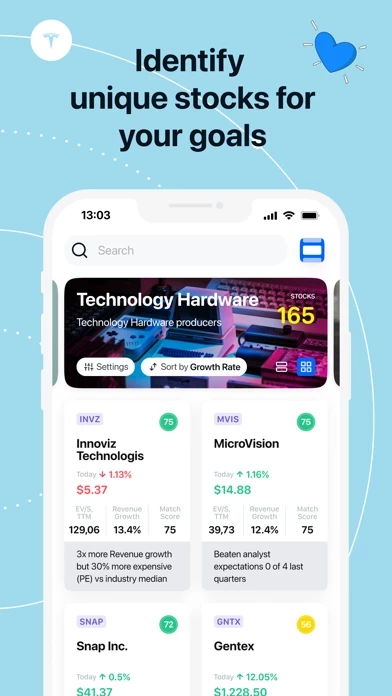

- In addition to investing in stocks, ETFs, and TTFs, Gainy users will also have access to personalized investment advice through the match score, which suggests stocks and portfolios that align with their interests and investment goals.

- TTFs don’t have hundreds of unknown companies like in ETFs that disperse all of your growth but typically 10-15 stocks hand-picked by professionals and optimized with algorithms with a goal of delivering diversification and balancing risk/return of the portfolio.

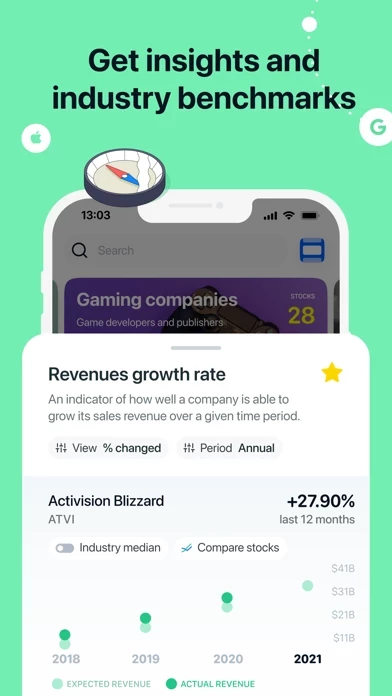

- Using Gainy's recommendation tools and financial data, users can choose from over 70 model portfolios based on industries (e.g., Electric Vehicles), investment styles (e.g., Low-volatility stocks), and market conditions (e.g., Inflation-Proof portfolio).

- Thematic Trading Fractionals are optimized model portfolios typically made of 10-15 stocks devoted to one topic, cause or investment strategy, e.g. FinTech, Cybersecurity, or Inflation-Proof Portfolio.

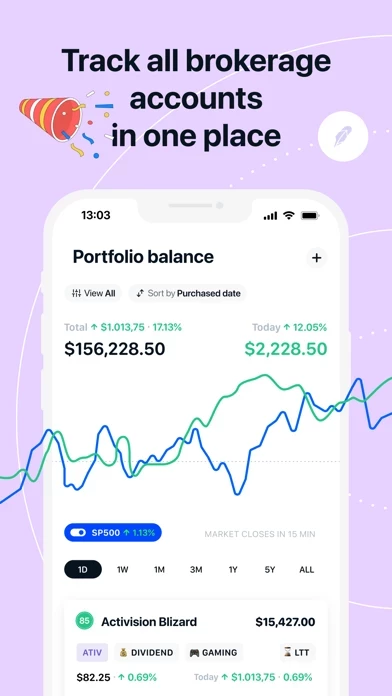

Gainy is a thematic investing platform that allows investing in stocks, ETFs, and TTFs.