Impact Credit Scores - Self Software

Company Name: Self Lender, Inc.

About: Self Financial is a venture-backed fintech startup that helps people build credit and save money.

Headquarters: Austin, Texas, United States.

Impact Credit Scores Overview

What is Impact Credit Scores? The Self credit app is designed to help users build credit history while building savings. It offers a Credit Builder Account that requires no credit history and includes credit score monitoring, reports to 3 credit bureaus, and plans starting at $25/month. The app also offers a secured Self Visa Credit Card that reports to 3 credit bureaus, adds a second type of credit to the user's credit report, and includes credit usage monitoring and alerts.

Features

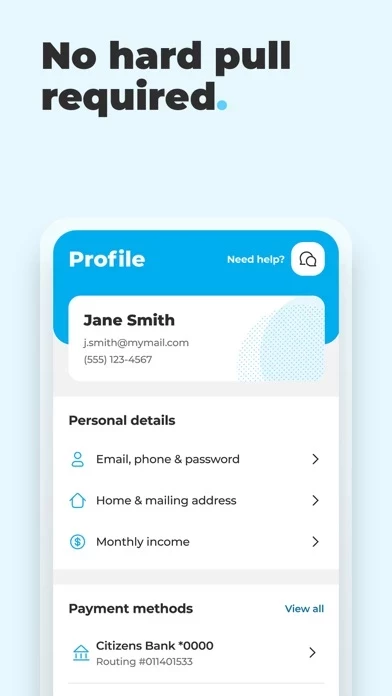

- Credit Builder Account with no credit history needed

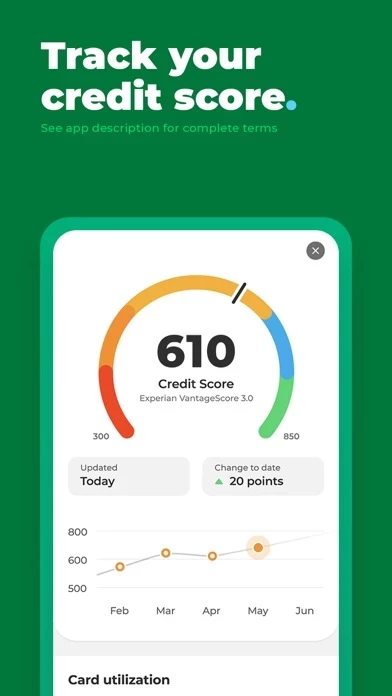

- Credit score monitoring (VantageScore 3.0)

- Reports to 3 credit bureaus

- Plans starting at $25/month

- Pay off over 12 or 24 months

- No hard pull

- 256-bit encryption to protect user data

- Principal is safe in a bank account

- On-time payments are good for credit report

- Secured Self Visa Credit Card

- Credit card eligibility requirements include having an open Credit Builder Account in good standing, making 3 payments on time, having $100 or more in savings progress, and not previously having a Self Visa Credit Card

- Lift credit scores by 30 points on average for customers who make on-time payments

- Lift credit scores by 49 points on average for customers who start with a credit score under 600 and make on-time payments

- Over 3 million Credit Builder Accounts originated

- Improvement in credit score is dependent on specific situation and financial behavior

- Failure to make monthly minimum payments by the due date each month may result in delinquent reporting to credit bureaus which may negatively impact credit score

- This product will not remove negative credit history from credit report.

Official Screenshots

Impact Credit Scores Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $9.22 |

| Monthly Subscription | $35.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

