PNC Mobile Banking Logiciel

Nom de la société: PNC Bank, N.A.

À propos: PNC Financial Services Group, Inc. is one of the nation's largest diversified financial services

organizations providing banking.

Siège social: Pittsburgh, Pennsylvania, United States.

PNC Présentation

Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number.

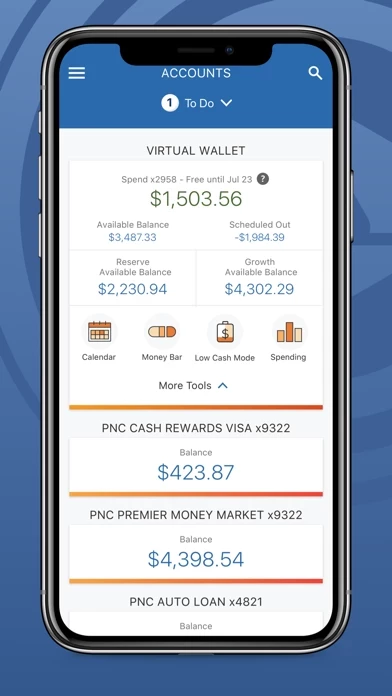

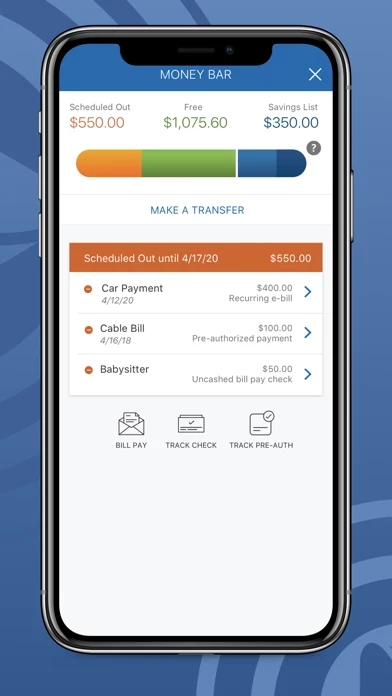

Visualize your money – Use Money Bar® to see how much is available to spend with your Free Balance, what you’ve scheduled for bills and how much you’ve set aside for goals.

See what’s free to spend – Your Scheduled Out subtracts known bills and expenses from your available checking account balance to show you what’s free to spend, which we call your Free Balance.

Check balances & recent transactions – See current account activity for your checking, savings, credit card and loan accounts.

(ii) There are limits to the number of transactions you can make from a savings or money market account per month.

Zelle is available to almost anyone with a bank account in the U.S. Transactions typically occur in minutes between enrolled users.

Make saving fun using your personalized piggy bank to transfer money to your savings.

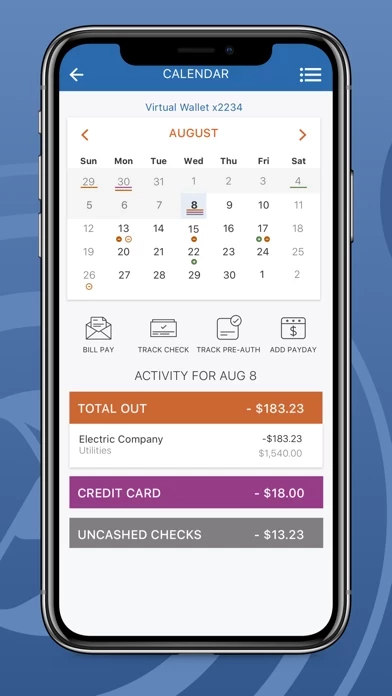

You can pay bills, schedule bill reminders, track external payments, view potential Danger Days and more.

Captures d'écran officielles

PNC Forfaits tarifaires

| Durée | Montant (USD) |

|---|---|

| Facturé une fois | $50.99 |

**Les données de tarification sont basées sur les prix d'abonnement moyens indiqués par les utilisateurs de Justuseapp.com..

