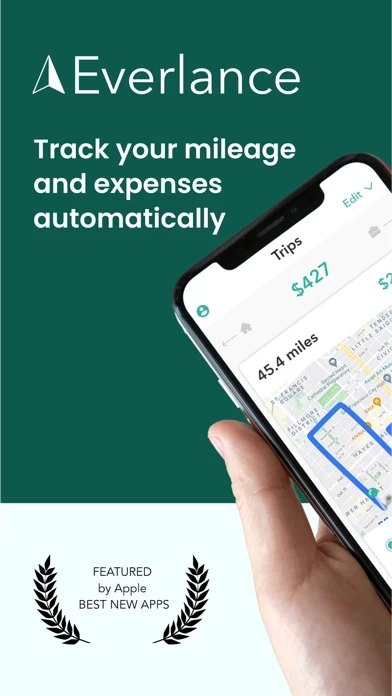

Mileage Tracker Erfahrungen und Bewertung

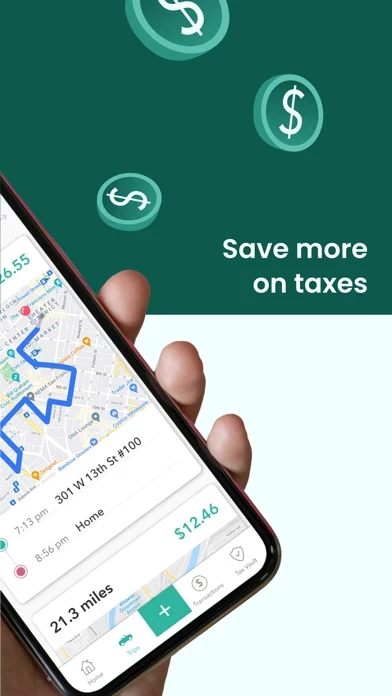

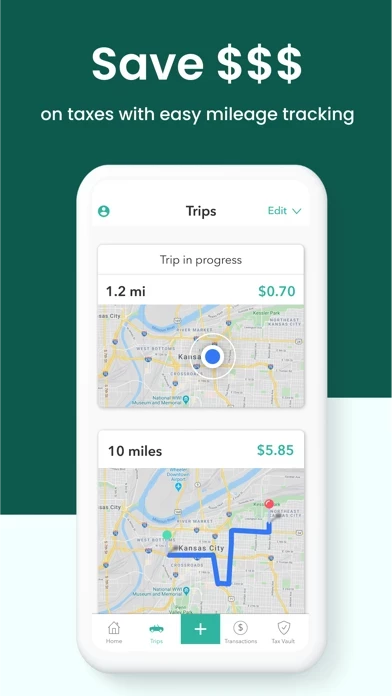

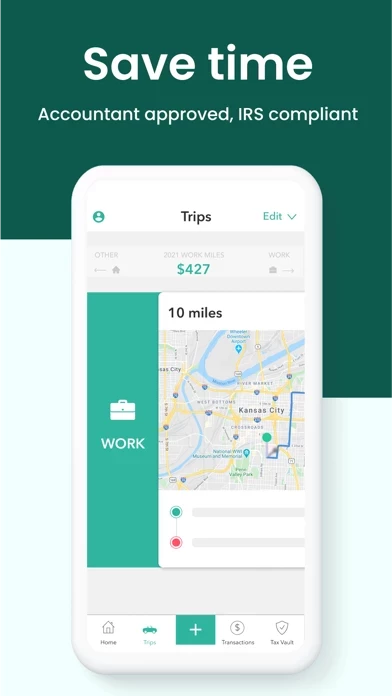

Veröffentlicht von Everlance Inc. on 2025-05-13🏷️ Über: The #1 automatic mileage and expense tracking app, trusted by over 1 million drivers. Did you know the average Everlance user saves $6,500 on taxes every year by maximizing their deductions with Everlance? Well, now you do.