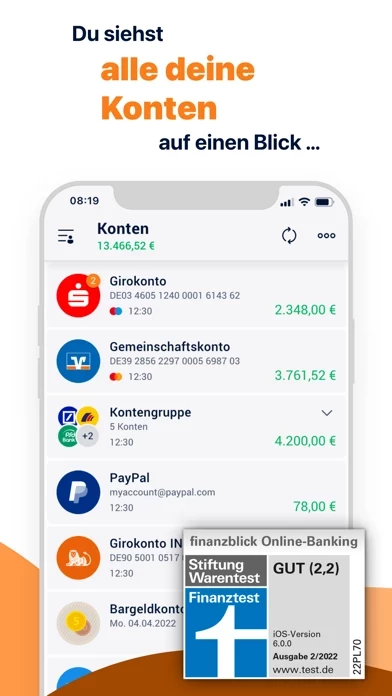

- Supports accounts and credit cards from more than 4,000 banks in Germany, including Sparkasse, Volksbank, DKB, Postbank, Sparda-Bank, Deutsche Bank, Targobank, Commerzbank, LBB, n26, and more.

- Supports credit cards from VISA, MasterCard, and American Express, including Amazon, ADAC, Tchibo, Thomas Cook, DMAX, Miles & More, and more.

- Supports Tagesgeldkonten from Santander Consumer Bank, MoneYou, Bank of Scotland, and more.

- Allows users to create and manage offline accounts.

- Supports customer cards from Payback, Shell ClubSmart, and more, including the ability to check point balances online.

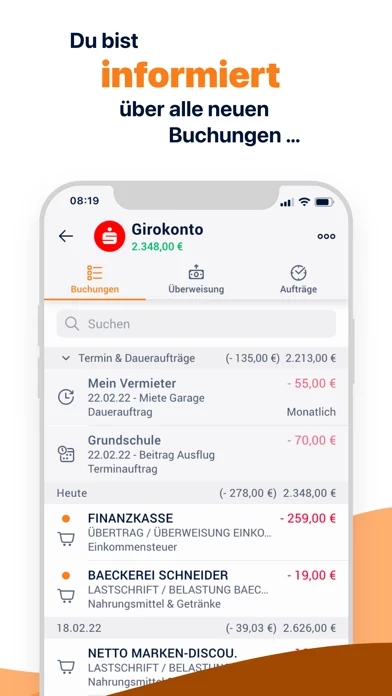

- Provides automatic and individual categorization of expenses and income.

- Offers automatic evaluation of expenses and income in clear graphics.

- Provides automatic and individual budgeting, including alerts for budget overspending.

- Offers evaluations of individual keywords.

- Provides automatic updates on new transactions, including push notifications for incoming and outgoing transactions.

- Allows automatic synchronization and access to data on multiple devices, including iPhone, iPad, Mac, Apple Watch, and web browser.

- Allows quick entry of cash expenses via widget or in-app without logging in.

- Provides quick access to customer cards without logging in.

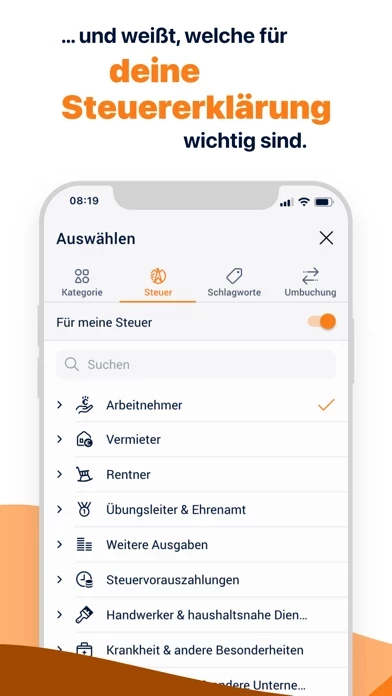

- Offers automatic review of transactions for tax relevance.

- Provides automatic allocation of tax-relevant transactions to the appropriate tax category.

- Allows transfer of tax-relevant transactions to tax returns.

- Offers secure banking features, including support for all TAN procedures, photoTAN from Commerzbank, and password protection.

- Provides a permanently encrypted database.

- Offers additional features, including ATM search, linking of documents and receipts to transactions, Apple Watch support, two color schemes, and Touch ID and Face ID support.