Beem Reviews

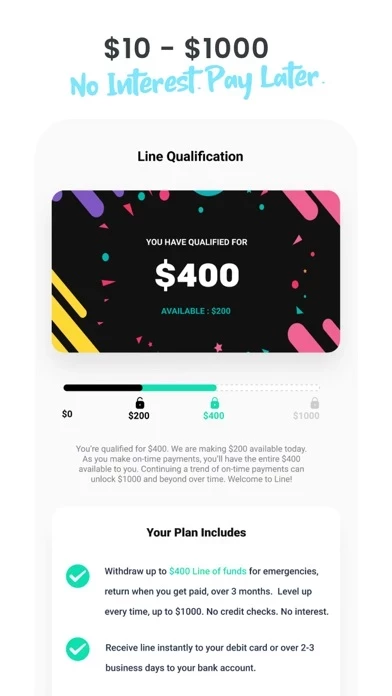

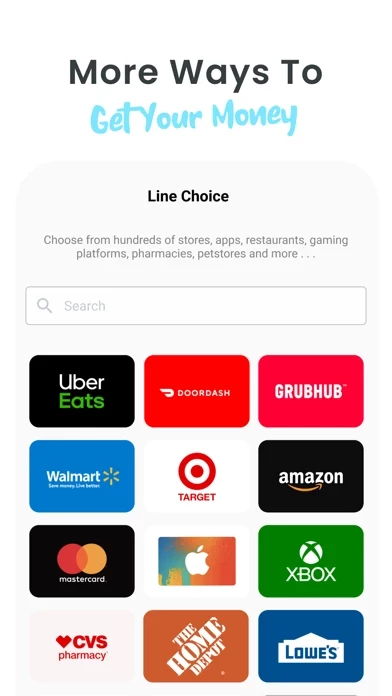

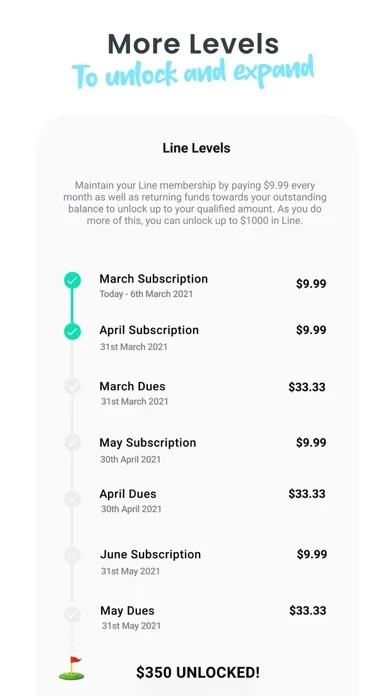

Published by Line Financial, Pbc on 2025-03-13🏷️ About: Line is a mobile app that provides an emergency line of funds to its members who qualify and maintain an active paid subscription on the app. It is not a loan and does not impact the user's FICO score. The app is developed by Line Financial, a Public Benefit Corporation based in the US. The app offers various benefits, including instant access to cash, higher amounts, gift cards, prepaid cards, cashback, credit monitoring, credit alerts, identity theft protection, and more. Users can sign up for a Line account in five easy steps that take less than five minutes. The app comes with bank-level security, data privacy, and 24/7 dedicated support.