OPay-We are beyond Banking Software

Firmenname: OPay Digital Services Limited

OPay We are beyond Banking Übersicht

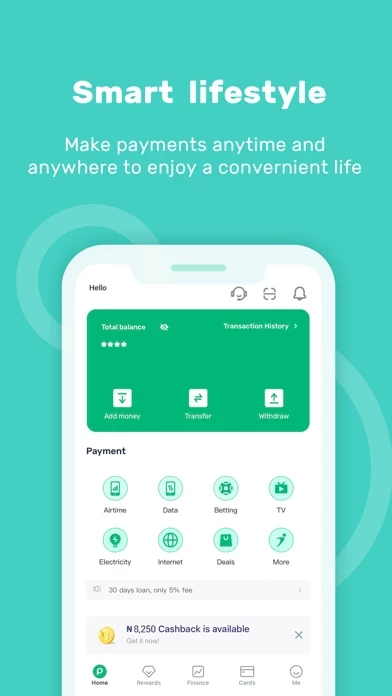

Subscribe for cable TV: You can pay for your GOTV, DSTV and STARTIMES subscription using OPay and the beauty is we don’t charge any convenience fee.

OPay is a wallet based mobile app for sending money and paying bills in Nigeria and Kenya.

Electricity bill: You can pay for your prepaid electricity with OPay and we don’t charge any convenience fee.

Mobile data: Purchase airtime for family or friends from any network in the OPay app.

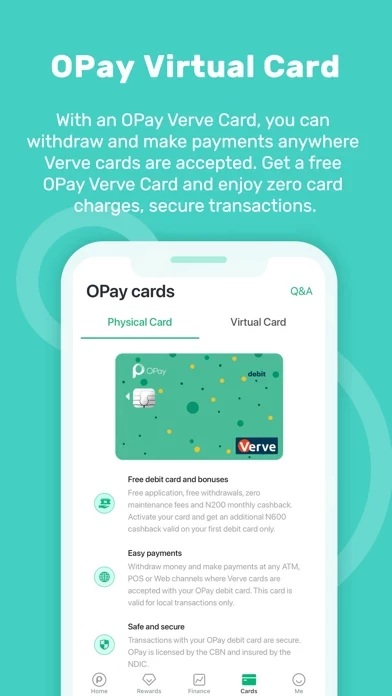

Offizielle Bildschirmfotos

OPay We are beyond Banking Preis pläne

| Dauer | Betrag (USD) |

|---|---|

| Einmal in Rechnung gestellt | $5.05 |

| Wochenabonnement | $2.00 |

**Die Preisdaten basieren auf durchschnittlichen Abonnementpreisen, die von Justuseapp.com-Benutzern gemeldet wurden..

Produkt einzelheiten und Beschreibung von

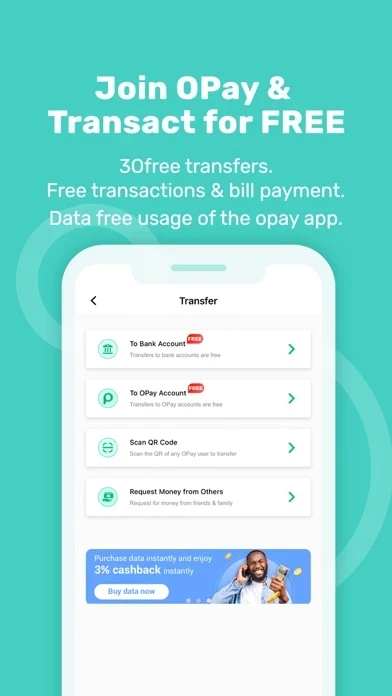

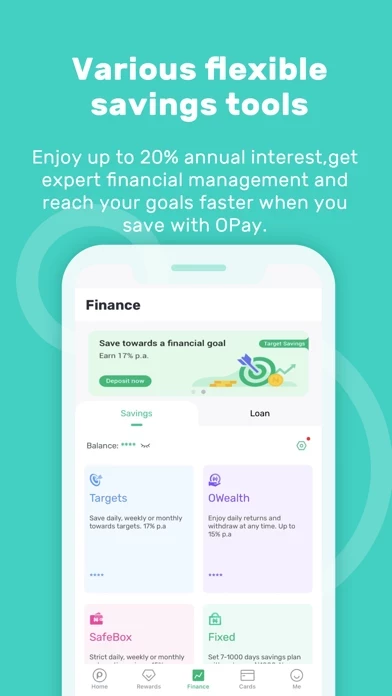

OPay - The first cashback wallet in Nigeria (A secure app that helps you make convenient payment anywhere you are! ) MORE SERVICES ● Use Now Repay Later CreditMe is an OPay wallet that allows customers to pay first and repay later. Up to ₦100,000 credit free to use without any service fee. Loan Products: Tenure: We will require your repayment from the 91st day to the 365th day*. Loan Amount: from ₦3,000 to ₦500,000. Interest Rate: With a minimum of 0.1% to a maximum of 1% Our interest rate is calculated on a daily basis. Annual interest rate is from 36.5% to 360%. Origination Fee: Range from ₦1,229 – ₦6,000 for one-time charge For example, 91-day loan payment terms have a processing fee of 41% and interest of 9.1%. For the loan processed with principal amount of ₦3,000; the processing fee would be ₦1,229; the interest would be ₦273; the total amount due would be ₦4,502. The total amount due in the first month would be ₦1,512; the processing fee would be ₦419; the interest would be ₦93. The total amount due in the second month would be ₦1,495; the processing fee would be ₦405; the interest would be ₦90. The total amount due in the third month would be ₦1,495; the processing fee would be ₦405; the interest would be ₦90. ● High Interest On Savings OWealth provides you with at least 15% rate of return per annum. For Example: Let’s say you invest ₦50,000 for one year. At the end of the annual savings date, the amount of return you will get is: ₦50,000 x 15 / 100 = ₦7,500, that means you will get ₦57,500 back at the end of your saving tenure. PS: You can withdraw your money at anytime with no extra fees. ● Add Money & Make Transfers Funding your wallet is secured and convenient. OPay provides you with seamless, and most importantly: free and discounted services! Enjoy free OPay transfers! ● Deposit & Withdrawal Our 300,000 merchant network will offer these services. Just search for a nearby merchant directly on the app and complete your daily transactions. ABOUT OPay ● The leading Mobile Payment platform in Nigeria, with over 8 million users. ● Enjoy free 90 bank transfers monthly. ● Get cashback when you pay for Airtime, bills and more. ● OPay attaches great importance to protecting users‘ information, wallets and privacy. CONTACT US We have a dedicated support team available 24/7 for all your inquiries and complaints. Our website: https://opayweb.com WhatsApp: 2349066722924 Email: [email protected] or [email protected] Office Address: 16B Emina Cresent, Off Toyin Street, Ikeja, Lagos State, Nigeria This APP is intended solely for users who are 18 years of age or older. Give yourself the power to do more. Download OPay app today!