Détails du produit et description de

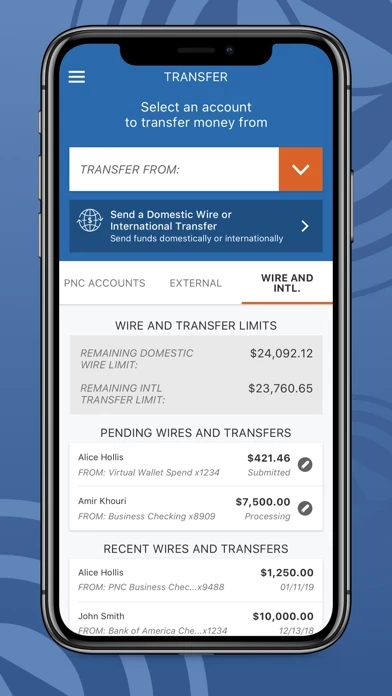

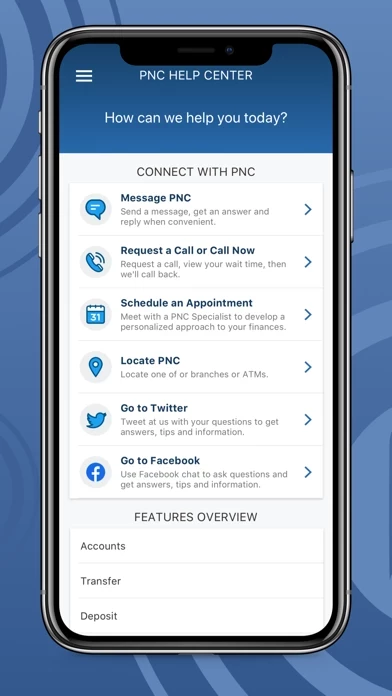

Check balances & recent transactions – See current account activity for your checking, savings, credit card and loan accounts. Protect your accounts – Set up Touch ID or Face ID to securely sign on to the app. Or, reset your password quickly and conveniently if you need to. Send money with Zelle® – Send money simply, to people you know and trust (i) using your mobile number or email address. Transfer funds – Transfer funds between eligible l’application accounts and external bank accounts (ii). Make deposits – Deposit checks quickly and easily with your iOS device (iii). Pay bills – Add your bills and make one-time or recurring bill payments right from the app. Manage your cards – View and manage your l’application credit, debit and SmartAccess® cards and make in-store payments with Apple Pay right from the app. Lock your cards – Easily lock or unlock your l’application debit card or credit card if you misplace it. Locate l’application – Locate the nearest l’application ATM or branch using our location services, or search by zip code and street address. If you have Virtual Wallet®, you’ll have access to more tools and insights to help you work toward your financial goals. See what’s free to spend – Your Scheduled Out subtracts known bills and expenses from your available checking account balance to show you what’s free to spend, which we call your Free Balance. You’ll also see potential Danger DaysSM, which is when your account is at risk of being overdrawn. Visualize your money – Use Money Bar® to see how much is available to spend with your Free Balance, what you’ve scheduled for bills and how much you’ve set aside for goals. Know your activity – Use the Calendar to see upcoming paydays and payments, and view a history of your transactions. You can pay bills, schedule bill reminders, track external payments, view potential Danger Days and more. Track your spending & set budgets – See where you're spending your money with categories like restaurants, gas and more. Then, create budgets to know if you’re staying on track. Make saving easier – Create savings goals to work toward your goals and keep track of your progress along the way. Set up automatic rules to regularly transfer money to your savings, like once a week or when you receive a paycheck. Make saving fun using your personalized piggy bank to transfer money to your savings. With l’application’s Security and Privacy, you can be confident that your personal and financial information will be protected while using our app. (i) Zelle should only be used to send or receive money with people you know and trust. Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number. Neither l’application nor Zelle offer a protection program for authorized payments made with Zelle. Zelle is available to almost anyone with a bank account in the U.S. Transactions typically occur in minutes between enrolled users. If the recipient has not enrolled, the payment will expire after 14 calendar days. (ii) There are limits to the number of transactions you can make from a savings or money market account per month. (iii) l’application does not charge a fee for Mobile Banking. However, third party message and data rates may apply. Mobile Deposit is a feature of l’application Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a l’application mobile banking app. Eligible l’application Bank account and l’application Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the l’application Online Banking Service Agreement. Virtual Wallet, l’application SmartAccess and SmartAccess are registered trademarks of The l’application Financial Services Group, Inc. ©2022 The l’application Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Haut Avis

Par pgh-in-paris

Cannot use mobile deposit

Camera is not connected to this version which means the mobile deposit function does not work

Par Lefifi

Unable to type the zero when transferring money

This app does not work. For example I cannot transfer 10$ to my credit card account. The app does not accept the zero. I can type 11.11$ but 10$.... it drives me crazy