Nest Payroll Software

Company Name: Felicity Inc

About: China Solar Power System Manufacturer, Supplier, Felicity Solar

Headquarters: Guangzhou, Guangdong, China.

Nest Payroll Overview

What is Nest Payroll?

Nest Payroll is a native iOS app that simplifies the complex tax and payroll process for household employers who pay their nannies, caregivers, aides, housekeepers, or babysitters over $2,400/year. The app takes care of all tax work, including setting up accounts, state and federal reporting, and filing each quarter, W-2s at year-end, and a signature-ready Schedule H that goes with personal taxes each April. Nest Payroll also allows employers to pay their employees anytime without deadlines or cutoffs, as often as they need, and provides professional pay stubs automatically. The app also offers a payroll calculator to estimate taxes and take-home pay, track sick time and paid time off, reimburse employee health insurance premiums, and weekly paycheck reminders.

Features

- Simplifies the complex tax and payroll process for household employers

- Takes care of all tax work, including setting up accounts, state and federal reporting, and filing each quarter, W-2s at year-end, and a signature-ready Schedule H that goes with personal taxes each April

- Allows employers to pay their employees anytime without deadlines or cutoffs, as often as they need

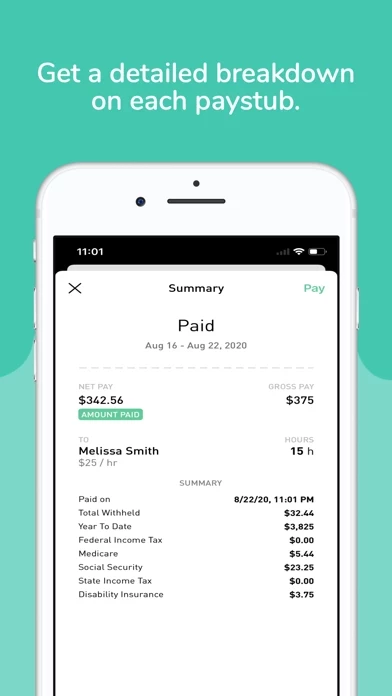

- Provides professional pay stubs automatically

- Offers a payroll calculator to estimate taxes and take-home pay

- Tracks sick time and paid time off

- Reimburses employee health insurance premiums

- Sends weekly paycheck reminders

- Provides in-app notifications when documents (W-2s, Schedule H, etc.) are ready or when filing and tax payments are happening

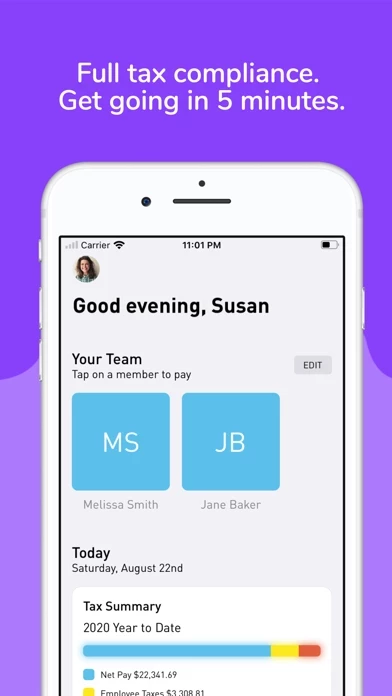

- Offers tax summaries, documents, and payroll history at your fingertips right in the app

- Provides a professional concierge service: Text, call, or email right from the app

- Offers simple and affordable pricing with no contract required

- Allows easy switching from another household payroll service

- Ensures compliance with household employer tax requirements

- Provides the safety net of unemployment insurance, Social Security, Medicare, the ability to build credit, and verifiable income for employees

- Protects employers from fines, penalties, wage theft lawsuits, and risk to their professional career

- Allows employers to take advantage of tax credits for dependent care.

Official Screenshots

Product Details and Description of

Do you pay your nanny/nanny share, caregiver, aide, housekeeper or babysitter (or any household employee) over $2,400/year? If so, Nest Payroll was made for you. Nest Payroll simplifies a complex tax and payroll process into the easiest and most affordable full-service solution. Setup takes 5 minutes. You get walked through three easy steps to get going. After adding your employee, it takes seconds to pay them each week. Professional pay stubs are automatically emailed to your employee All tax work is completed behind the scenes so you don't do anything. This includes setting up your accounts, state and federal reporting and filing each quarter, W-2s at year-end for your employees and a signature-ready Schedule H that goes with your personal taxes each April. Nest Payroll: - Establishes your federal and state tax IDs. - Submits New Hire reports on your behalf. - Prepares and files your quarterly payroll taxes. - Payroll taxes are debited directly from your bank account by the IRS and your state. -All paperwork from tax authorities mailed to us so we stay on top of changes for you. - Each January, we prepare W-2s for you to give to your employees, file your W-3, and provide a signature-ready Schedule H for your personal tax return. - Pay employees anytime without deadlines or cutoffs, as often as you need. - Pay employees quickly via Cash App or Venmo right from the paystub, or use your favorite mobile payment app. - Employees receive professional pay stubs automatically. - Track sick time and paid time off. - Reimburse your employee's health insurance premiums, reducing taxes for both of you. - Weekly paycheck reminders keep things timely. - In app notifications when documents (W-2s, Schedule H, etc.) are ready or when filing and tax payments are happening. - Tax summaries, documents and payroll history at your fingertips right in the app. - Payroll Calculator to estimate taxes and take home pay. It simplifies budgeting your care costs & makes hourly wage discussions easier & more transparent. - Professional concierge service: Text, call or email right from the app. Simple and affordable pricing. - No contract required. - Already using another household payroll service? Text or call us--We make switching easy. HOUSEHOLD EMPLOYER TAX REQUIREMENTS If you’re paying over $2,400 in a year, which is only $47/week, did you know it’s the law to pay above board? Many people think nannies, caregivers, or that learning supervisor you just hired are independent contractors. They are actually your employees, even if they only work part-time or for multiple families. The IRS is really clear that you are required to withhold and pay employer taxes. That sounds complicated and hard to do, and that’s where we come in. We believe you deserve an easy way to pay legally so you’re always above board. We created Nest Payroll, a native iOS app for your iPhone or iPad, which takes care of all your tax work, while making payday a cinch. Why does paying on the books even matter? It benefits everyone: Your employee receives the safety net of unemployment insurance, Social Security, Medicare, the ability to build credit, and verifiable income for basic needs like renting an apartment. You’ll sleep better knowing you’re protected from fines, penalties, wage theft lawsuits and risk to your professional career that can be triggered when a former employee files for unemployment. You might think it’s expensive to pay employer taxes, but it really isn’t too bad! It’s about 10% more, which is well worth the peace of mind you’ll get for following the law. And paying above board means you can take advantage of tax credits for dependent care. Many families even break even! https://this app.com/terms-of-service https://this app.com/privacy-policy-app-link Support URL https://this app.com/support

Top Reviews

By lewisd6

Great service

Have been using for months, very easy to get setup, they handle all the work, and easy to use!