- FDIC-insured bank account and free Visa Secured Card

- Invest in cryptocurrencies and stocks

- Build positive credit with every purchase even before turning 18

- Rewards at favorite merchants

- Get paid up to 2 days early with direct deposit

- Instantly send and receive money

- Deposit cash at over 70,000+ retail locations nationwide

- Over 30,000 fee-free ATMs nationwide at major stores and retailers

- Customize your own Step Visa Card

- Add Virtual Step Card to Apple Pay

- Create Savings Goals to help budget for big purchases

- Track balance in the app

- Exclusive Access to Step’s Financial Literacy curriculum

For Parents:

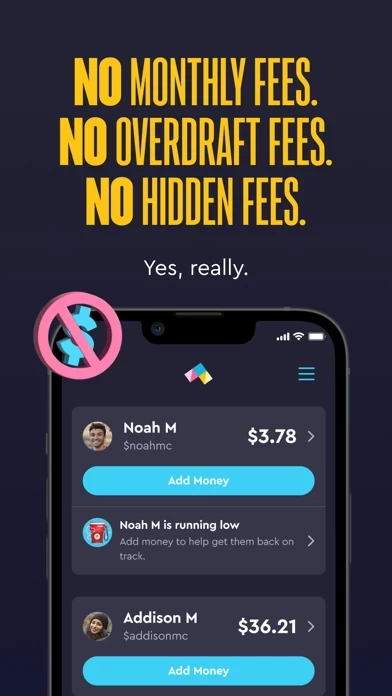

- No signup fees, no monthly fees, no overdraft fees

- Instantly send money to teens

- Automate teen’s allowances & skip or adjust anytime

- Connect existing debit card, bank account, or other apps for instant transfers

- Visibility into teen’s spending and savings

- Access to Step’s Financial Literacy curriculum

- Rewards at top merchants

- Customer support 7 days a week

- Freeze teens’ Step Card anytime

- Add whole family to Step

- Protected by Visa's Zero Liability Policy

Note: Step is a financial services platform. Banking services provided by and the Step Visa card issued by Evolve Bank and Trust, member FDIC. Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Out-of-network ATM withdrawal fees apply. Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. These funds are generally made available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.