Once you enter all information and include year-to-date gross paid wages, Payroll Guru will calculate your net paycheck amount and will show you the appropraite taxes.

For small business owners and payroll service providers Payrollguru will help estimate net and gross paycheck amounts in a particular payroll situation, and will provide a pretty accurate assessment of applicable payroll taxes.

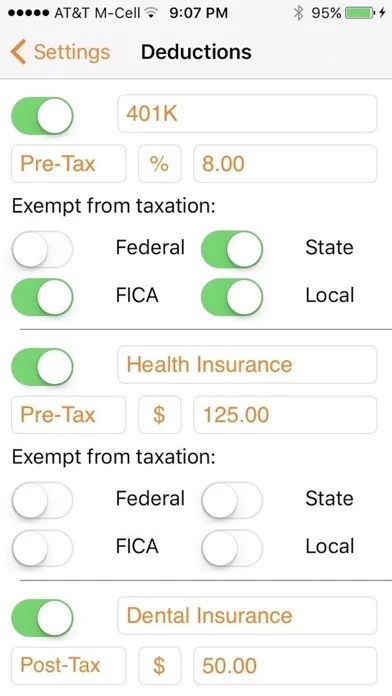

Payroll Guru calculates paychecks with net pay amount and applicable taxes from gross wages.

Payroll Guru app allows for unlimited number of profiles to cover every employee or a group of similarly taxed employees.

Employees can also use Payroll Guru app to compare net paycheck amounts (after tax) in different states.