When tracking trips by public transport, pre-plan your first trip in order to teach Psngr which transit lines you use to get from A to B.

• Psngr bundles standard, tax-deductible mileage rates in 15+ countries, including US (IRS), UK (HMRC), Canada (CRA), Australia (ATO), New-Zealand, France, Germany, Switzerland, Belgium, Netherlands, Denmark, Austria, South-Africa, and Ireland.

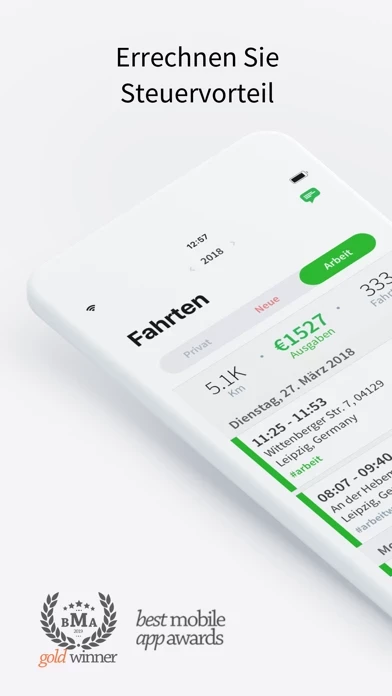

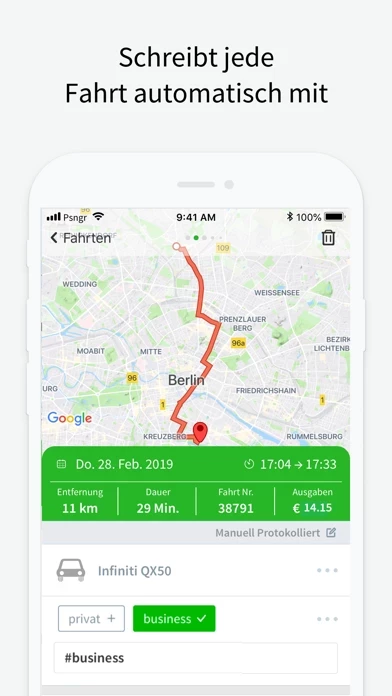

Psngr tracks your trips automatically, calculates mileage and expenses, and generates reports for IRS tax deduction.

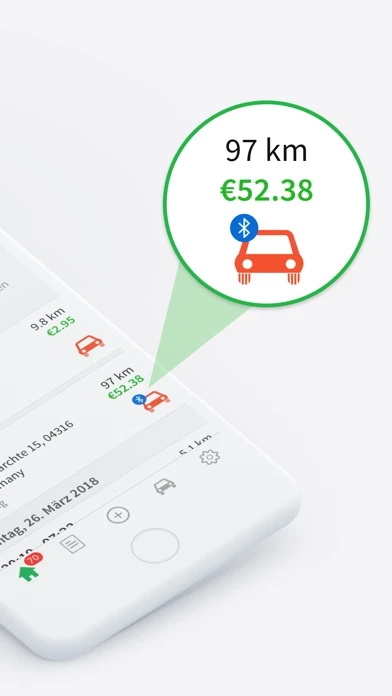

• The beacon increases tracking accuracy, enables vehicle detection, and allows you to share a vehicle with other drivers, thus maintaining a single vehicle logbook of all trips made, regardless of the driver.

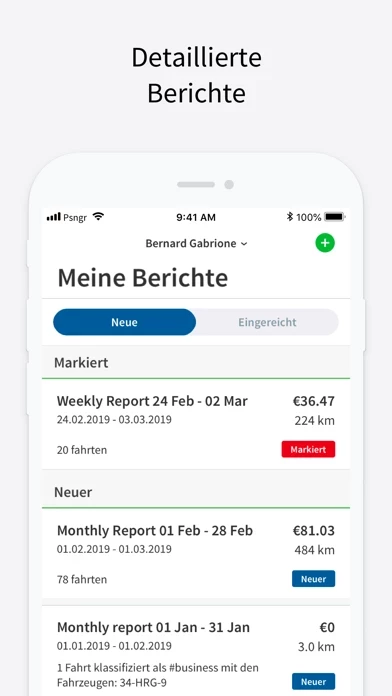

• Psngr Enterprise accounts include reports workflow, allowing employees to submit their mileage report directly from the app, for review and approval by their manager.