You checked your credit report, but feel like your credit score is stuck in a rut. Good news! Your credit score isn’t set in stone The Self credit app is a way to build credit history while building savings¹. Build credit with Self even with a low credit score (or none)! Start with the Self Credit Builder Account. - No credit history needed - Includes credit score monitoring (VantageScore 3.0)² - Reports to 3 credit bureaus - Plans start at $25/month³ - Pay off over 12 or 24 months - No hard pull - 256-bit encryption to protect your data - Your principal is safe in a bank account⁴ - On-time payments are good for your credit report - Get back the savings¹ Continue with the secured Self Visa® Credit Card⁵ designed for building credit. - Reports to 3 credit bureaus - Your Credit Builder Account savings progress secures your Self credit card & sets your limit - Adds 2nd type of credit to your credit report - Includes credit usage monitoring & alerts - Use everywhere Visa is accepted in the US ACCESS THE SELF VISA CREDIT CARD Card eligibility requirements include having an open Credit Builder Account in good standing, making 3 payments on time, having $100 or more in savings progress, and not previously having a Self Visa® Credit Card. Requirements are subject to change. BE A BUILDER Whether your goal is to get a credit card, a loan to buy a car or house, a good FICO® score can help. According to FICO, building payment history has the biggest impact on your credit score⁶. TAKE YOUR CREDIT SCORE TO A NEW LEVEL Self customers who make on-time payments lift their credit scores by 30 points, on average⁷. Self customers who start with a credit score under 600 and make on-time payments lift their credit scores by 49 points, on average⁸. WHY PEOPLE LOVE SELF Over 3 million Credit Builder Accounts originated! ¹ Minus fees & interest. Individual results may vary and are not guaranteed. Improvement in your credit score is dependent on your specific situation & financial behavior. Failure to make monthly minimum payments by the due date each month may result in delinquent reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report. ² Credit scores will only be available to customers our 3rd party vendor is able to validate. ³ Sample products are $25 monthly loan payment at a $520 loan amount with a $9 administration fee, 24 month term and 15.92% Annual Percentage Rate; Check the pricing page in the Self mobile app or www.self.inc for current pricing. ⁴ All Credit Builder Accounts are issued by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or SouthState Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to ID verification and approval. ⁵ The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender. ⁶ See https://www.myfico.com/credit-education/whats-in-your-credit-score. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. ⁷ Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, made on-time payments, based on VantageScore 3.0. 8 Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, starting VantageScore 3.0 under 600, who made on-time payments. Other factors, including activity with other creditors, may impact results. On-time payments does not mean full program completion and past performance based on study does not guarantee future results. Credit score increase not guaranteed.

Top Reviews

By BryGuy80

Friendly Service and Easy to Use

This app does what it says. I was on the road to credit repair following a major car accident, which left me in a world of hurt financially. Needless to say I was on the road to making progress increasing my score about 6 points a month when I came across this app. I decided to give it a shot. By my second or third payment I started to see my score increase 9-10 points every month. So I can safely say this program helped me add an extra 3-4 points every month. When the opportunity to purchase another car presented itself 8 months into my term I called Customer Service and they were very friendly and happy to help me close my account and deposit my funds. The process was quick and easy and two days later I had my money in my account. Looking to start up a new account now that I’m a few months into my car payment and know I’m ok again. The car loan gave me a slight hit so this will help offset that.

By MLT Jr

Awesome

Those that are seriously in need of rebuilding their credit to obtain a higher score for future financial security need to take advantage of this awesome opportunity. I say opportunity because you pay yourself each month and at the end get all your money back all while building credit in your favor! It’s a “No Brainer” so to speak! I wish I had only found this opportunity sooner. It helped improve my score once already and I’m using it to my favor again. Time flies, we all know that, so before you know it you’ll have your “reward” back when the timeframe you choose is over and the fee is well worth it. If someone told me I could pay $79 and increase my score over 100 points I’d be stupid to say no! So, just pay on-time each month and let Credit Builder do the rest! Thanks Credit Builder! M. Tompkins Jr. USMC Veteran Thomaston, Ct.

By Ashley31165

This is a great opportunity

As someone trying to rebuild my credit after a chapter 7 bankruptcy I tried everything and was getting denied left and right until I came across this place on Facebook and I was very skeptical at first thinking that I would either get denied again and take yet another hit to my credit score or that is was a scam and they would take my money and I would have nothing to show for it. Then one day I just tried it by making the initial payment then I waited......once I made the second payment it only took about a week and boom I had a credit update 🧐 so I checked it out and boy was I surprised and excited to see that it was them! And they had reported to all 3 credit bureaus that I had been in good standing and my payment was on time so my score went up 41 points just that fast!