QuickBooks Self-Employed Software

Company Name: Intuit Inc.

About: BriteCore is an enterprise-level insurance processing suite that combines core, data, and digital

solutions into a single platform.

Headquarters: Springfield, Missouri, United States.

QuickBooks Self Employed Overview

What is QuickBooks Self Employed? QuickBooks Self-Employed is a finance management app designed for self-employed individuals, freelancers, and independent contractors. It helps users organize their finances, track mileage, expenses, and generate invoices. The app also estimates tax deductions and prepares users for tax time.

Features

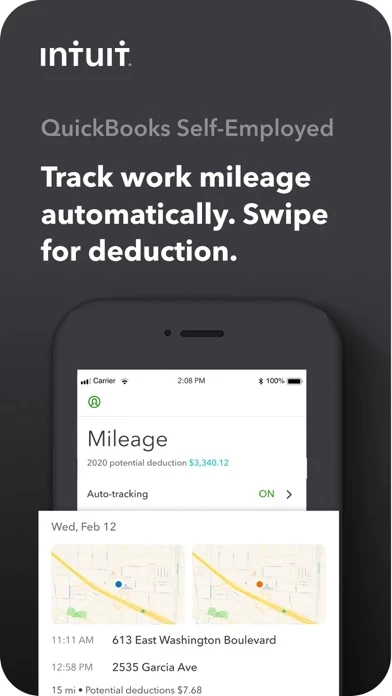

- Automatic mileage tracking using phone's GPS

- Receipt scanner to easily enter transaction information and store receipts

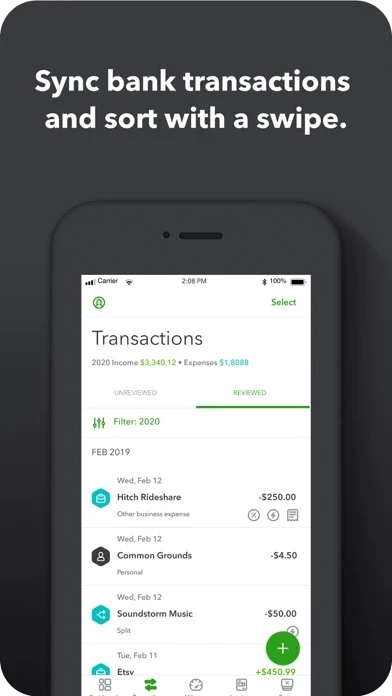

- Expense tracker to manage finances and import expenses from bank account

- Invoice generator to create and send invoices on the go

- Payment and bank transfer services to get paid faster

- Tax deductions estimator to maximize refunds

- Direct export of Schedule C income and expenses

- Integration with TurboTax Self-Employed for easy tax filing

- Free mobile app with subscription to QuickBooks Self-Employed on the web

- Privacy policy and terms of service available for review

- Battery-saving mileage tracking feature

- 2X faster payment based on U.S. customers using QuickBooks Online invoice tracking & payment features from August 2016 to July 2017.

