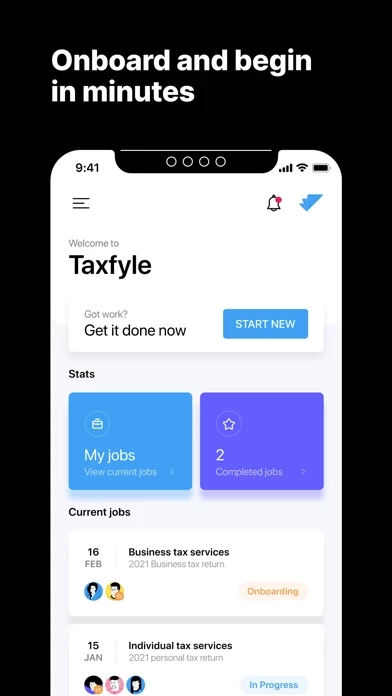

- Automatically matches you to a credentialed tax professional specializing in your tax position within seconds

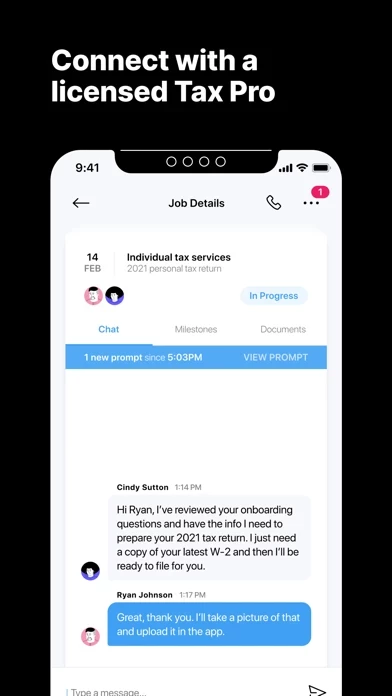

- Allows you to upload documents via photos and the cloud

- Offers in-app messaging with your tax professional

- Provides secure data sharing and messaging, encrypted at rest and in transit

- Works only with credentialed tax professionals, such as enrolled IRS agents (EA) or licensed certified public accountants (CPA)

- Offers free tax advice 24/7

- Provides access to all your documents year-round

- Allows you to email your tax return directly from the app

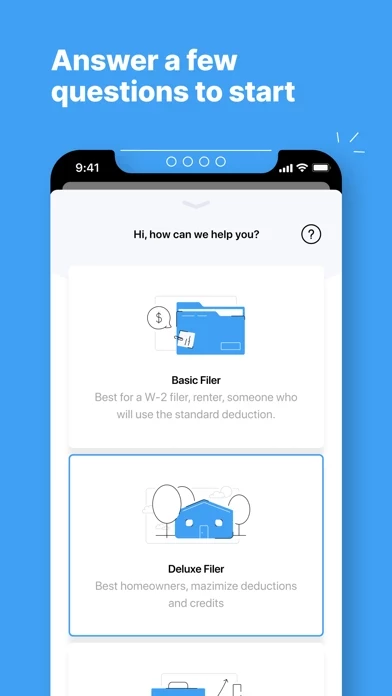

- Offers professionally prepared income taxes for individuals and businesses

- Prepares all business forms, including Corporate (C Corp) Form1120, S Corporation (S Corp) Form 1120S, Partnership (LLP or LP or GP) Form 1065, Non-Profit Corporation (Form 990)

- Prepares personal forms, including non-resident alien (Form 1040-NR) and expatriate or expat or someone living abroad

- Designed for individuals who own a home, are independent contractors/freelancers/business owners/Uber drivers/Airbnb hosts/couriers, own rental property or receive rent income, receive a K-1, sold stocks or investments, received dividends, or own a foreign bank account or investment

- Designed for businesses that are an LLC, Sole proprietor, Corporation, Partnership, S Corporation, Not-for-profit, have revenue between $0 - $20M, make a profit or loss, maintain inventory, have sales of business or capital assets, have partners or shareholders and make a distribution or contribution, have a foreign parent or investors, or are engaged in rental real estate, and use accounting software (Quickbooks, Xero, Shoeboxed, Expensify, Mint) to track your books (bookkeeping/record keeping) or use excel to track income expenses.