You can value firms using the ‘weighted average cost of capital’ (WACC, or 'cost of capital') approach, the ‘adjusted present value’ (APV) approach, the ‘dividend growth model’ (DGM), or real option valuation (ROV) techniques.

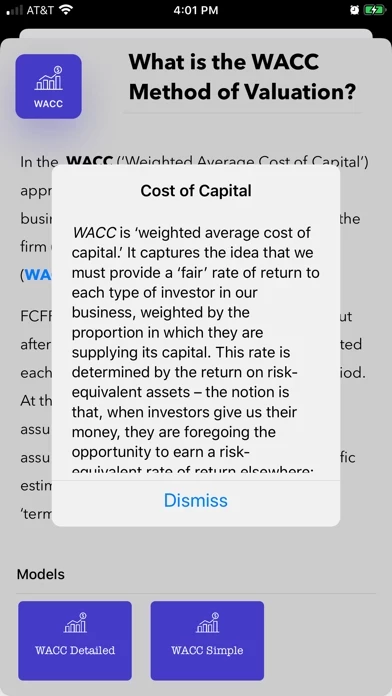

Consequently, uValue is fundamentally educational in its intent — it comes with three important features: pop-up boxes that define and explain every input or concept, a uValue Companion that is a mini-textbook on valuation, and links to a data set that give you industry data benchmarks.

It was jointly created by Professor Aswath Damodaran at the Stern School of Business and Professor Anant Sundaram at the Tuck School of Business at Dartmouth, two academics with extensive teaching, advising, consulting, and research experience on business valuation.

The app also includes a set of calculators to value bonds, annuities and perpetuities, as well as calculate cost of capital, forecast exchange rates, lever/unlever betas, and so forth.

Developed by two professors from leading US business schools, uValue is a corporate valuation app.