How to Delete SoLo Funds

Published by SoLo Funds Inc. on 2024-06-12We have made it super easy to delete SoLo Funds: Lend & Borrow account and/or app.

Guide to Delete SoLo Funds: Lend & Borrow

Things to note before removing SoLo Funds:

- The developer of SoLo Funds is SoLo Funds Inc. and all inquiries must go to them.

- Under the GDPR, Residents of the European Union and United Kingdom have a "right to erasure" and can request any developer like SoLo Funds Inc. holding their data to delete it. The law mandates that SoLo Funds Inc. must comply within a month.

- American residents (California only - you can claim to reside here) are empowered by the CCPA to request that SoLo Funds Inc. delete any data it has on you or risk incurring a fine (upto 7.5k usd).

- If you have an active subscription, it is recommended you unsubscribe before deleting your account or the app.

How to delete SoLo Funds account:

Generally, here are your options if you need your account deleted:

Option 1: Reach out to SoLo Funds via Justuseapp. Get all Contact details →

Option 2: Visit the SoLo Funds website directly Here →

Option 3: Contact SoLo Funds Support/ Customer Service:

- Verified email

- Contact e-Mail: [email protected]

- 12.5% Contact Match

- Developer: p2Vest Technologies

- E-Mail: [email protected]

- Website: Visit SoLo Funds Website

How to Delete SoLo Funds: Lend & Borrow from your iPhone or Android.

Delete SoLo Funds: Lend & Borrow from iPhone.

To delete SoLo Funds from your iPhone, Follow these steps:

- On your homescreen, Tap and hold SoLo Funds: Lend & Borrow until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the SoLo Funds: Lend & Borrow app from your phone.

Method 2:

Go to Settings and click on General then click on "iPhone Storage". You will then scroll down to see the list of all the apps installed on your iPhone. Tap on the app you want to uninstall and delete the app.

For iOS 11 and above:

Go into your Settings and click on "General" and then click on iPhone Storage. You will see the option "Offload Unused Apps". Right next to it is the "Enable" option. Click on the "Enable" option and this will offload the apps that you don't use.

Delete SoLo Funds: Lend & Borrow from Android

- First open the Google Play app, then press the hamburger menu icon on the top left corner.

- After doing these, go to "My Apps and Games" option, then go to the "Installed" option.

- You'll see a list of all your installed apps on your phone.

- Now choose SoLo Funds: Lend & Borrow, then click on "uninstall".

- Also you can specifically search for the app you want to uninstall by searching for that app in the search bar then select and uninstall.

Have a Problem with SoLo Funds: Lend & Borrow? Report Issue

Leave a comment:

Reviews & Common Issues: 1 Comments

By Sonia Mederos

3 years agoI want to delete my solo funds account please.

What is SoLo Funds: Lend & Borrow?

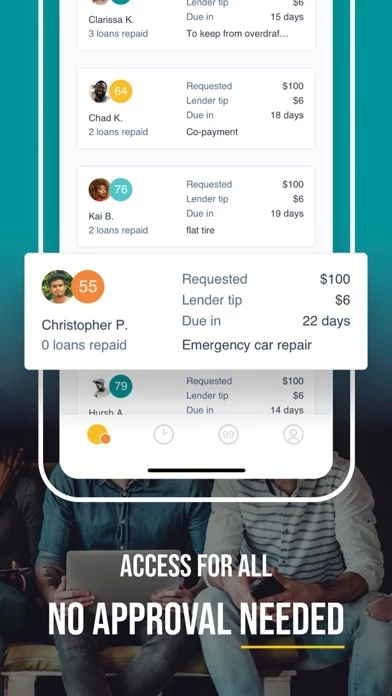

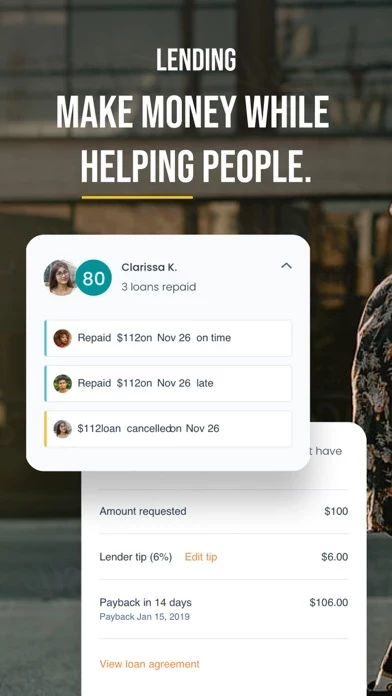

Access up to $500 on your own terms or supply funds to make a social impact and return. Fun fact → SoLo Funds is a Certified Public Benefit Corporation. SoLo is the community finance platform where our members step up for one another. We enable financial services for real people, powered by people. We back each other because we believe in each other. Here’s why thousands of members use SoLo… ACCESS UP TO $500 ON YOUR OWN TERMS We give you choice and control where others don’t. No interest, no credit checks. We come through for each other because we’re in this together. EARN MONEY WHILE HELPING OTHERS SoLo is a great way to make a social impact while also earning a return on your money. Our data driven tools allow you to verify and make smarter choices. Fund a request today. We’re people helping people. Fun fact → SoLo won the 2022 Visa Everywhere DEI Contest amongst the nation’s best fintechs SOLO PROTECTION We’re in this together. We protect each member in our community via s...