Curve | Supercharge your money Logiciel

Nom de la société: Curve

À propos: Curve is an Over The Top banking platform that consolidates all bank cards into a single smart card

and app.

Siège social: London, England, United Kingdom.

Curve Su Présentation

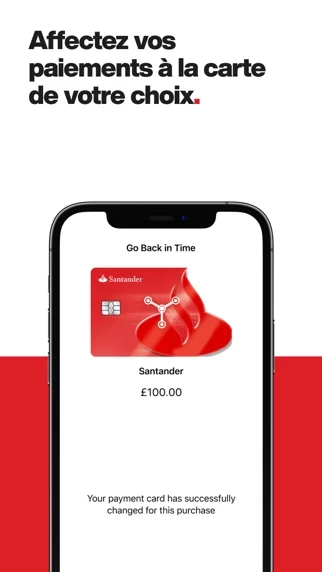

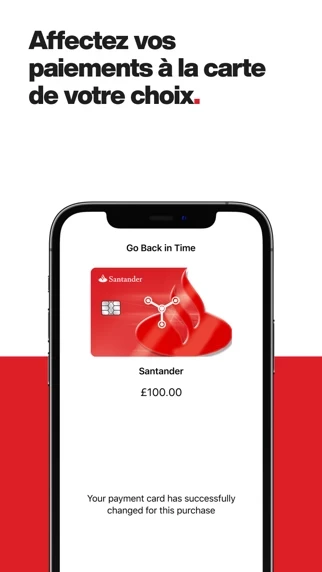

Curve’s killer exchange rates make spending money abroad worry-free, and if you wish you’d used a different bank card for a transaction, Curve allows you to change the card you used.

As Curve is a debit Mastercard, you can use it for spending money in places which don’t accept credit cards and then charge it to your credit card.

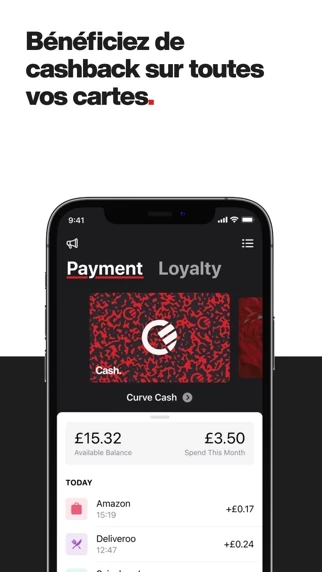

There’s also Curve rewards where you can earn 1% cashback from a selection of 100+ retailers, with the money sent right to your Curve Cash card.

Set up an account in minutes, then securely add all your Visa and Mastercard debit cards to your Curve Card app and use any of your bank accounts with just one Curve Mastercard.

Curve instantly categorises each purchase to your spend timeline, whether you’re spending money at home or abroad, keeping track or trying to save, Curve’s here to help you manage your money.

Curve gives you financial freedom, simplifying your mobile banking experience by connecting your current, business and personal accounts to one smart card and an even smarter app.

Curve puts all your finances in one place by connecting your debit and credit cards to one simple app & beautiful card.

Curve lets you switch the bank card you used for purchases up to £1,000 and up to 14 days after your purchase.

Captures d'écran officielles

Curve Su Forfaits tarifaires

| Durée | Montant (USD) |

|---|---|

| Facturé une fois | $1.00 |

**Les données de tarification sont basées sur les prix d'abonnement moyens indiqués par les utilisateurs de Justuseapp.com..

Détails du produit et description de

Curve combines your credit, debit and loyalty cards into one next-gen money super app. It’s a free, one-of-a-kind digital wallet for your cards that lets you supercharge your finances without switching banks. Just sign up, add your credit and debit cards to your Curve Wallet and start shopping. The more cards you add, the more cashback you’ll earn, helping you experience shopping in a new rewarding way. Take control of your money and finances. The future is not another bank, it’s Curve. -- ALL YOUR CARDS IN ONE Curve connects your credit and debit cards in one app to supercharge your finance and spending power. And it works just as easily in-store, online or with Apple Pay - just tap and go. Sign up today for a money app that pays you back and say goodbye to your wallet. EARN MORE CASHBACK WITH CURVE REWARDS You get more when shopping with Curve, cashback offers of up to 20% from tons of top brands like Amazon Fresh, Five Guys, Selfridges, Just Eat, Harvey Nichols and more with our Cashback Rewards scheme when you pay with Curve. So you can earn money back on everything from your weekly shop to your payday splurge – consider it your mini side hustle (without the hassle). SPEND MONEY ON ADVENTURES, NOT FEES Curve has the best foreign exchange rates across your wallet, no matter which card you use abroad. Travel with confidence and get money when you need it with access to free ATM withdrawals up to £600/month and 0% fees on overseas transactions (weekend charges apply.) CONTROL YOUR MONEY WITH SMART INSIGHTS Curve helps you keep track of your loyalty cards with Curve Wallet so you never miss out on rewards or cashback at your favourite shopping destinations. Use your Curve card and app to automatically collect your loyalty points along the way. Curve also helps you manage your budget and finances by making it easy to see what you’re spending and where you’re shopping. To sign up and start using Curve you need to be 18 years or older. *Terms and privacy policy apply at www.curve.app. 0FX subject to caps and weekend charges. Cashback with selected retailers.

Haut Avis

Par freemulder

Testé et approuvé !

C’est un système simple et pratique qui permet de laisser toutes vos cartes bancaires chez vous, car cette carte les regroupe toutes ! Je teste ce système depuis plusieurs mois, sans aucun problème. La possibilité de modifier la carte débitée après l’achat est un vrai plus, et l’alerte des transactions en temps réel est bien faite. Mais attention, c’est une carte à autorisation systématique, ce qui veut dire que votre paiement sera un peu plus lent qu’avec une carte classique dans de nombreux cas !

Par s.yorick

Jamais sans ma carte

Très bonne idée de réunir en une carte toute ses cartes. Simple et facile d’utilisation ,même si tout est en anglais. Vivement que l’application soit en Français et qu’on puis utiliser Apple pay

Par Manhattan13

Top

Toutes les cartes bancaires réunies en une seule. Pas de frais de change à l’étranger même avec votre carte qui vous en facture habituellement. On peut même ajouter la carte d’une autre personne (avec son consentement) qui a par exemple pour habitude de vous la prêter. Je paye tout avec cette carte en voyage et y’a qu’une seule fois ou ce n’est pas passé dans un petit fast food à New York. Sinon aucun souci. Je recommande. Code de parrainage : 2P5YB