Plum Übersicht

**This includes a fund management fee of 0.15% which goes to our technological partner, as well as a 0.06%–0.90% fund provider fee (depending on the funds you choose to invest in).

Offizielle Bildschirmfotos

Produkt einzelheiten und Beschreibung von

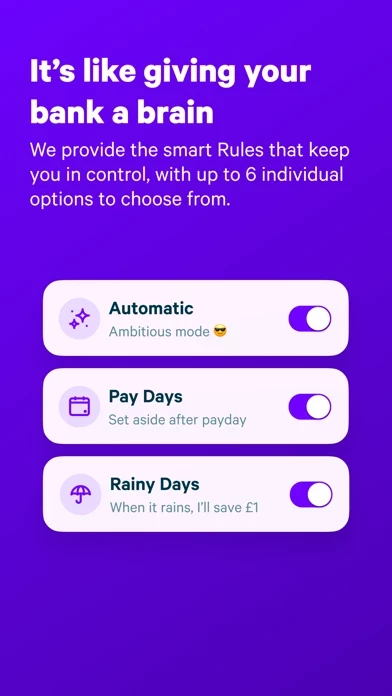

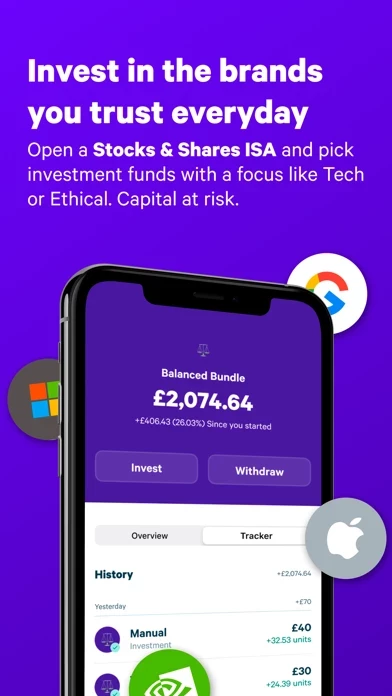

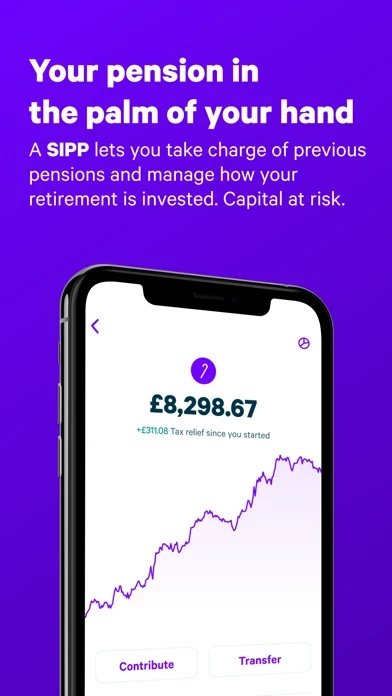

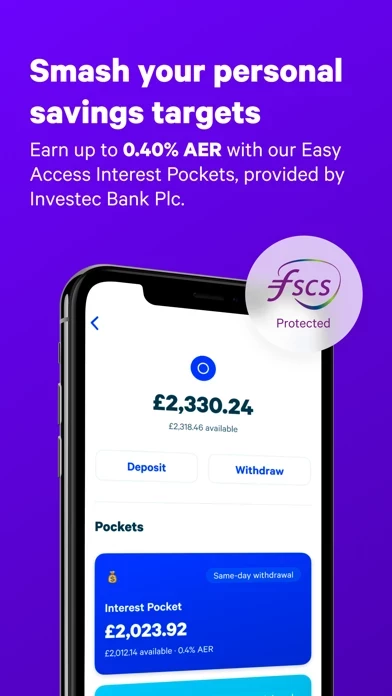

At diese App, we’re on a mission to make your money go further. Our smart automation helps you put money aside and easily invest in what matters to you. Here’s how… Note: We’re exporting diese App to new markets so not all features may yet be available outside the UK. Check our website for more info. GIVE YOUR BANK A BRAIN • Link your bank accounts and credit cards so diese App can give you an overview of all your finances • diese App is then able to automate your deposits to help you put more money aside over time • You choose the Rules that control how much money you’d like to set aside • Options include our Automatic algorithm and Round Ups • Withdraw anytime, as often as you’d like AUTOMATE DEPOSITS • Use our Splitter to apportion your deposits between your savings and investments • Earn up to 0.40% AER on your savings with a FSCS protected, Interest Pocket* • Investment options include funds or a Self Invested Personal Pension (SIPP) • Start investing in a Stocks & Share ISA or General Investment Account with just £1 * Easy Access Interest Pockets are provided by Investec Bank Plc. DIVERSIFY YOUR INVESTMENTS WITH FUNDS • Choose from 12 different funds themed around risk level or sector • Personalise your portfolio with funds like ‘Slow & Steady’, ‘Tech Giants’ or options with an ethical focus • Funds are professionally managed, and each one contains lots of different company shares • As with all diese App investments, the fees§ are intuitive and transparent • From £1.00 per month subscription fee for diese App Plus (first month free) §Here are the fees that you’ll be charged when you invest with diese App: • £1.00 minimum monthly subscription • 0.48% average annual fund management plus provider fee‖ • No hidden transaction or trading costs • No withdrawal fees or limits ‖This includes a fund management fee of 0.15% which goes to our technological partner, as well as a 0.06%–0.90% fund provider fee, depending on the specific investment fund(s) you choose. GET READY FOR RETIREMENT • Consolidate all your existing pensions in one place with a diese App SIPP • Invest your pension savings into a risk managed fund (based on your age and target retirement date) • Pick from a range of diversified global funds. • There are no subscription charges for a diese App SIPP¶ • Get tax relief on your contributions ¶ A 0.45% annual Product Provider fee and average 0.25% annual fund management fee still apply. Fund management fee depends on the fund(s) you choose. COMPARE BILLS, SWITCH SUPPLIERS AND BUDGET BETTER • Compare household bills, like gas / electric, broadband or insurance • We’ll let you know if there’s a better deal and can switch you in seconds • Use Money Maximiser to get a real-time view of your budget OUR TECH KEEPS YOU SAFE • We support biometric security (face & fingerprint ID) • Any sensitive data we hold is stored using symmetric cryptography (AES) • We use 256-bit TLS encryption to communicate with our servers WE’RE HERE WHEN YOU NEED US • Customer support available 7 days a week WE PRIORITISE YOUR PRIVACY • We never share your data with third parties without your consent diese App is a trading name of diese App Fintech Ltd. diese App is registered with the Financial Conduct Authority (FRN: 836158). Investment services are provided by Saveable Ltd. which is also authorised and regulated by the FCA (FRN: 574048). For investments and pensions, all fund management and provider fees are charged annually, billed monthly and immediately reflected in your portfolio.