How to Delete EarnIn

Published by Activehours Inc. on 2024-05-22We have made it super easy to delete EarnIn: Make Every Day Payday account and/or app.

Guide to Delete EarnIn: Make Every Day Payday

Things to note before removing EarnIn:

- The developer of EarnIn is Activehours Inc. and all inquiries must go to them.

- Under the GDPR, Residents of the European Union and United Kingdom have a "right to erasure" and can request any developer like Activehours Inc. holding their data to delete it. The law mandates that Activehours Inc. must comply within a month.

- American residents (California only - you can claim to reside here) are empowered by the CCPA to request that Activehours Inc. delete any data it has on you or risk incurring a fine (upto 7.5k usd).

- If you have an active subscription, it is recommended you unsubscribe before deleting your account or the app.

How to delete EarnIn account:

Generally, here are your options if you need your account deleted:

Option 1: Reach out to EarnIn via Justuseapp. Get all Contact details →

Option 2: Visit the EarnIn website directly Here →

Option 3: Contact EarnIn Support/ Customer Service:

- 100% Contact Match

- Developer: Activehours Inc.

- E-Mail: [email protected]

- Website: Visit EarnIn Website

How to Delete EarnIn: Make Every Day Payday from your iPhone or Android.

Delete EarnIn: Make Every Day Payday from iPhone.

To delete EarnIn from your iPhone, Follow these steps:

- On your homescreen, Tap and hold EarnIn: Make Every Day Payday until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the EarnIn: Make Every Day Payday app from your phone.

Method 2:

Go to Settings and click on General then click on "iPhone Storage". You will then scroll down to see the list of all the apps installed on your iPhone. Tap on the app you want to uninstall and delete the app.

For iOS 11 and above:

Go into your Settings and click on "General" and then click on iPhone Storage. You will see the option "Offload Unused Apps". Right next to it is the "Enable" option. Click on the "Enable" option and this will offload the apps that you don't use.

Delete EarnIn: Make Every Day Payday from Android

- First open the Google Play app, then press the hamburger menu icon on the top left corner.

- After doing these, go to "My Apps and Games" option, then go to the "Installed" option.

- You'll see a list of all your installed apps on your phone.

- Now choose EarnIn: Make Every Day Payday, then click on "uninstall".

- Also you can specifically search for the app you want to uninstall by searching for that app in the search bar then select and uninstall.

Have a Problem with EarnIn: Make Every Day Payday? Report Issue

Leave a comment:

Reviews & Common Issues: 1 Comments

By Alvin Cornwell

11 months agoHello. Earnin app hasn't worked in about a month.

What is EarnIn: Make Every Day Payday?

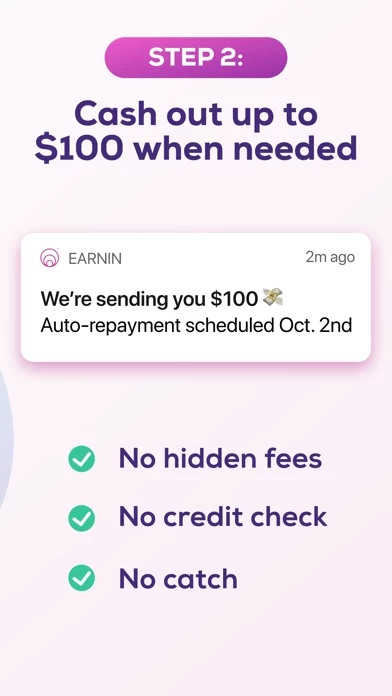

this app is a simple way to get paid early—and live life on your terms. Access up to $100/day or $500/paycheck. Think of it as instant cash you can use before payday to cover anything you need. ‡ Using a cash advance or loan to borrow money can be confusing, misleading, and costly. With this app, you can tap into money you’re already earning—for free.[1] Unexpected bill or upcoming rent? We got you. Plus there’s no interest, no credit checks, and no surprises.‡ Accessing your paycheck in advance is easy. HERE’S HOW IT WORKS: 1. Add your bank and debit card details, then submit your employer info. 2. We’ll verify everything, including the hours you work. 3. Cash out up to $100 per day (up to $500 per pay period). 4. On payday, we'll debit your account for the money you’ve cashed out + any optional tips. 5. Keep cashing out to get paid early—whenever you need. — GET INSTANT CASH Access earnings from your pay in minutes without waiting for payday.[1] By taking advantage of the mon...