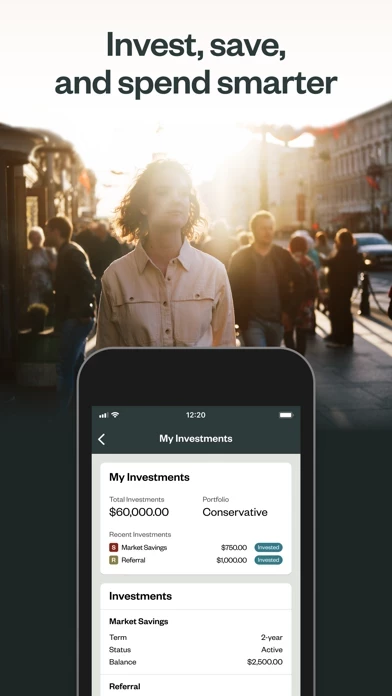

Actual deposit insurance coverage may be lower if you have other funds deposited at Webster Bank, N.A.. Customers are responsible for determining the amount deposited in each account at Webster Bank, N.A., and for monitoring the total amount of their deposits at Webster Bank, N.A., to determine the extent of available FDIC insurance coverage in accordance with FDIC rules.

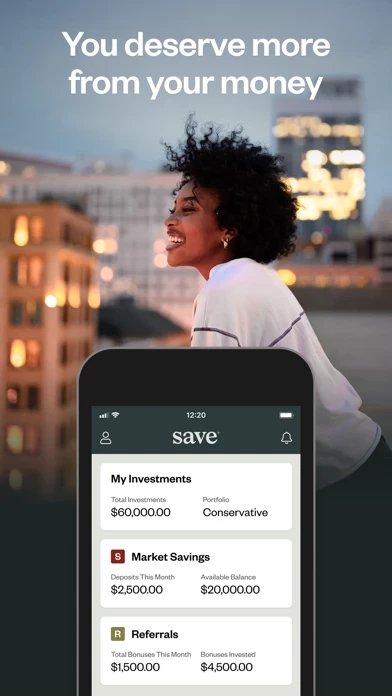

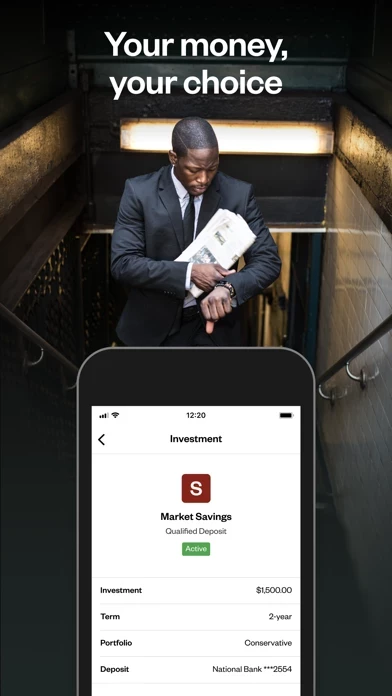

The deposit account portion of the Save Market Savings product and service is provided by Webster Bank, N.A., Member FDIC.

¤ The deposit account portion of the Save Market Savings product and service is provided by Webster Bank, N.A., Member FDIC.

FDIC insurance coverage for funds deposited at Webster Bank is limited to not more than $250,000 per depositor, per FDIC-insured bank, per ownership category.

† To obtain FDIC insurance coverage, customer funds provided will be deposited into non-interest-bearing accounts at Webster Bank.