PEX Avis

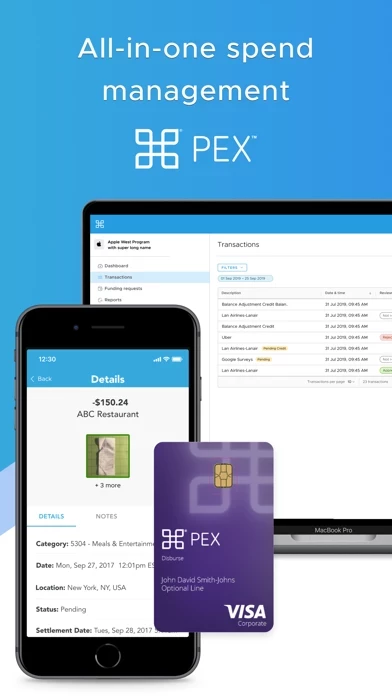

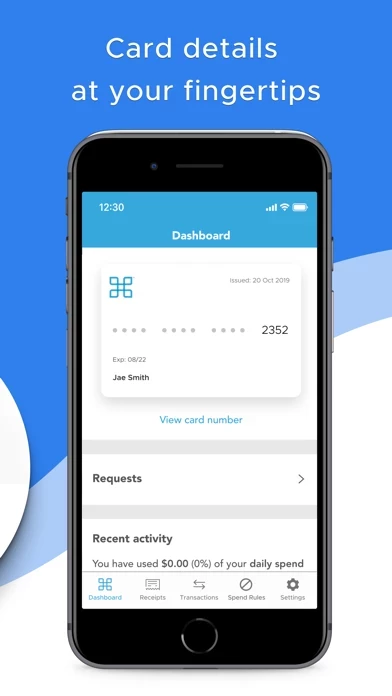

Publié par PexCard on 2025-05-22🏷️ À propos: The PEX employee spending platform and PEX Prepaid Card provide powerful capabilities to manage staff spending and expense reconciliation. PEX automates and simplifies your spend and expense workflows, saving you time on issues meaningful to your bottom line.