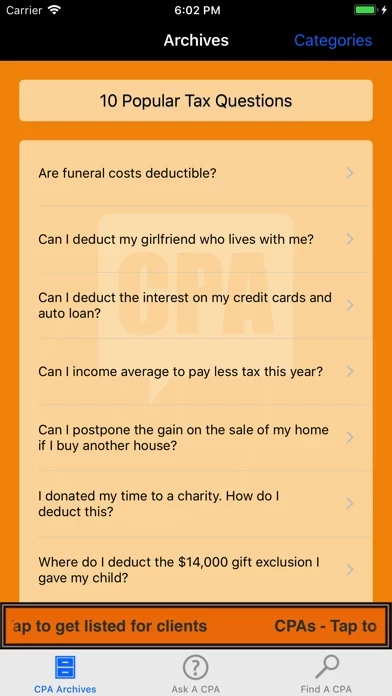

1. Search the “ASK A CPA ARCHIVES” by category to find your answer instantly.

2. If you don’t find your answer, you can “ASK A CPA” your question. Answers will be provided for free directly from CPAs in your area.

3. Need more help? You can “FIND A CPA” easily by zip code.

4. Answer categories include the latest tax changes, 401(k), adoption expenses, alimony, alternative minimum tax, American opportunity credit, armed forces tax info, bonus depreciation, bookkeeping, business startups, buying & selling a business, C corporations, cancellation of debt, capital gains, car & truck expenses, casualty losses, charitable deductions, child card expenses, college costs, corporate tax rates, day trading, deceased taxpayers, defined benefit plans, dependents, depreciation, dividends, divorce & marriage, earned income credit, educational tax benefits, estate planning, estate tax rates, estimated tax payments, exemptions, filing status, financial statements, foreign earnings, gambling winnings, gifts, head of household, hiring a CPA, home office, household employees, health savings account, incorporation services, independent contractors, innocent spouse, insurance, interest, investment planning, IRAs, itemized deductions, job costs, Keogh plans, kiddie tax, late filing penalties, lifetime learning credit, LLCs, LLPs, losses, married filing separately, medical expenses, mileage rates, minimum wage, miscellaneous income, mortgages, moving expenses, mutual funds, partnerships, passive activities, payroll taxes, probate, property taxes, rental expenses, residence, residential energy credits, retirement plans, Roth IRAs, self-employment, SEP IRAs, SIMPLE IRAs, small business, sole proprietorships, schedule C, standard deductions, standard mileage allowance, student loans, Sub S corps, tax rates-individuals, travel & entertainment, W-2, where’s my refund? Where and how do I file?

5. The app is owned by CPAdirect Marketing Inc., and was created by Michael Rosedale CPA, the founder of CPAdirectory.com, the largest online database of over 400,000 Certified Public Accountants.

Official Screenshots

Product Details and Description of

FREE INSTANT ANSWERS TO THOUSANDS OF TAX AND ACCOUNTING QUESTIONS. It’s the only tax reference tool you will ever need. A great tax and business resource for individual taxpayers, business owners, accounting students and tax accountants - search for up to date answers to help you prepare this year’s tax return and plan for the future. Stay Informed - Includes the latest tax changes and how they effect you. 1.Search the “ASK A CPA ARCHIVES” by category to find your answer instantly. New questions and answers are added daily without the need to update your App. 2.If you don’t find your answer you can “ASK A CPA” your question. Answers will be provided for free directly from CPAs in your area. 3.Need more help? You can “FIND A CPA” easily by zip code. ANSWER CATEGORIES INCLUDE: Latest Tax Changes,401(k),Adoption Expenses, Alimony, Alternative Minimum Tax, American Opportunity Credit, Armed Forces tax info,, Bonus Depreciation, Bookkeeping, Business Startups, Buying & Selling a Business, C Corporations, Cancellation of Debt, Capital Gains, Car & Truck Expenses, Casualty Losses, Charitable Deductions, Child Card Expenses, College Costs, Corporate Tax rates, Day Trading, Deceased Taxpayers, Defined Benefit Plans, Dependents, Depreciation, Dividends, Divorce & Marriage, Earned Income Credit, Educational Tax Benefits, Estate Planning, Estate Tax Rates, Estimated tax payments, Exemptions, Filing Status, Financial Statements, Foreign Earnings, Gambling Winnings, Gifts, Head of Household, Hiring a CPA, Home Office, Household Employees, Health Savings Account, Incorporation services, Independent Contractors, Innocent Spouse, Insurance, Interest, Investment Planning, IRAs, Itemized Deductions, Job Costs, Keogh Plans, Kiddie Tax, Late Filing Penalties, Lifetime Learning Credit, LLCs, LLPs, Losses, Married Filing Separately, Medical Expenses, Mileage Rates, Minimum Wage, Miscellaneous Income, Mortgages, Moving Expenses, Mutual Funds, Partnerships, Passive Activities, Payroll Taxes, Probate, Property Taxes, Rental Expenses, Residence, Residential Energy Credits, Retirement Plans, Roth IRAs, Self Employment, SEP IRAs, SIMPLE IRAs, Small Business, Sole Proprietorships, Schedule C, Standard Deductions,Standard Mileage Allowance, Student Loans, Sub S Corps, Tax Rates- Individuals, Travel & Entertainment, W-2, Where’s my refund? Where and How do I File? ASK A CPA is owned by CPAdirect Marketing Inc., and was created by Michael Rosedale CPA (“MR” CPA), the founder of CPAdirectory.com, the largest online database of over 400,000 Certified Public Accountants. CPAdirect Marketing Inc. is a wholly owned subsidiary of CPAdirectory.com Inc. All rights reserved.

Top Reviews

By MRP326

It Really works - Got Free Tax Answers Fast

I had my doubts but this app really is a great resource for getting tax answers. I completed submission form, typed my question about S corps and got my answer from Jeff. I submitted another question on business use of my car and got that answered within an hour. Also - I noticed the second time I submitted the question- I didn't have to complete the profile again. I think "duped taxpayer" reviewer had issues with an Internet connection cause the App really works great.

By pclover1984

Great Find for new business owner

I just started my business and was told about this free tax app in an email I received . Its Easy to use - so much info available in the CPA archives. Asked a question and got an email back instantly with names of CPAs in my area. Then I got another email later with a very detailed specific answer to my question - wow- great free service. I'll definitely use this App over and over again.

By pepmom

This app rules!

It is so nice to have a CPA at my fingertips and I can rest assured that my questions are being answered by a true professional. I have used the service successfully twice so far. The fact that it is free to use the service makes it unquestionably the best place on the web to go for all my tax questions! I cannot recommend it more highly.