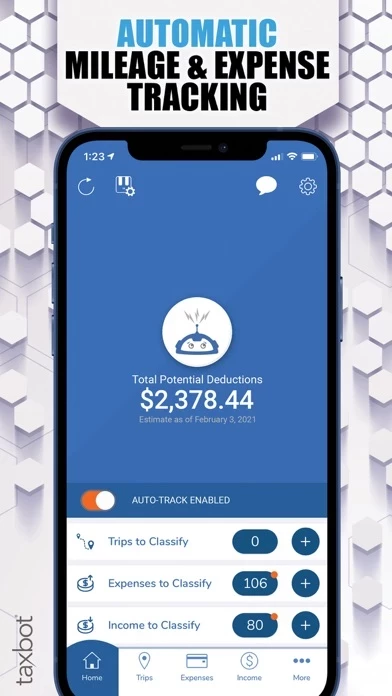

Your Taxbot subscription will automatically renew each month for $9.99 or annually for $99.99 and your credit card will be charged through your iTunes account.

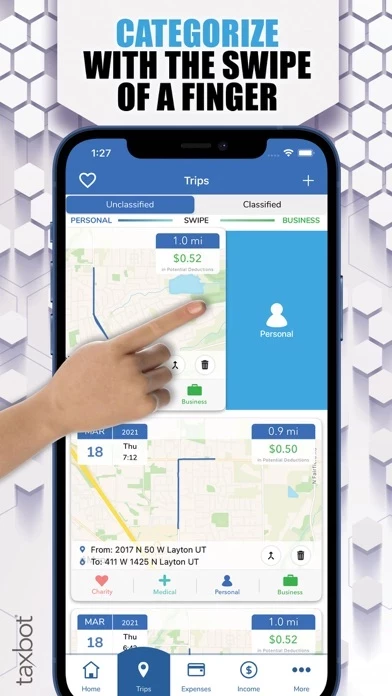

*Note: Because trip tracking uses the GPS in your phone we recommend plugging your phone in while driving to help with battery usage.

While driving, Taxbot will use battery equivalent to other navigation or GPS enabled apps.

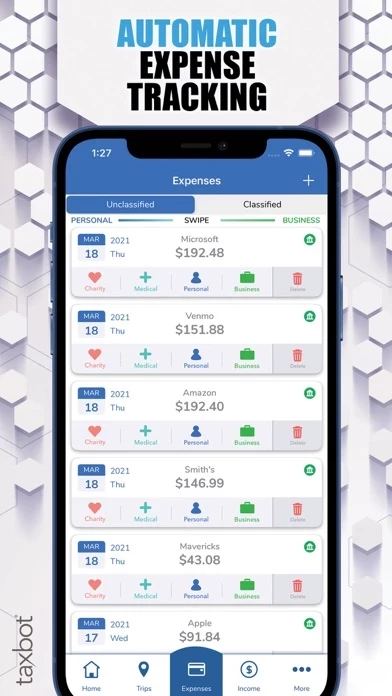

Taxbot Takes Over -- The app reads the receipts using OCR (optical character recognition).

On average Taxbot customers track and save over $10,000 in taxes... Not bad considering Taxbot is only $8.33 per month (when billed annually).