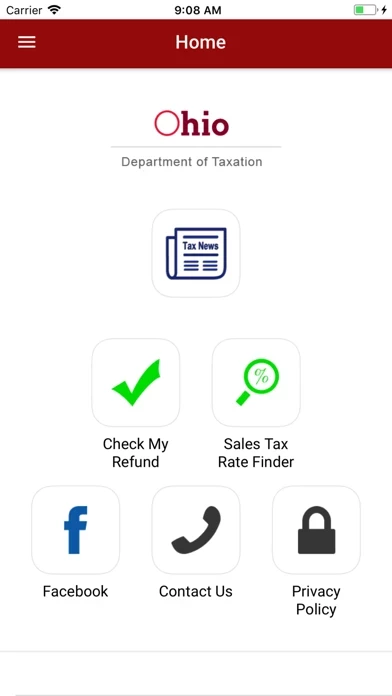

Ohio Taxes Avis

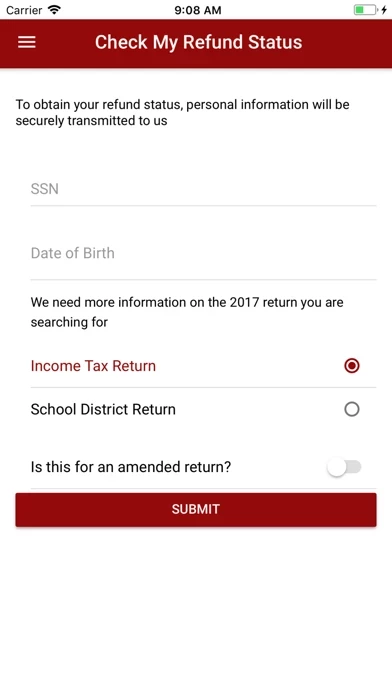

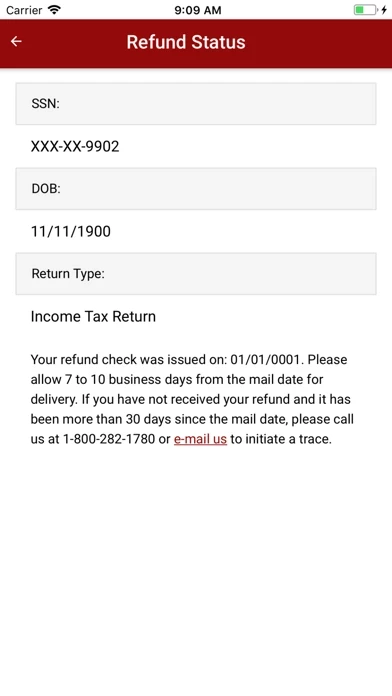

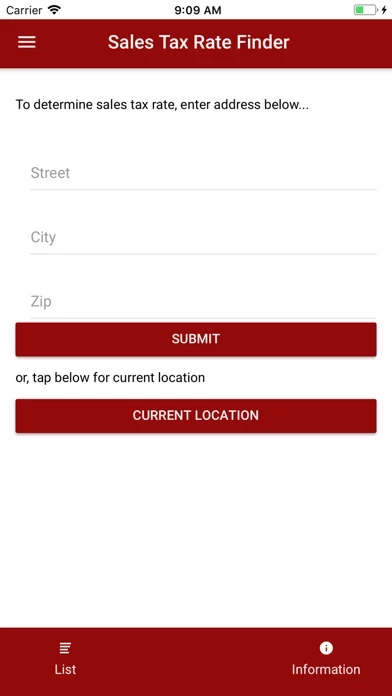

Publié par Ohio Department of Taxation on 2024-04-22🏷️ À propos: This app can be used to obtain information regarding the refund status of your Ohio and school district individual income tax return, check the Ohio sales tax rate for all addresses in the State of Ohio, calculate sales tax due and view news about Ohio taxes. Check the Refund Status of your Ohio and School District Individual Income Tax Refund(s) This application only allows you to check the status of the return filed in .