A real estate portfolio is subject to risks similar to those associated with the direct ownership of real estate and real estate debt, as the investments are sensitive to factors such as changes to real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and credit worthiness of the issuer & borrowers.

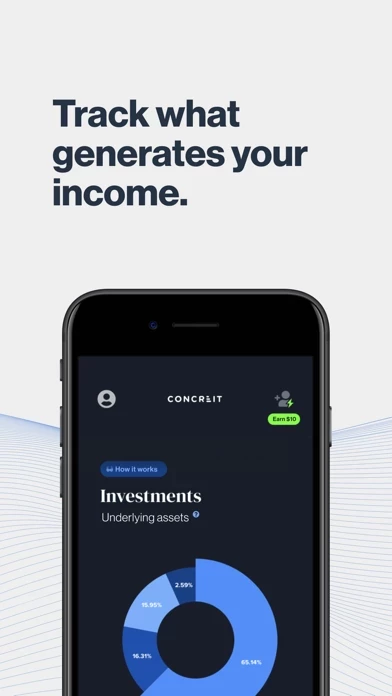

With a single investment, you get access to a diversified portfolio of commercial real estate assets managed by a professional investment team.

Access to a private market real estate investment team shouldn't be limited to the wealthy.

We’re leveraging a proprietary full-stack real estate technology platform to make data-driven decisions combined with the experience of our investment advisory committee on each investment.

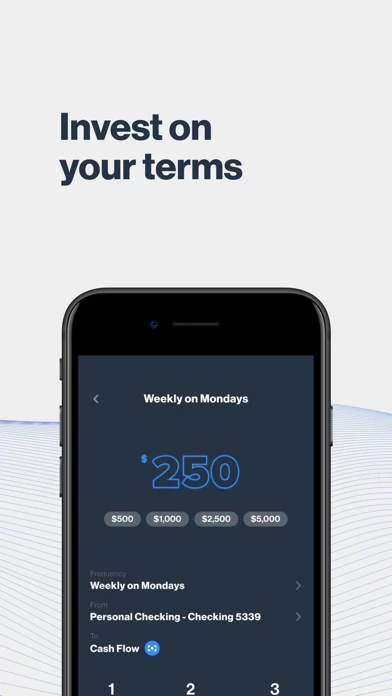

Incredibly Easy Real EstateTM in the app screenshots refers to the ease of use of the mobile application and the platform and does not infer that private real estate investing is easy or simple.