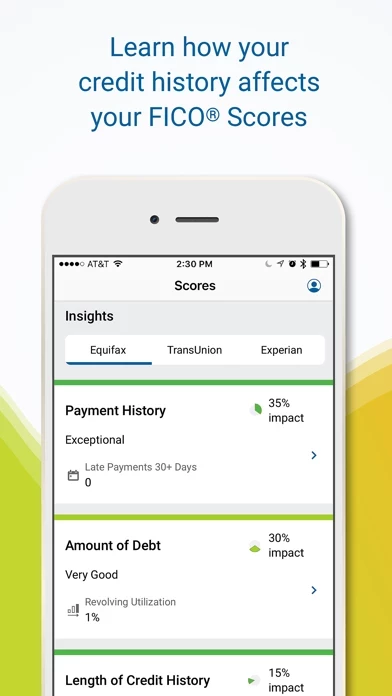

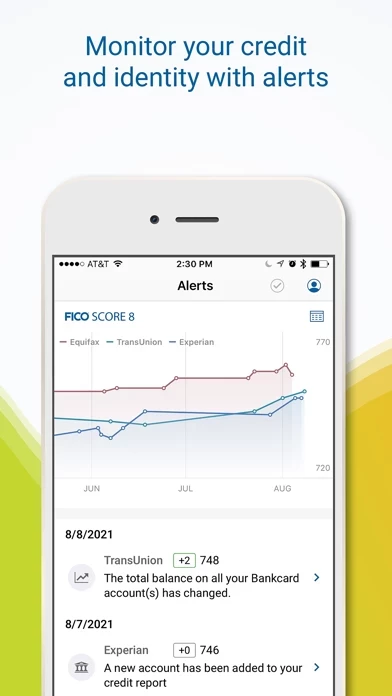

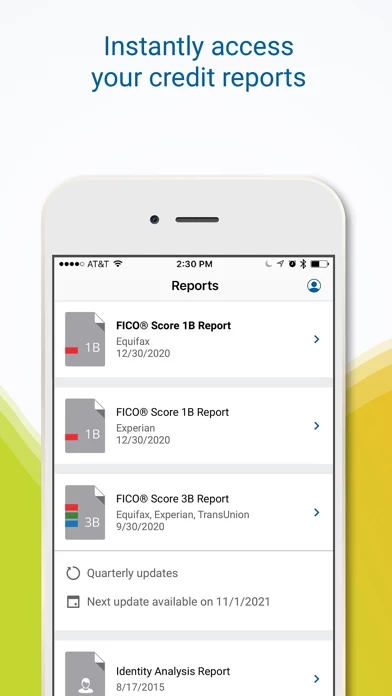

I’m spending way to much time trying to figure things out. Or example, only on a he this app app and experian does it show my credit score is in the low 600s on all credit bureaus for the past 3 months. But for the last two months, I’ve been checking the Equifax and TransUnion apps as well, and they score me at 719 and 721. They more accurately reflect my credit card balances and student loan issues. So I don’t know why I’m paying for conflicting, outdated and inaccurate information. My credit card balance was listed at $7 for nearly 3 months, but when it finally registered that the balance was $0, this app took my score down by -14 points on each bureau. That cannot be right. For a while I was wondering if TransUnion was faulty and they were right, but after checking with my bank (Capital One), they told me I need to do this and that to get that fixed with them, because there’s no reason my score should have gone down. And there’s no reason my scores should be so much lower on the this app app. Experian has as low as 640 there, and Equifax has me at 680, and that gap has been like that for nearly 2 months. The reason I pay for myFICO , is to make sure all my scores are above 670 before I do something like a new auto loan, but I feel like I’m paying for inaccuracy and it’s been an inconvenience to my finacial goals.