Official Screenshots

QuickBooks Self Employed Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Monthly Subscription | $16.25 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Are you self-employed, a freelancer or an independent contractor? Organize your finances with QuickBooks Self-Employed and let us help you find your tax deductions! Put more money in your pocket with this convenient mile tracker, expense tracker, invoice generator and tax deductions estimator. QuickBooks Self-Employed users have found billions in potential tax deductions by using this automatic mileage tracker, attaching receipts to business expenses, creating invoices and categorizing business expenses while separating from your personal finances and get all the tax refunds a self-employed business owner is entitled to! Track Mileage Automatically! • Mileage tracking automatically works using your phone’s GPS, without draining your phone’s battery. • Mileage data is saved and categorized to maximize mileage tax deductions. Photograph your Receipt • Receipt scanner enters transaction information easily stores receipts. • Business expenses are automatically matched and categorized – saving you time and maximizing your tax refunds so that you are ready for IRS tax time. Expense Tracker to Organize Business Expenses • Self -employed, freelancer or small business owner – manage finances easily and keep up to date so you do not miss out on any tax deductions. • Import business expenses directly from your bank account. Get Paid Faster • Create invoices and send invoices easily on the go. • Enable payments and bank transfer services to get paid faster. • Invoice generator – get notified when invoices are sent, paid, and money is deposited! Stay Prepared For Tax Time • We do the math so you can avoid year-end surprises • Easily organize income and expenses for instant tax filing • Directly export Schedule C income and expenses. • Instantly export your financial data to TurboTax Self-Employed by upgrading to the Tax bundle*. *Users will receive one state and one federal tax return filing. Purchased TurboTax Self-Employed? Activate QuickBooks Self-Employed today at no extra cost. Already have QuickBooks Self-Employed on the web? The mobile app is FREE with your subscription, and data syncs automatically across devices. Just download, sign in, and go! Price, availability and features may vary by location. Subscriptions will be charged to your credit card in your iTunes Account at confirmation of purchase. Your subscription will automatically renew monthly unless canceled at least 24-hours before the end of the current period for the same amount that was originally purchased. You may manage your subscriptions and auto-renewal may be turned off in Account Settings after purchase. Any unused portion of a free trial period will be forfeited after purchasing a subscription. QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint. Privacy Policy: https://security.intuit.com/privacy Terms of Service: https://selfemployed.intuit.com/terms *Based on QuickBooks Self-Employed users who have identified less than $100k in deductions *Based on TY15 subscribers that have identified >$0 in business expenses and of those users that have >$0 in tax savings *Continued use of GPS running in the background can dramatically decrease battery life. QuickBooks Self-Employed’s mileage tracking feature has been designed and optimized to limit GPS usage. *Getting paid 2X faster based on U.S. customers using QuickBooks Online invoice tracking & payment features from August 2016 to July 2017

Top Reviews

By WSgingTon323

Been very helped (I wouldn’t be who/where I am without him

I appreciate the ability to differentiate spending , I travel for work LONG distances ,I interviewed and choose a pet/house sitter . It costs me about 700 a month to make sure they are taken care of ( is otherwise be able to do it myself ) please let me know if I should be doing anything at all, all I have is a picture of her I’d and ss# she agreed sign stub ment🙏🏼if needed of rage of pay start sayy ,was through day of and day after returnwill be paying 40/day plus tip to insure respectful but fearful tactics. I’ve been a supervisor before a mix of fear and love will get you a fAr way ILOVE questbooks selfenployed. Snow and jbgs I would not know I do , it’s help netwoand move on the direction of my life I CHOOSE not told to go🥂even if if doesn’t last I know today I will wake up with more money In my account than when I fell asleep but I work hard and QB helps me delegate finances so I am forever grateful 🤞🏼

By SSGTRocky

Good app, missing some details.

Overall this is a great app for me and my business needs especially since I'm traveling to customer locations. I have the ability to bill them, collect payment from them, manage income and expenses all from this app. A major plus is my ability to scan my receipts or email them in and have QuickBooks input them to my expenses so I can just approve them saving me time and money, great job on this feature! BUT I have noticed that the mileage tracker is not great, sometimes it pickups my drive sometimes it doesn't. I've been forced to use MileIQ for my mileage tracker which is annoying to say the least paying two separate companies when QuickBooks advertised the Mileage Tracker. Another downside is that this app is only available on the phone, not the iPad. I know I can run iPhone apps on the iPad, but it don't look as professional and clean especially when presenting estimates to customers. With times evolving and more business using tablets I would say it's about time that QuickBooks looked into getting their app updated for Tablets.

By Kidwillz

Good app but could definitely use different features

The app it self is good but not being able to add a PO number to my invoices is a hassle because a lot of big companies require PO’s to send payments to vendors like myself. Also the limitation on the invoice notes for the client makes it difficult to send an invoice with detail about what work was done so the client has a written document of all the work that was accomplished for future reference. Another thing I would really like to see is an option to allow clients to make partial payments because some money is better than no money when a client can’t afford to pay the entire sum of a bill because then I have to create a brand new invoice and adjust the old every time. One last improvement I would really like to see would be the ability to send a quote through QuickBooks that I can turn into a invoice with a contract section and ability to E-sign the contract for the client and contractor. All of those would be great addition that would make my decision on keeping this app a whole lot easier