iDrive Erfahrungen und Bewertung

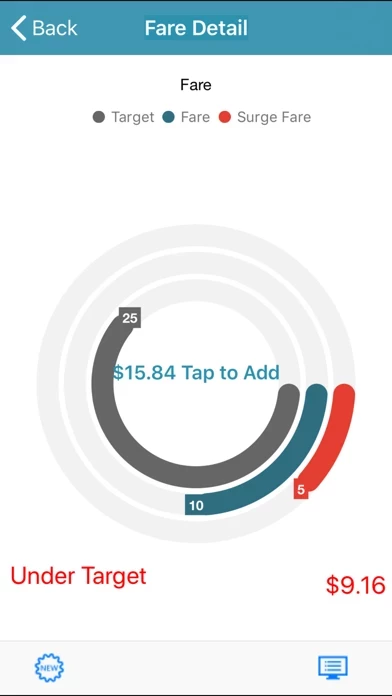

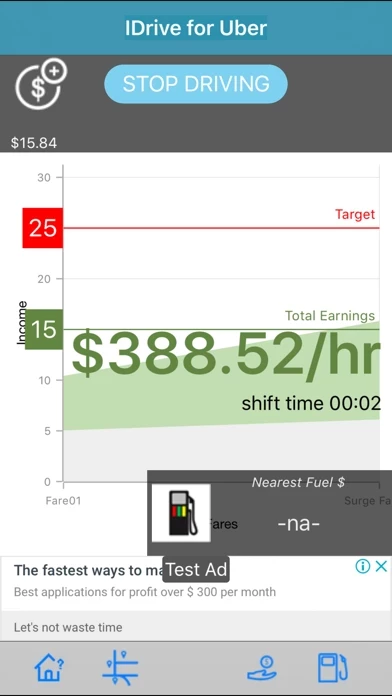

Veröffentlicht von NextWave Mobile Apps, LLC on 2021-03-13🏷️ Über: Driving ride share for Uber or another company? Use this FREE app to find out how much money you REALLY make from your driving business. Turn on iDrive as you start every shift.