Paycheck Lite Reviews

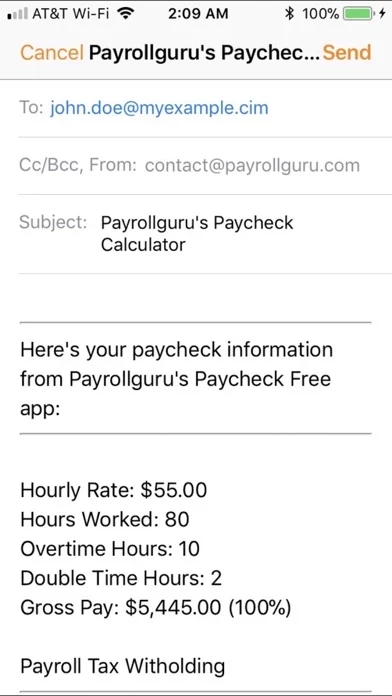

Published by Payrollguru, Inc. on 2025-01-02🏷️ About: Paycheck Lite is a mobile app that helps users calculate their net paycheck amount and applicable federal and state payroll taxes. It is ideal for anyone looking to estimate their take-home pay in different states and territories of the US. The app considers various details that affect the accuracy of the calculation, such as federal and state deduction allowances, current year to date wages paid, and federal and state filing statuses.