Cash Advance - Loan Holdings Software

Company Name: LOAN HOLDINGS LTD

Cash Advance Overview

What is Cash Advance? The app is designed to help people who are in need of payday loans. It offers the convenience of applying for loans online and getting funded, if approved, all online. The app also provides information about APR rates and repayment terms.

Features

- Online application process: The entire process of applying for a loan is completed online, making it convenient for users.

- Quick decision: Users can expect to receive a decision on their loan application quickly.

- Funding: If approved, users can expect to receive their funds online.

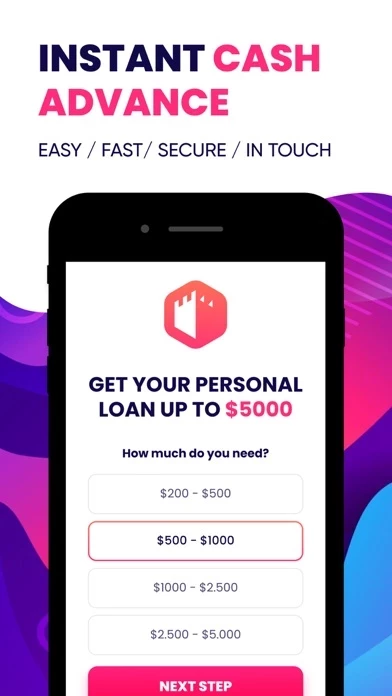

- APR rates: The app provides information about APR rates, which range from 5.99% to 35.99% for qualified consumers.

- Repayment terms: The app also provides information about repayment terms, which range from 3 months to 36 months.

- Loan calculator: The app has a loan calculator that helps users calculate their monthly repayments and total payback amount.

- Material disclosure: The app provides material disclosure about the loan, including the total cost of the loan and representative APR.

Official Screenshots

Product Details and Description of

Looking for payday loans online? When you're faced with financial difficulties, a day or even an hour can be a lot of time, especially in our fast-paced world. Sometimes you need a loan as soon as possible. While you can apply for payday loans in brick-and-mortar stores, more people are beginning to take advantage of the benefits that online lenders offer. With online lenders, the entire process is completed online, so you can expect to apply, receive a decision and get funded, if approved, all online. Material Disclosure: APR rates range from 5.99% to 35.99% (maximum APR for qualified consumers). Repayment terms from 3 months to 36 months. This number will be set by your lender, and you will be notified of the final number before accepting the loan terms. We are not a lender and do not have the ability to disclose exact APR. If you borrowed $5,000 over a 48-month period and the loan had an 8% arrangement fee ($400), your monthly repayments would be $131.67 with a total payback amount of $6,320.12, which, including the 8% fee paid from the loan amount, would have a total cost of $1,720.12. Representative 18.23% APR.