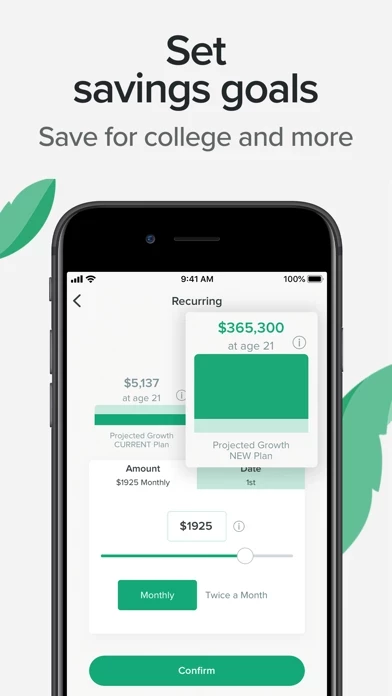

The performance results for UNest’s 529 plan investment account is based, in part, upon certain hypothetical assumptions which have been compiled by UNest.

Compared to a traditional savings or investment account, UNest offers tax advantages on qualified education expenses.

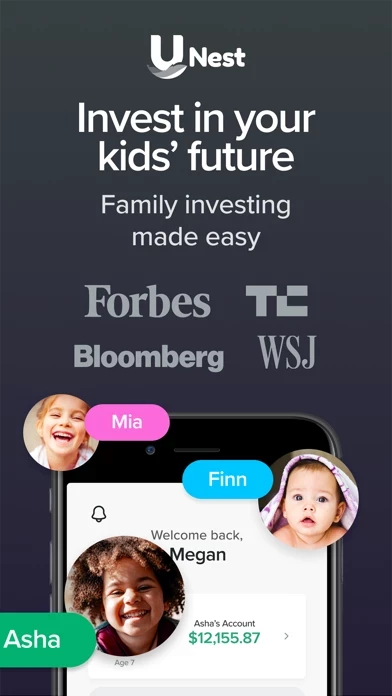

Using the UNest college savings app is a great way to save money for education in a 529 College Savings Plan.

Personalized Portfolio - UNest picks an investment portfolio based on your child’s age.

Tax-free growth - Your money grows tax-free when you use it for tuition, student housing, books, computers, and other educational expenses.